Add Sales Tax to Still Image Pricing?4939

Pages:

1

Louisville, KY |

JohnLoser private msg quote post Address this user | |

| I have "spread my wings" and added still imagery (DSLR photography) to our offerings. In my research, I have found that "digital images" which we deliver for a price are subject to sales tax and I am required to fix a price for them - I am not allowed to just say the cost of the service includes the labor and the photo images. I really don't have an issue, except I am not sure how to price the images. I am considering doing something similar to the local photo developing store and say "each image delivered is $1.00". I want to be up front with the customers. Shall I include the sales tax in the price (effectively lowering the price of the image?) Do I add the sales tax onto the price? We have a 6% sale tax, so the image is either [$0.94 plus .06=$1.00] or it's [$1.00 plus .06=$1.06]. Frankly, my business partner prefers the latter. I prefer the former because it makes the customer's book keeping easy. What do other forum members do? |

||

| Post 1 • IP flag post | ||

|

DouglasMeyers private msg quote post Address this user | |

| I charge about $125.00 for extra photos, now I have been taking Real Estate photos for 12 years. | ||

| Post 2 • IP flag post | ||

WGAN WGANStandard Member Bon Secour, Alabama |

Chemistrydoc private msg quote post Address this user | |

| I charge $5 for each image delivered. Typically, this is 30 or so. I cut the price in half if the client does a concomitant Matterport. | ||

| Post 3 • IP flag post | ||

|

Expertise private msg quote post Address this user | |

| Are you positively sure you need to add sales tax on digital image sales in your state? Most RE photographers do not add sales tax, unless they deliver a tangible physical product. | ||

| Post 4 • IP flag post | ||

WGAN WGANStandard Member Bon Secour, Alabama |

Chemistrydoc private msg quote post Address this user | |

| We never charge sales tax here (MS/AL/FL) since we're not typically selling anything. We are granting a license to use our materials. It's a service here and generally not taxable. If I operate a studio for the general public and turn out hard photos or DVDs of photos or other hard goods, then it's possible that we would need to collect and pay sales taxes. | ||

| Post 5 • IP flag post | ||

|

JonJ private msg quote post Address this user | |

| @JohnLoser, Are you currently charging tax for your Matterport services? Here in SC, the is no tax on digital goods, just as many have stated above. Jon J |

||

| Post 6 • IP flag post | ||

Louisville, KY |

JohnLoser private msg quote post Address this user | |

| I am in Kentucky. The law here allows the labor and digital streaming of the models (3dTours) to be tax fee, but it specifically states that delivered digital images are subject to sales tax. Therefore, we need to have a price for them. The realtors expect a price of about $150 or less for a 2000sqft house. This includes images. | ||

| Post 7 • IP flag post | ||

|

JonJ private msg quote post Address this user | |

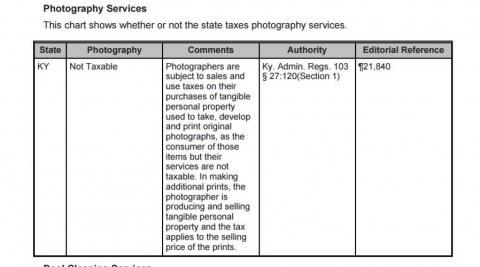

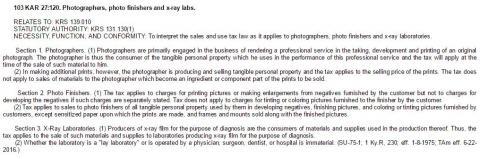

| Hi @JohnLoser, I am not a tax professional, but based on http://www.grassifranchiseservices.com/~jbcpapcc/files/Kentucky%20-%20Sales%20And%20Use%20Tax%20Chart.pdf  and the regulation it references http://www.lrc.ky.gov/kar/103/027/120.htm,  I would not think the photos that you are delivering are subject to tax. If I were you, I would seek advice from a competent tax professional who has experience with working with the delivery of original digital assets. Jon J |

||

| Post 8 • IP flag post | ||

WGAN WGANStandard Member Bon Secour, Alabama |

Chemistrydoc private msg quote post Address this user | |

| Another way around the tax would be to not charge for the photos themselves, but charge only for the delivery... but again, I'm not a tax professional. | ||

| Post 9 • IP flag post | ||

Pages:

1This topic is archived. Start new topic?