Matterport's Sweet Spot is Spatial Data for Enterprise at Scale16597

Pages:

1

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

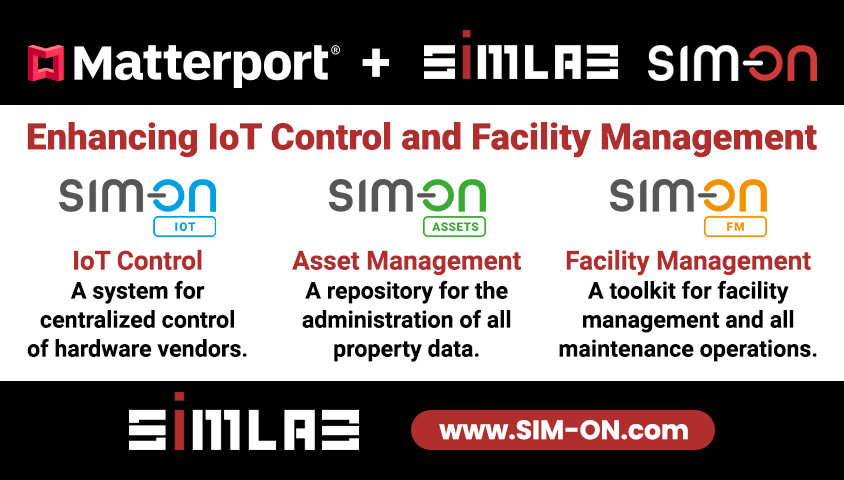

| Video: Matterport's Sweet Spot is Spatial Data for Enterprise at Scale | Video courtesy of www.WGAN-TV.com YouTube Channel | 24 March 2022 WGAN Forum Podcast #80 Matterport's Sweet Spot is Spatial Data for Enterprise at Scale Commentary and Analysis by Dan Smigrod Founder and Managing Editor We Get Around Network Forum WGAN-TV Live at 5 WGAN-TV Training U (in Matterport) The sweet spot for Matterport is spatial data for enterprise at scale. Then, if you add Matterport's recent acquisition of Enview, which is a company that teases out those analytics of three-dimensional models at scale, once Enview puts the tools and solutions in place for Matterport, that is the single greatest use case for Matterport. The sweet spot is spatial data at scale for enterprise. Let me see if I can give you an example. If you're a facilities manager and you have 150 different commercial office spaces across the United States, for that matter, across the world, and you're tasked with, "hey, what if we put in this light bulb versus this light bulb in all those three by six boxes that have the fluorescent lights, how much money would that cost? How much money would that save? What would be the energy efficiency?" Whatever questions that get queried. Well, the old-school way of doing that is, you'd send an email to the 150 different counterparts at each one of those buildings and say, "hey, Jim John, those fixtures in the ceiling that are three by six, that each have four fluorescent light bulbs, how many do we have in that 100,000 square foot location?" They say, "well, I don't know. Let me go walk all these floors and count these fixtures, and I'll get back to you." That is a Herculean manual task done old-school. Now imagine, you have a Matterport spatial data, digital twin, of all those 150 buildings, and you have this powered by Enview solution, and you're able to say, "okay, here's the object I'm looking for with AI. Go find all those three by six light boxes in 150 buildings, tell me how many boxes do I have by building and total?" That should be a 10 minute exercise that would otherwise take weeks and tons of people time, and totally inefficient. Now, let's go count fire extinguishers and let's go count windows because we have this inefficient glass. If we go put this other type of glass in, we'll be able to save energy by 50 percent. But, we need to know how many windows that we're talking about in 150 buildings. Go count the windows. That's an example of Matterport in the best, highest use case, where it can add the most value to enterprise, and charge the most money. That's all about software, that's all about recurring revenue. Has nothing to do with what device that I use to capture the data? We didn't talk about it. But if you were to ask me, I would say, "in the long run, Matterport should be out of the camera business." They shouldn't be making any devices. They should be out of Capture Services (On Demand). They shouldn't be running a labor-intensive business. They should just be the essence of what is the best, highest use case for Matterport, and that's spatial data meets enterprise at scale. Everything I look at, I tend to evaluate in terms of quadrants. I think about it in terms of my career over time. Did I like working for that company? Did I like who I worked for? That was in Quadrant four. I was happy, and the company was happy. Quadrant 1 in the lower case was, I was unhappy and the company was unhappy. That's metaphorically what we're talking about. Let's get in the right box. If you take all the different use cases for Matterport, if you were telling me about residential real estate, obviously, Matterport doesn't really add a lot of value in terms of spatial data and it takes a long time to capture, and all these things. I'll put it in that lower box where it doesn't add a huge amount of value versus competitors. Matterport probably can't charge as much for it. By the way, they can't sell a lot of add-ons over time for it. Now, this top quadrant box, which I would describe as what is the highest use case for Matterport? Things that involve spatial data that matter for enterprise. That's a sweet box up in this top right corner. That provides a ton of value to enterprise, and that is something that Matterport can charge a lot of money over time as recurring revenue. Then you have all the things that Matterport can make money as in addition. Maybe we're going to license our Enview AI platform for counting things in Matterport spaces at scale. Matterport has already announced that they have 120 different companies that are building out to their API using their SDKs: licensing revenue. Companies have tools and solutions – Let's take Internet of Things. That's going to be a really interesting category for Matterport. That's going to be a third-party solution. That's going to be license revenue. That's an add-on that adds to that top quadrant. If you think about, if you're in that top quadrant of what is the highest use case for Matterport, that Matterport can charge the most money over time at scale, and then make add-on sales might be floor plans. That's a service it does internally, but it might be let's add a huge amount of value to our client through the third-party ecosystem just like on our iPhone where we have so many apps available that add value to our iPhone. There are presently 120 companies that are using the Matterport API and SDKs. That means licensing revenue for Matterport. We track that. I keep a list of the publicly available solutions. It's about two dozen so far that I'm aware of that are publicly available to other companies to license, and so I go, "great, that's going to help me do something in that quadrant, and Matterport is going to get a piece of that action." I would say, if Matterport can focus on that top quadrant, it's going to maximize its recurring revenue over time, and it'll be super-sticky. By the way, Matterport is a proprietary platform. You can't just pick up and say, "I'm tired of Matterport. I'm going to move to somebody else." No! You went and scanned the 150 spaces that are 100,000 square feet, and they're located all over the place. You can't move away from the platform easily. Ten years from now, I would say, we don't know what we don't know. We just know that it's super-exciting. The fact that Matterport has made their API and their SDKs licensable, that super-exciting. Because truly the innovation that's going to come with Matterport is really not going to come from Matterport. It's going to come from all the other companies that build out to the mothership. I think one of the challenges that Matterport has today is, it's trying to build out its platform in multiple countries, in multiple verticals, in multiple languages, and that means it moves super-slow at a glacial pace. There are other companies that are doing super-interesting things and they're only focused on one vertical. Just to give you an example, in the AEC space, Cupix with their service called CupixWorks. In my opinion, presently today, they run circles around Matterport because you can look at side-by-side. Here's the BIM model, here's the weekly construction documentation. If I move the BIM model, it moves the weekly documentation. If I move the weekly documentation, it moves the BIM model. Matterport has got some challenges and the only way – 10 years from now is to emerge from that, they have to enable third-party companies to keep building out solutions for enterprise at scale. I obviously mixed feelings in terms of Matterport. I obviously built an ecosystem around them, but I want to see them succeed faster and they're just moving too slow. If they get distracted by, "oh, let's go build this rotator." There were other companies already building rotators. There's lots of other rotators, why don't they just build-out solutions using existing rotators rather than developing a proprietary rotator which by the way, in my opinion is in that lower quadrant because it's really not a solution for enterprise. It is training wheels. It'll get people started with Matterport scanning, but they'll quickly realize that there are other ways to capture scan data that are probably faster and easier and better, and really don't cost that much more than using a smartphone in a rotator. But it's an example of, I think, it's easy for Matterport to get distracted building out a hardware solution when I don't really think of them as a hardware company. I think of them as a software company. The only reason they built the camera in the first place is, they were building electricity and the light bulb at the same time. If you're building the light bulb, you need electricity. If you need electricity, you got to do both at the same time. When Matterport started, it figured out a way to do scanning, processing, hosting, distributing, and related stuff. It had to do everything because it was inventing something from scratch. At that time, it was really the only thing of its kind when I got started in July of 2014. Fast forward today, Matterport's got a lot of competitors and it's being distracted by hardware when it should be a software company. It's being distracted by services when it should be a software company. It's being distracted – this whole idea of scale and how do you be the first to conquer all countries – to be in (multiple countries, languages and verticals). But, it's slowing up innovation and it's slowing up innovation that matters in that top quadrant. Anything that's outside of that quadrant; it's a distraction. You might just come to the conclusion may be Matterport shouldn't be servicing residential real estate to begin with, even though that's where its future is not, in my opinion, in residential real estate. Frankly, a big risk compared to other competitors. Yes, there is an advantage to first-mover and everybody has heard of Matterport and all that stuff. But over time, it doesn't involve spatial data. That could be argued. If I was Matterport, I'd probably come back and say, "well, you can get your mortgage approved faster because we don't need to send somebody out to go count bedrooms and count heated space and everything else. That can be teased out of a Matterport tour." But that's not the client. The client is the resident real estate agent. Never mind all those other great use cases that we can think of a digital twin for residential. --- WGAN Forum Related Discussions: ✓ Why Matterport will Build/Sell a Leica BLK360 Clone for Less Than $7,500 ✓ WGAN Forum discussions tagged: Commentary | Analysis Enview | BIM | Facilities Management | API | SDK | Matterport SDK Partners | Matterport Axis |

||

| Post 1 • IP flag post | ||

WGAN WGANStandard Member Osaka, Japan |

Meidansha private msg quote post Address this user | |

| Thank you Dan for your thoughts. It's hard to comment on all posted but in your conclusion "Matterport's got a lot of competitors and it's being distracted by hardware when it should be a software company." I would have to agree. The hope I imagine of shifting to a model where they try to satisfy all with new features combined with capture services maybe because that investors were unhappy with the pace of growth. That said, this stuff doesn't sell itself and still needs photographers to make it sell. The push for a high end I do not believe will make much profit for Matterport but it will lend extra credibility to the platform that we can benefit from. That is the most likely reason I can think of for this tilt, as the profit margin on a capture service is small even for Matterport and they only gain one more account out of one new enterprise client anyway which may only mean another $70 a month. But for us this public endoursement is a useful tool. For instance when a prospective client is on the fence about scanning their premises we can explain how so many big businesses in their field have used Matterport. It is fortunate that Matterport has succeeded in obtaining public endoursement this way. It is dissapointing when to gain this endoursement they trample on the sales channels created by existing photographers (MSPs). I think eventually the realisation will come that growth this way is complicated and there will be a more nuanced change in account plans. Specifically a shift back to uploads being the core unit for charging retail (MSP) clients. Afterall when all the young engaged real estate agents are sold on Matterport and you're left with the ones who can't be bothered learning something new (and they are busy selling anyway) the only way to engage such a client is through an MSP. |

||

| Post 2 • IP flag post | ||

|

mori private msg quote post Address this user | |

| From a european perspective as long as the author or owner has not full control and ownership of all content (provided and generated by an AI or whatever) incl. processing and hosting in europe, Matterport is no option for any enterprise company based in europe. We had many requests in the past years from large real estate companies, but the Matterport Legals made it a very short discussion with their legal departments. Often also they needed in-house "local" hosting on their servers or their selected cloud provider. It´s just a side fact, but also not offering a WCAG 2.1 AA compliant user interface by default has often been a show stopper too - especially for government related companies. It´s not yet mandatory in EU when the service comes from a 3rd party, but from 2025 on the european accessibility act will also affect commercial companies and as digital accessibility is a marathon and no short track race, the affected companies need to start now with this journey. See https://ec.europa.eu/social/main.jsp?catId=1202 In the US by the way Section 508 already makes an accessible UI a mandatory requirement: https://www.section508.gov/ |

||

| Post 3 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Video: Matterport Announces Genesis | Video courtesy of Matterport YouTube Channel | 14 June 2023 --- Hi All, This is a great example of the best, highest use-case of Matterport spatial data (announced Wednesday, 14 June 2023): => Matterport Announces Genesis: A Generative AI Initiative to Transform How Buildings are Designed, Built, and Managed Your thoughts? Dan P.S. Matterport video (above) is a "must watch" ... |

||

| Post 4 • IP flag post | ||

Pages:

1This topic is archived. Start new topic?