Matterport tax9263

Pages:

1|

Belfast, United Kingdom |

3dshowcaseuk private msg quote post Address this user | |

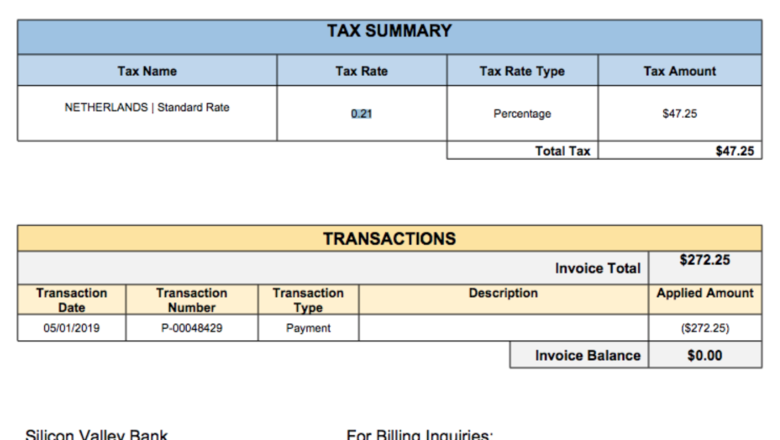

| Hi We are based in the UK however we are being charged Tax at 21% on Matterport services. Does anyone out there know if they should be doing this. We are not VAT registered in the UK therefore we cant claim it back. It also strangely says Netherlands Standard Tax 21%????? See image  |

||

| Post 1 • IP flag post | ||

|

Belfast, United Kingdom |

3dshowcaseuk private msg quote post Address this user | |

| I have emailed accounts at Matterport, it will be interesting to see what I get back, as i have a friend who specialises in international taxation | ||

| Post 2 • IP flag post | ||

|

CharlesHH private msg quote post Address this user | |

| If you are not registered for tax, it is normal they have to bill you VAT and at the country of invoice origin rate. They changed all their invoicing recently and made quite a mess of it. My VAT number disappeared off invoices and VAT appeared! I queried it and my VAT number is back, no VAT charges and those they did take, have now been reimbursed. But in your case it is normal to be charged VAT as you are a private individual. Cross EU borders invoices have to charge VAT unless it is to a registered company and their number is on the invoice. BTW I am British but not UK based but understand EU tax law. What happens post Brexit depends on what the UK government finally does and if they stay in customs union etc. Anyone’s guess at the moment. |

||

| Post 3 • IP flag post | ||

|

Belfast, United Kingdom |

3dshowcaseuk private msg quote post Address this user | |

| We are a limited company in the UK. However the limited company is not VAT REGISTERED as our annual turnover does not go to the threshold. So are you saying that we should be charged taz CharlesHH? If we were VAT REGISTERED THEN WE WOULDNT BE? |

||

| Post 4 • IP flag post | ||

WGAN Fan WGAN FanClub Member Queensland, Australia |

Wingman private msg quote post Address this user | |

| I think VAT/GST registration and rules are similar in UK and AU. When you are registered for GST in Australia you must collect GST from your sales and pay them to ATO(minus paid GST to others of course). However whether you are registered for GST or not you still must pay GST on purchased product/service from others. Unless those who charge you are not registered for GST. In this case they are not allowed to charge it. So I am not sure about 21% and Netherland VAT for an UK company but you should be charged some VAT on Matterport services no matter of your VAT registration. I am sure Matterport is registered for it considering their turnover. |

||

| Post 5 • IP flag post | ||

|

CharlesHH private msg quote post Address this user | |

| @3dshowcaseuk. Probably yes. It sounds as if you are not charging VAT so it makes sense you pay it. I charge VAT to clients. I am billed VAT. Every quarter I pay the Belgian taxman what I have billed, minus what I paid. If I sell goods to individuals anywhere in Europe I charge them Belgian VAT. If I sell to a company and I put their Vat number on my invoice, then no VAT needs to be charged. I now have an EORI number for sales to the UK post Brexit. Frankly, in your case, I would sit back and see how Brexit pans out first. You might register for VAT now and in 6 weeks (or 6 months) find all the rules in uk change. |

||

| Post 6 • IP flag post | ||

Pages:

1This topic is archived. Start new topic?