Media Coverage: Matterport Going Public14173

Pages:

1

WGAN Basic WGAN BasicMember Denver |

pixelray private msg quote post Address this user | |

| Is there a date yet? | ||

| Post 2 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| @pixelray According to: ✓ ✓ SEC Form 8-K Gores Holdings VI, Inc. For: February 7, 2021 1. Deal expected to close 2Q21 2. And ... The Merger Agreement may be terminated at any time prior to the consummation of the Mergers (whether before or after the required Company stockholder vote and Matterport stockholder vote has been obtained) by mutual written consent of the Company and Matterport and in certain other circumstances, including if the Business Combination has not been consummated by September 7, 2021 and the delay in closing prior to such date is not due to the breach of the Merger Agreement by the party seeking to terminate. Dan |

||

| Post 3 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| ✓ Inman (8 February 2021) Matterport going public via SPAC merger - The spatial data and 3D tour company estimates the enterprise value of the combined companies will clock in at approximately $2.3B "In 2020, Matterport expects it will have generated $86 million in revenue, up from $46 million the year prior. The company projects steady year-over-year revenue growth reaching $747 million in 2025," reports Inman. --- Free 90 day trial of Inman with this WGAN Affiliate Code |

||

| Post 4 • IP flag post | ||

WGAN Fan WGAN FanClub Member Buffalo, New York |

GETMYVR private msg quote post Address this user | |

| Any chance us founding Matterport service providers we'll get an offer of any preferred shares? | ||

| Post 5 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| The Real Deal (8 February 2021) Real estate VR tech firm Matterport to go public via SPAC "Virtual walkthroughs of properties have become increasingly popular during the pandemic, especially in areas of the country where in-person showings were prohibited for a period of time," reports The Real Deal. The SPAC frenzy that has gripped investors in the past year has extended to real estate, with several companies — including Opendoor and Porch.com — going public in 2020 via blank-check firms. Other large real estate firms, including Tishman Speyer and CBRE, have launched their own blank-check companies to court proptech deals, reports The Real Deal. I encourage you to read the entire article. Best, Dan |

||

| Post 6 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Bloomberg (8 February 2021) Matterport to Go Public Via Alec Gores SPAC in $2.9 Billion Deal "To support the transaction, the companies will raise about $295 million from investors including Tiger Global Management, Senator Investment Group, Dragoneer Investment Group and Fidelity Management & Research Co.," reports Bloomberg. |

||

| Post 7 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Silicon Valley Business Journal (8 February 2021) Billionaire Alec Gores, who took Luminar public, plans to do same for Matterport in $2.9B deal "Billionaire Alec Gores is the investor behind the special purpose acquisition company (SPAC) in the merger. Gores Holdings VI raised $345 million in an IPO in December when it sold units made up of stock and warrants for $10 each. The stock (NASDAQ:GIHVU) has jumped by about 26% since Friday [5 February 2021], when news of the deal was first reported by Bloomberg. It opened trading Monday at $13.90," reports Silicon Valley Business Journal. Looks like Wall Street likes Matterport going public. Your thoughts? Dan |

||

| Post 8 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

Matterport’s Founders Dave Gausebeck and Matt Bell (2013) | Image courtesy of LUX Blog LUX Blog (Peter Hébert, Managing Partner) (8 February 2021) Matterport Is Going Public to Digitize the Built World --- Peter Hébert is Co-Founder & Managing General Partner of Lux Capital. Lux Capital has invested in Matterport in multiple rounds. --- Peter Hébert writes: (excerpt) Want to hear a mind-blowing fact? How about this: there are at least twice as many buildings in the world as websites. Within those buildings there are often multiple rooms, spaces, floors, and sections. And virtually all of those buildings are stuck in the past. They have not been digitized, making it time consuming and costly to manage them in an online world. But that’s changing quickly, accelerated by today’s announcement that Matterport plans to go public on the NASDAQ through a business combination with Gores Holdings VI, Inc. [NASDAQ: GHVI]. The deal will provide for $640 million in gross proceeds at a post-transaction value of up to $2.9 billion. Lux is excited to make a new investment into the PIPE, alongside Tiger Global, Senator, Dragoneer, Fidelity Management & Research Company, funds and accounts managed by BlackRock, and Miller Value Partners. ... With less than 0.01% of the built world digitized, space really is, as they say, the final frontier. Source: Peter Hébert via LUX Blog I encourage you to read the entire LUX blog post. Dan |

||

| Post 9 • IP flag post | ||

WGAN WGANStandard Member Los Angeles |

Home3D private msg quote post Address this user | |

| I sure think that original white Matterport 'egg' camera is the coolest one. Seems to me that 'going IPO' generally happens when the biggest stockholders and C-Suite team understand that their company will never be valued this high ever again, so it's time to cash out while the gettin' is good. Pandemic? Stay-at-home edicts? Virtual everything? That's where we are today, but greater normality is around the corner and, more important, Lidar is now on the phone in your pocket. Hmm. Matterport could sue little GeoCV out of operation. But who wins when the competition is Apple? I grew up in Chicago, a city with its own unique historical figures. Al Capone was never convicted of anything until they got him on tax evasion. By then he was older and understood the financial industry. According to legend, he said "If I had understood Wall Street back then, I would have gone straight!" |

||

| Post 10 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| @Home3D Time will tell! Dan |

||

| Post 11 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| ✓ The New York Times (8 February 2021) The serial SPAC sponsor Alec Gores strikes another deal ✓ HousingWire.com (9 February 2021) Matterport to go public via SPAC in $3B deal ✓ GlobeSt.com (10 February 2021) CRE Tech Company Matterport To Go Public in $2.9B SPAC ✓ Motley Fool (10 February 2021) Matterport is Next Proptech Company to Go Public Through a SPACE |

||

| Post 12 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

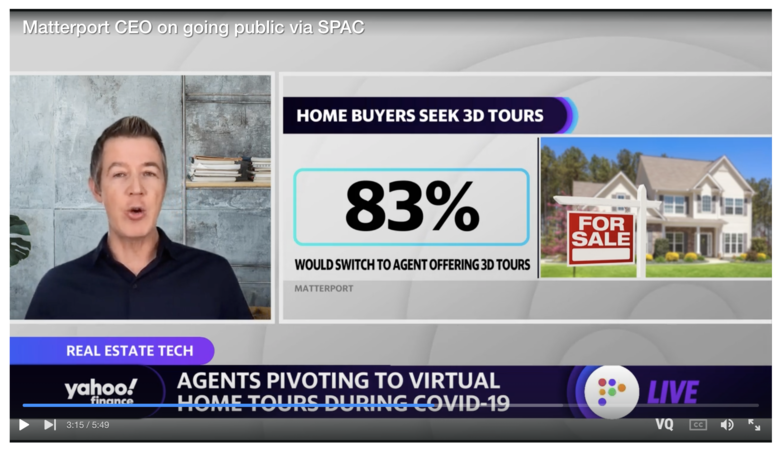

Screen Grab: Matterport CEO RJ Pittman talking about going public via SPAC with Yahoo! Finance Yahoo! Finance (10 February 2021) Matterport CEO on going public via SPAC |

||

| Post 13 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| ✓ Market Realist (10 February 2021) Matterport Plans to Go Public, GHIV SPAC Stock Is a Buy Before the Merger ✓ PR Newswire (11 February 2021) Matterport $2.9B SPAC Announcement Marks Navitas' 2nd Billion Dollar Plus Portfolio Company Public Valuation Since December |

||

| Post 14 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| ✓ The Motley Fool (11 February 2021) This SPAC Could Be the Best Stock Of the Decade - Digitizing real estate could be big business. From The Motley Fool I don't usually get excited about IPOs or special-purpose acquisition company (SPAC) mergers because they often come with more uncertainty and risk than I want to take on as an investor. But every once in a while, there's a company that hits the market that I see as a once-in-a-lifetime opportunity That's why this week's announcement that Matterport will merge with Gores Holdings VI (NASDAQ:GHVI) had me extremely excited. Matterport has built incredibly powerful technology for the real estate market, and its spacial data business is just starting to scratch the surface of its potential. I don't know if Matterport will hit any of the projections it laid out in a presentation to investors, like $747 million in revenue and 73% gross margin in 2025, up from an estimated $86 million in revenue for 2020 and a 56% gross margin. Even if it doesn't hit those numbers, I think the company has the potential to be a very high-growth stock with a massive market to grow into. For long-term investors, this is the kind of company that could be the best stock of the next decade. Source: The Motley Fool I encourage you to read the entire story. Your thoughts? Dan |

||

| Post 15 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| SPAR3D (10 February 2021) As Matterport prepares to go public, all eyes are on 3D real estate tech | ||

| Post 16 • IP flag post | ||

WGAN Fan WGAN FanClub Member Queensland, Australia |

Wingman private msg quote post Address this user | |

| I have looked at their stock chart using data from NASDAQ symbol GHVI and there are two possibilities with where they may be going. If it goes over $18.80 it most likely to grow over $21 However there is another not so shiny one: if it goes below $16.00 it will drop below $14 | ||

| Post 17 • IP flag post | ||

|

sandhun private msg quote post Address this user | |

| Real estate agents in the UK claim property is selling easily without the use of Matterport, so they're reluctant to pay for it. It's a dead end. Non real estate clients I offered the service to were interested in CAD drawings and Matterpaks, but when they got the output from a Matterpak they lost interest. Another dead end. Other businesses would rather buy the camera themselves than hire a third party to produce a model. So overall Matterport probably has a bright future but sadly I can't see much of a future for MSP's. Would you guys buy the stock? Deadnsyde seemed quite positive about it on his channel https://www.youtube.com/watch?v=XZUylr0ch_Q Video: Could This Be The Best Stock Of The Decade? | Video courtesy of Deadsyde YouTube Channel | 17 February 2021 |

||

| Post 18 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Seeking Alpha (21 March 2021) Matterport: 3D For The Real World | ||

| Post 19 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| The Motley Fool (29 March 2021) Where Will Matterport Be in 5 Years? - The market leader in creating "digital twins" of real-world spaces could generate explosive growth after it goes public. --- Seeking Alpha (30 March 2021) Matterport: 3D Digital Assets Without The Hype As the SPAC sector sells off, investors can now pick up some quality names without the insane premium valuations. Gores Holdings VI (GHVI) is working on closing an attractive business combination with Matterport, a leader in 3D spatial data for buildings. The stock is a far better deal after the 50% dip from the highs at $28, but investors need to still realize this valuation is aggressive. Source: Seeking Alpha |

||

| Post 20 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Realty Biz News (13 April 2021) Matterport: Will It Be This Year’s Biggest PropTech IPO? | ||

| Post 21 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Media Release --- Gores Holdings VI Announces Registration Statement Effectiveness and Special Meeting Date BOULDER, Colo.--(28 June 2021)--Gores Holdings VI (NASDAQ: GHVI, GHVIU, and GHVIW) (“Gores Holdings VI”), a special purpose acquisition company sponsored by an affiliate of The Gores Group, LLC, a global investment firm founded in 1987, announced that the Securities and Exchange Commission (the “SEC”) has declared effective its registration statement (the “Registration Statement”) on Form S-4 in connection with its previously announced proposed business combination with Matterport, Inc. (“Matterport” or the “Company”), the spatial data company leading the digital transformation of the built world. The Company has filed with the SEC a definitive proxy statement/prospectus with respect to the proposed business combination. The definitive proxy statement/prospectus contains important information about the proposed business combination contemplated by the Agreement and Plan of Merger by and among the Company, Maker Merger Sub, Inc., Maker Merger Sub II, LLC, and Matterport dated February 8, 2021 (the “Merger Agreement”) and announces that the Company will hold a Special Meeting at 9:00 a.m., Eastern time, on July 20, 2021. Every stockholder’s vote is important, regardless of the number of shares held, and all stockholders are strongly encouraged to vote as soon as possible in advance of the Special Meeting. The declaration of effectiveness by the SEC and the filing of the definitive proxy statement/prospectus is an important step in Matterport becoming a publicly traded company, with the goal of being listed on the Nasdaq Capital Market under the symbol “MTTR.” As previously announced, and as further described in the Registration Statement, the post-business combination company will have an implied pro forma enterprise value of approximately $2.3 billion and an equity value of approximately $2.9 billion at closing. After giving effect to any redemptions by the public stockholders of the Company, the balance of approximately $345 million cash held in Gores Holdings VI's trust account, together with approximately $295 million in PIPE proceeds, net of transaction expenses, will be used to support continued growth of the business across key verticals. The PIPE investment is led by institutional investors including Tiger Global Management, LLC, Senator Investment Group, Dragoneer Investment Group, Fidelity Management & Research Company LLC, funds and accounts managed by BlackRock, Miller Value Partners, Darlington Partners, Untitled Investments, and Lux Capital. All existing Matterport stockholders will roll the entirety of their equity holdings into the combined company and are expected to hold approximately 75% of the issued and outstanding shares of common stock of the combined company immediately following the closing. The transaction, which has been unanimously approved by the boards of directors of both Gores Holdings VI and Matterport, and has the voting support of the requisite equity holders of Matterport, is expected to close by the end of July 2021, subject to regulatory approvals, approval of the proposed business combination by stockholders of Gores Holdings VI, and the satisfaction or waiver of other customary closing conditions. Following the closing of the business combination, the Company’s management team, led by Chief Executive Officer RJ Pittman, will continue to operate and manage Matterport. About Gores Holdings VI, Inc. Gores Holdings VI was formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. Gores Holdings VI's strategy is to identify, acquire and, after the initial business combination, to build a company in an industry or sector that complements the experience of its management team and can benefit from their operational expertise. Additional Information about the Transactions and Where to Find It In connection with the proposed business combination, Gores Holdings VI has filed a registration statement on Form S-4 that includes a proxy statement/prospectus of Gores Holdings VI. The Form S-4 was declared effective by the SEC on June 17, 2021. The definitive proxy statement/prospectus will be sent to all Gores Holdings VI stockholders as of June 16, 2021, the record date established for voting on the proposed business combination and the other matters to be voted upon at a meeting of Gores Holdings VI’s stockholders to be held to approve the proposed business combination and other matters (the “Special Meeting”). Gores Holdings VI may also file other documents regarding the proposed business combination with the SEC. The definitive proxy statement/prospectus contains important information about the proposed business combination and the other matters to be voted upon at the Special Meeting and is not intended to provide the basis for any investment decision or any other decision in respect of such matters. Before making any voting decision, investors and security holders of Gores Holdings VI and Matterport are urged to read the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed business combination as they become available because they will contain important information about the proposed business combination. Investors and security holders will be able to obtain free copies of the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by Gores Holdings VI through the website maintained by the SEC at www.sec.gov, or by directing a request to Gores Holdings VI, Inc., 6260 Lookout Road, Boulder, CO 80301, attention: Jennifer Kwon Chou or by contacting Morrow Sodali LLC, Gores Holdings VI’s proxy solicitor, for help, toll-free at (800) 662-5200 (banks and brokers can call collect at (203) 658-9400). Participants in Solicitation Gores Holdings VI and Matterport and their respective directors and officers may be deemed to be participants in the solicitation of proxies from Gores Holdings VI’s stockholders in connection with the proposed business combination. Information about Gores Holdings VI’s directors and executive officers and their ownership of Gores Holdings VI’s securities is set forth in Gores Holdings VI’s filings with the SEC. Additional information regarding the interests of those persons and other persons who may be deemed participants in the proposed business combination may be obtained by reading the proxy statement/prospectus regarding the proposed business combination. You may obtain free copies of these documents as described in the preceding paragraph. Source: Gores Holding VI via BusinessWire |

||

| Post 22 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Bloomberg (22 July 2021) Matterport Takes Its 3D Maps to the Public Markets | The $2.9 billion startup will get its public market debut via a SPAC on Friday. In 2020, Matterport’s revenue grew by 87% to $86 million, and for the first time, it made more money on software than hardware and services. Matterport expects revenue to hit $123 million in 2021 and to exceed $202 million in 2022, according to a presentation it made to investors. It predicts that the majority of those sales will come from licenses and subscriptions. Source: Bloomberg |

||

| Post 23 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Inman (23 July 2021) 3D tour giant Matterport makes its stock market debut | The company will begin selling shares via a SPAC merger at a moment when interest in 3D tours is surging — and when more competitors are inching onto Matterport's turf --- Free 90 day trial of Inman with this WGAN Affiliate Code |

||

| Post 24 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Video: Matterport CEO on going public and the future of 3D technology | Video courtesy Yahoo Finance | 23 July 2021 | ||

| Post 25 • IP flag post | ||

Pages:

1This topic is archived. Start new topic?