Redfin: Home Sales, Listings Plunge Over 20% in September 202217678

Pages:

1

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

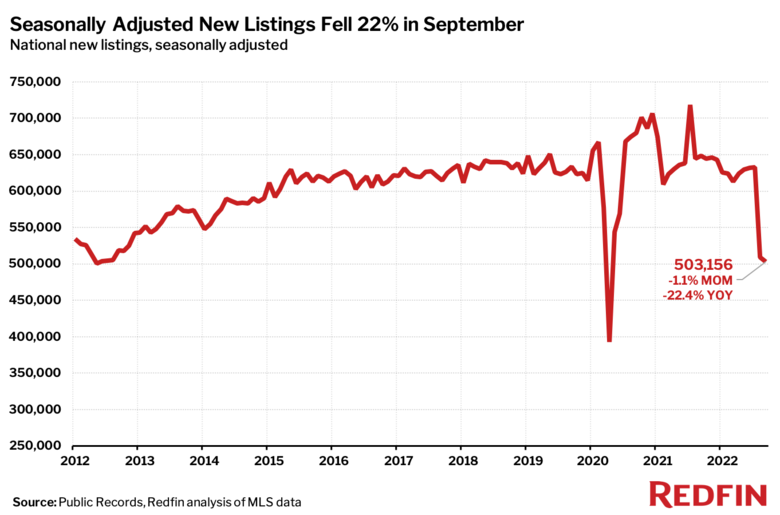

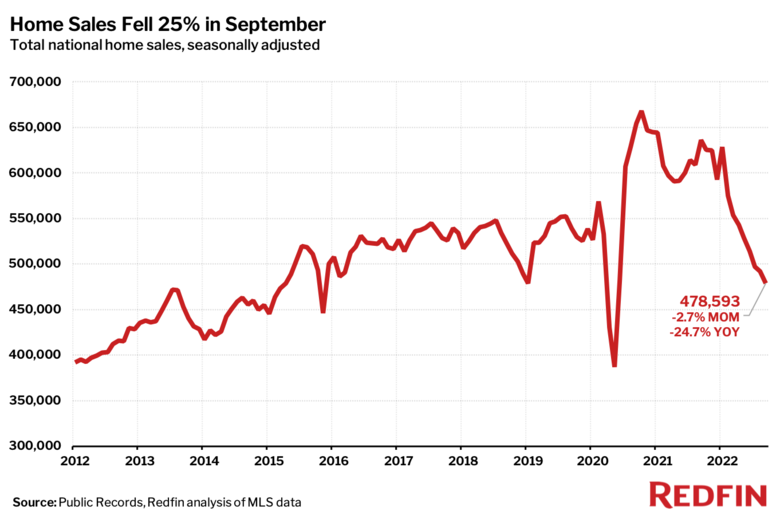

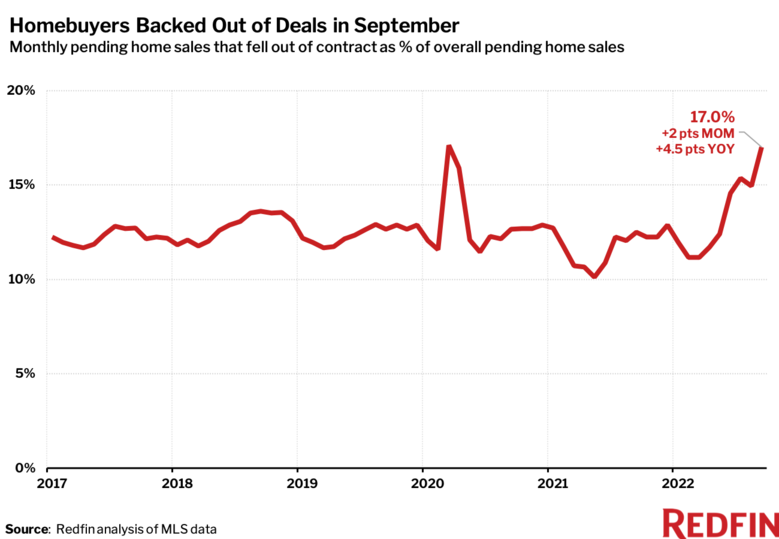

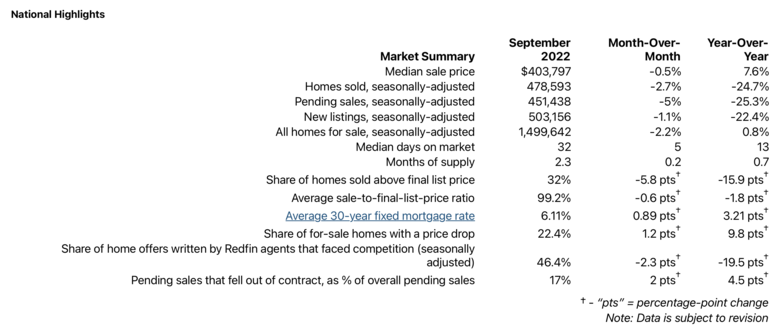

| Redfin Media Release ---  Source: Redfin  Source: Redfin  Source: Redfin Home Sales, Listings Plunge Over 20% in September—Most on Record Aside From Pandemic Start Redfin reports about 60,000 deals were called off, equal to 17% of homes that went under contract—the highest share on record aside from March 2020 SEATTLE--(BUSINESS WIRE)-- (NASDAQ: RDFN) — Home sales and listings in September both slumped the most on record with the exception of the early months of the pandemic as rapidly rising mortgage rates prompted both buyers and sellers to stay put, according to a new report from Redfin (www.redfin.com), the technology-powered real estate brokerage. The number of homes sold dropped 25% year over year while new listings fell 22%—the largest declines since May 2020 and April 2020, respectively, when the onset of the pandemic brought the housing market to a near halt. “The U.S. housing market is at another standstill, but the driving forces are completely different from those that triggered the standstill at the start of the pandemic,” said Redfin Economics Research Lead Chen Zhao. “This time, demand is slumping due to surging mortgage rates, but prices are being propped up by inflation and a drop in the number of people putting their homes up for sale. Many Americans are staying put because they already relocated and scored a rock-bottom mortgage rate during the pandemic, so they have little incentive to move today.” While the median home-sale price was down 0.5% month-over-month in September, it still rose 8% on a year-over-year basis to $403,797. Zhao continued: “The housing market is going to get worse before it gets better. With inflation still rampant, the Federal Reserve will likely continue hiking interest rates. That means we may not see high mortgage rates—the primary killer of housing demand—decline until early to mid-2023.” Homebuyers are backing off because mortgage rates are now at the highest level in two decades, which has driven monthly housing payments for buyers up more than 50% year over year. Prospective sellers are backing off because they don’t want to risk losing the low mortgage rate they already have locked in. As a result, deals are increasingly falling through and buyer competition is plunging. Roughly 60,000 home-purchase agreements were canceled in September, equal to 17% of homes that went under contract that month. That’s the highest percentage on record with the exception of March 2020—the month the World Health Organization declared the coronavirus a pandemic. Fewer than half (46%) of offers written by Redfin agents faced competition in September, the lowest share since the start of the pandemic.  Source: Redfin Metro-Level Highlights Competition ► Rochester, NY was the fastest market, with half of all homes pending sale in just 9 days. It was followed by Grand Rapids, MI and Omaha, NE, with 10 median days on market in September. Next came Buffalo, NY and Indianapolis, with 11 median days on market. ► Chicago was the slowest market, with 57 median days on market. Next came Lake County, IL (54), Charleston, SC (53), Honolulu (52) and Pittsburgh (52). ► In Rochester, 68.4% of homes sold above their final list price—a higher share than any other metro Redfin analyzed. It was followed by Buffalo (65.7%) Hartford, CT (60.1%), Newark, NJ (56.2%) and Worcester, MA (54.4%). ► In Boise, ID, 13.7% of homes sold above their final list price—a lower share than any other metro Redfin analyzed. Next came North Port, FL (15%), Phoenix (15.3%), Cape Coral, FL (15.4%) and Las Vegas (15.6%). ► Philadelphia had the highest bidding-war rate, with 62.2% of home offers written by Redfin agents facing competition. Next came Colorado Springs, CO (60.9%), Boston (58.6%), San Francisco (54.6%) and Providence, RI (53.8%). ► The lowest bidding-war rates were in Las Vegas (20.3%), Phoenix (20.7%), Tampa, FL (25%), Riverside, CA (25.7%) and Houston (26.9%). Prices ► El Paso, TX saw the highest growth in prices, which rose 23% year over year to $245,950. Next came West Palm Beach, FL (22.2%), Greenville, SC (19.3%), Miami (17.6%) and Greensboro, NC (17.5%). ► Three metros saw year-over-year price declines: New Orleans (-5.7%), Oakland, CA (-2.1%) and San Francisco (-1.9%). ► More than two-thirds (67.8%) of homes for sale in Boise had a price drop in September—a larger share than any other metro Redfin analyzed. Next came Denver (58.4%), Indianapolis (55.9%), Phoenix (54.5%) and Salt Lake City (54.3%). ► Newark had the smallest share of price drops (15.9%), followed by El Paso (16.1%), Miami (18.6%), New Brunswick, NJ (19.6%) and Honolulu (20.3%). Sales ► Only one metro area—New Orleans—saw year-over-year home-sales growth, up 13.9%. The smallest declines were in Newark (-5.4%), Buffalo (-5.6%), Allentown, PA (-7.4%) and Oklahoma City, OK (-8.3%). ► North Port saw the largest decline in sales, falling 39.7% year over year. Next came Cape Coral (-39%), Las Vegas (-38.4%), Boise (-37.9%) and Tampa (-35.8%). ► In Jacksonville, FL, 745 home-purchase agreements fell through, equal to 30.3% of homes that went under contract that month—the highest percentage among the metros Redfin analyzed. It was followed by San Antonio, TX (25.3%), Atlanta (25%), Orlando, FL (24.6%) and Tampa (24.5%). ► Newark had the lowest percentage of cancellations (3.9%), followed by San Francisco (5.5%), Nassau County, NY (5.6%), New York (6.9%) and San Jose, CA (7.7%). Inventory ► Austin, TX saw the largest increase in the number of homes for sale, up 41.4% year over year, followed by North Port (41.3%), Nashville (36.9%), Las Vegas (34.1%) and New Orleans (31.9%). ► Hartford, CT had the largest decrease in overall active listings, falling 34.2% year over year. Next came Frederick, MD (-31.9%), Allentown (-31.3%), Montgomery County, PA (-30.9%) and Bridgeport, CT (-29.7%). To view the full report, including charts, additional metro-level data and methodology, please visit: Redfin.com About Redfin Redfin (www.redfin.com) is a technology-powered real estate company. We help people find a place to live with brokerage, instant home-buying (iBuying), rentals, lending, title insurance, and renovations services. We sell homes for more money and charge half the fee. We also run the country's #1 real-estate brokerage site. Our home-buying customers see homes first with on-demand tours, and our lending and title services help them close quickly. Customers selling a home can take an instant cash offer from Redfin or have our renovations crew fix up their home to sell for top dollar. Our rentals business empowers millions nationwide to find apartments and houses for rent. Since launching in 2006, we've saved customers more than $1 billion in commissions. We serve more than 100 markets across the U.S. and Canada and employ over 6,000 people. --- Source: Redfin via BusinessWire |

||

| Post 1 • IP flag post | ||

|

Expertise private msg quote post Address this user | |

| Always remember- Real Estate Is Local. Also- "positive or negative real estate trends" do not necessarily correlate to positive business conditions for those of us shooting/scanning residential real estate. In our local MLS, the volume of new listings in September was down 18.2% from the previous September. However, our sales revenue was up 9.2%. |

||

| Post 2 • IP flag post | ||

WGAN Fan WGAN FanClub Member Buffalo, New York |

GETMYVR private msg quote post Address this user | |

| I'm in that Buffalo market, it's a big area composing 2 counties and it's probably still one of the most affordable places to scoop up property. No wonder about the activity. 30 minutes ago I got off the phone with one of my agents and they have three listing appointments and finally 3 pending deals on units that were priced down from the peak crazy market high that preceded this current market. But that's definitely not every agent. |

||

| Post 3 • IP flag post | ||

Pages:

1This topic is archived. Start new topic?