CNBC: "32% of U.S. households missed their July housing payments"12460

Pages:

1

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| CNBC (8 July 2020) 32% of U.S. households missed their July housing payments "As the economic fallout from the coronavirus pandemic continues, almost one-third of U.S. households, 32%, have not made their full housing payments for July yet, according to a survey by Apartment List, an online rental platform," reports CNBC. "About 19% of Americans made no housing payment at all during the first week of the month, and 13% paid only a portion of their rent or mortgage," reports CNBC. Source: CNBC --- I could imagine that we will see many foreclosures a year form now (which will bring down the prices of houses in the same communities.) I could imagine that this means more houses for sale a year from now. Your thoughts? Dan |

||

| Post 1 • IP flag post | ||

Houston |

briangreul private msg quote post Address this user | |

| Holy [redacted]! That's my thought..... | ||

| Post 2 • IP flag post | ||

|

johnwheatley private msg quote post Address this user | |

| I live in a college town with about 15,000 students in a population of about 100,000. I would guess that equates to about 3,500 off-campus housing units. Nearly all the students went home earlier this year when it was announced that school would be 100% online. Many of them were locked into leases till school ended in June. Then the rest moved out, and no rent is coming in for all those property owners. It was announced a couple months ago that next year will be 100% online, so students are not coming back anytime soon. I imagine some teachers will teach from other locations, too, so more rentals will open up. That is a lot of empty units in a relatively small community. Based on these factors alone, I can imagine many units coming up for sale and plenty of foreclosures. Beyond that, there are many businesses in town that are dependent on the student population. If we add to all this that a third of the remaining population already can't pay rent, well, property owners in this community, and our economy in general, are in for a world of hurt. And this survey focused on renters, didn't even go into how many people already can't pay their mortgage. |

||

| Post 3 • IP flag post | ||

Houston |

briangreul private msg quote post Address this user | |

| As @JohnWheatley alluded, there is a whole other poo circus coming on the commercial side. The first closing was really hard on small businesses and restaurants. A second or prolonged closing will sink many of them. I read an article the other day, I think in the NY Times, discussing how many malls have a clause in the contract with small tenants that if they lose 2 large anchors the small tenant gets an out or a discount. Definitely time to bundle up as a cold wind is blowing this way. |

||

| Post 4 • IP flag post | ||

WGAN Fan WGAN Fan Club Member Gilroy, California |

Dataventurer private msg quote post Address this user | |

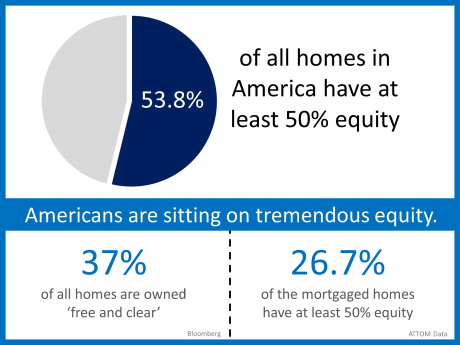

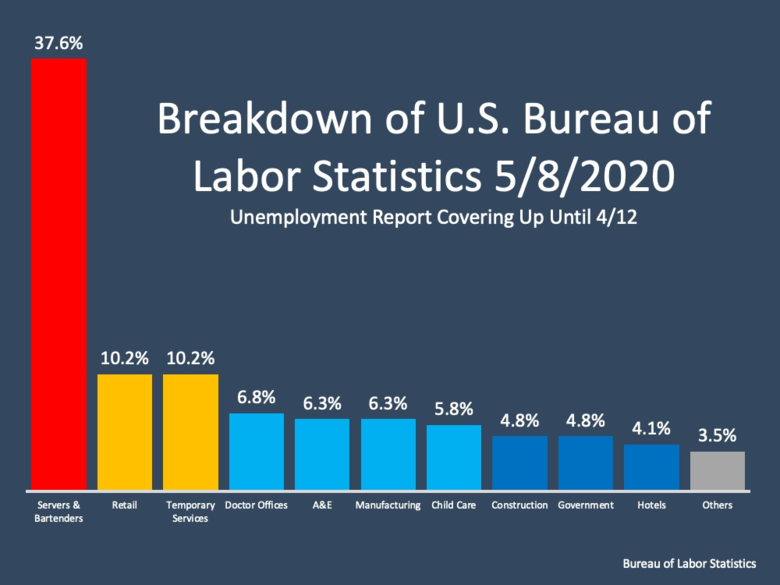

| Hey, happy to jump in here from northern California as a new Forum member this week. I recently began my real estate career as a "mature worker" near retirement age. Been watching the real estate market closely and reading the various sources of info available to real estate professionals through our various associations. Here's my take in a nutshell... This graphic shows the amount of equity that Americans have in their homes. These numbers are significantly higher than during the 2007-2009 crash when home equity had been widely leveraged by homeowners through lines of credit. In the current situation, homeowners have more equity in their homes which provides more options and flexibility with the lenders for forbearance and refinancing. Mortgage rates are at an all time low this week, too!  This next graph shows the sale of "distressed property" over the past eight years. We came into the beginning of 2020 in a very strong position in the housing market.  Lastly, the unemployment impact has been largely focused in the service sector, where many workers are not homeowners.  It's my personal opinion that homeowners who were offered the option for mortgage payment forbearance took the opportunity to because of the uncertainty of the economy during the early weeks of the virus outbreak. Banks are offering various plans to homeowners: catch-up repayment, lump sum repayment, or tacking the unpaid payments to the end of the mortgage. These kinds of options were not available during the housing crisis in the late 2000's. For homeowners who do decide to sell in the next few months, the housing inventory is comparatively very low. That is keeping prices up and even increasing home prices slightly over last year because of supply and demand. Looking into my crystal ball (and not presenting myself as an expert!) I don't think it's likely that there will be a Buyer's Market any time in the foreseeable future. I'd be happy to connect home buyers and sellers in the greater San Jose area with an experienced real estate team! |

||

| Post 5 • IP flag post | ||

|

johnwheatley private msg quote post Address this user | |

| @Dataventurer - Thanks for the great analysis and optimistic outlook! I think college towns with a high percentage of transient student population might be a different story. I would like to see where the other 46% of home stand with equity. (46% of US homes is a lot of homes!) |

||

| Post 6 • IP flag post | ||

WGAN Fan WGAN Fan Club Member Gilroy, California |

Dataventurer private msg quote post Address this user | |

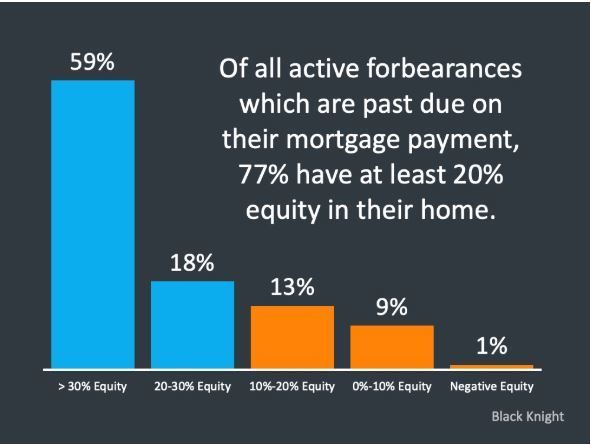

@johnwheatley, thanks for your interest! Your inquiry reminded me of a graphic I had seen a couple months ago and it was just used again in a presentation that was published today. The information is a bit different than the first graph I presented for general equity statistics. This graph shows the equity distribution specifically for homeowners with active past due forbearance. It shows the spread of equity in more detail for the sub-group of homeowners who would be possibly considering their options. |

||

| Post 7 • IP flag post | ||

Houston |

briangreul private msg quote post Address this user | |

| @Dataventurer - rumor in Houston is that turnkey homes are moving and projects aren't. I also think there is some lag in white collar jobs hitting the skids. It will start with the perceived expendable / outsourcable jobs such as IT. In the oil patch they already shed massive numbers of people. Middle management will be next..... followed by customer service which is already pretty lean. My friends in the airline business are counting the days until October 1st when the sword will fall at most airlines. UAL has warned tens of thousands to start looking for new work based on radically reduced demand. I think we will survive, but it's going to be a dark period until we get a vaccine and get past this. In the meanwhile we have to get people to wear a mask and quit doing stupid things..... SMH |

||

| Post 8 • IP flag post | ||

|

johnwheatley private msg quote post Address this user | |

| IF an effective vaccine is possible, it is at least several months away, maybe more than a year. Looking at this graphic, I would guess that about 23% of homeowner currently in forbearance are at risk of losing their homes in the next year or so. How many homes is that? What portion of those won't make it? I own two companies. Both are at great risk of failing. One, for example, is dependent on tourism. After 17 years in business, a couple months ago this business went from serious gangbusters to zero, from 25 employees to 3 part-time employees, almost overnight. If things don't change by the end of august, or if I don't find someone to lend me money (anybody?), it's lights out. I am hopeful we can pull off a meager break-even point by that time and keep hanging to a shoestring till the cavalry arrives with a vaccine (IF), or until the virus burns itself out through natural selection (IF), but survival of this business (and my retirement plan) is tenuous at best. The bank that holds the paper on our seven tourist vans has deferred our loans until September, as they have for a thousand other similar vans, all parked without work. We are in a better situation than most of the others. In September if the bank ends deferments, if the borders do not open or if the tourists do not come? I fear most will lose their van(s) along with their family-sustaining income potential. Then what happens to the bank? Maybe it will need to be bailed out (or not). Point is, if this is happening to me, I know it is happening to countless other entrepreneurs and their employees around the world. Eventually, if this lasts long enough, the housing market has got to shift. |

||

| Post 9 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| @Dataventurer Welcome to the WGAN Forum and thank you for your insightful data and analysis. I @johnwheatley Thank you for sharing. .... I could imagine that the entire WGAN Community join me in thinking good thoughts for you, your family and your businesses. I can't even imagine ... Dan |

||

| Post 10 • IP flag post | ||

Founder FounderNail Soup Media Sarasota, Florida |

GlennTremain private msg quote post Address this user | |

are you as a WGAN Matterport and 3D provider just pushing a button and delivering or are you teaching your agents and business owners how to use what you made them to the fullest so they are seen as the progressive marketer, innovative and the virtual real estate real estate agent. You are getting boatloads of business but are using this time where you have their attention to lock them in to using you forever and seen as essential in their success? Do you know how? |

||

| Post 11 • IP flag post | ||

Pages:

1This topic is archived. Start new topic?