Matterport Capture Services: Dan Smigrod Recommendations | Part 311620

Pages:

1

WGAN Forum WGAN ForumFounder and Advisor Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

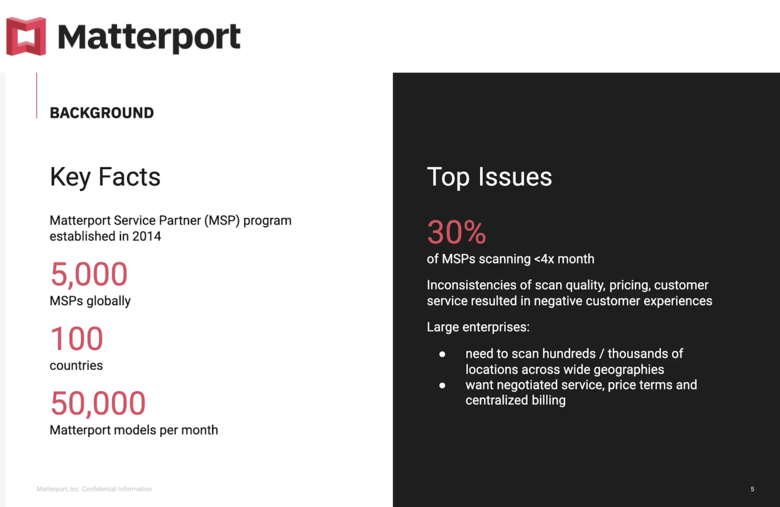

Screen Grab 5 | Matterport Capture Services Webinar | 16 April 2020 Matterport Capture Services: Dan Smigrod Recommendations | Part 3 Hi All, In Matterport Capture Services: Dan Smigrod Recommendations | Part 2, I wrote that in Part 3 - this installment - I would write about how Matterport should have handled enterprise companies seeking an "easy button" to order from Matterport Service Providers. First some backstory. In the Matterport Capture Services Webinar (16 April 2020), Matterport Chief Revenue Officer Jay Remley described both the challenges and opportunities, including: Quote: Originally Posted by @DanSmigrod And, Matterport Senior Director, Business Development Brendan Dowdle added: Quote: Originally Posted by @DanSmigrod The Matterport Capture Services Webinar slide 5 (Screen Grab 5 above) highlights the above: --- Large enterprises: ✓ Need to scan hundreds / thousands of locations across wide geographies ✓ Want negotiated services, price terms and centralized billing --- And, just this morning (Wednesday, 22 April 2020), a Matterport Service Provider posted this to the WGAN Forum: (portion quoted) Quote: Originally Posted by @briangreul Clearly, there is a need for one order/multiple markets - as I said so in my 2014 We Get Around blog post -- Analysis: How the We Get Around Network of Matterport Pro 3D Camera Photographers Will Accelerate Adoption of Matterport 3D Showcase Cloud Processing and Hosting -- (and reprinted here in the WGAN Forum), I identified this problem. So, we are all agreed – Matterport, Matterport Service Providers, enterprise companies and me. That said, Matterport’s strategy – build and implement the solution internally – is the wrong strategy to achieve the goal. While it likely Matterport will achieve the desired goal in the short term, unfortunately, in long term, it is not in the best interest of: ✓ Matterport ✓ Matterport Investors ✓ Matterport Service Providers ✓ Enterprise Clients So, what strategy should Matterport have implemented for enterprise companies seeking an "easy button" to order from Matterport Service Providers? What strategy would have resulted in dramatic, long-term growth for Matterport, including: ✓ processing ✓ hosting ✓ 2D schematic floor plans ✓ MatterPak ✓ Publish to Google Street View ✓ Matterport SDK/APs ✓ TrueSketch™ & TrueSketch™ PLUS for Xactimate ✓ Other services to be announced And, would also result in happier: ✓ Matterport Investors ✓ Matterport Service Providers ✓ Enterprise Clients Matterport should be in support of the photography agencies - and not compete - such as: ✓ HouseLens (Seek Now) ✓ KoaWare ✓ Meero ✓ Shawn May Photography ✓ Snappr ✓ Zigna Matterport should be in support of companies - and not compete - such as: ✓ Adaptive Property Solutions ✓ Keekstr ✓ Koridor ✓ IFTI/PROvision Solutions ✓ Multivista ✓ Outhouse There are many photography agencies – and companies – around the globe that specialize in different verticals (hotels, residential real estate, construction documentation) and understand the local countries and languages. In the long run – Matterport would scale faster – working with photography agencies and companies to offer Matterport at scale. By competing with these (and many more) photography agencies and companies, it is likely that some – if not all – will: ✓ stop offering Matterport as a solution ✓ start offering competing 3D/360 solutions Two photography agencies that reached out to me on this topic: 1. one said he had already lost dozens and dozens of jobs to Matterport Capture Services; jobs that he said he paid more to the Matterport Service Provider than Matterport. He's not sure how to deal with competing with Matterport. 2. another photography agency that was planning to add Matterport to their services - and source Pros via the WGAN Find a Matterport Pro Map - has decided not to because it doesn't make sense to compete with Matterport. (I also talked with a Matterport Service Provider today who said that he was near to closing a deal for 40 properties and the Matterport Capture Services program won the business at half the cost.) Plus, Matterport handed a gift to 3D/360 hosting platforms like EyeSpy360 (building out a Network of service providers to service eXp360 Tours powered by EyeSpy360) and iGuide for professional real estate photographers. Matterport Service Providers are already selling their Matterport camera and seeking other 3D/360 cameras and other 3D/360 hosting software/platforms. While Matterport Service Providers may still feel that they are not being paid fairly via a photography agency or company, clearly the following would have been an unlikely scenario: Quote: Originally Posted by @immersivespaces Quote: Originally Posted by @immersivespaces In this WGAN Forum post from a year ago ... ✓ Matterport Survey: a Wolf in Sheep's Clothing? and discussed here too ... ✓ Is Matterport a Service Company or is Matterport a Software Company? ... @MeshImages correctly predicted the Matterport Capture Services program: Quote: Originally Posted by @MeshImages Something inherently seems wrong with the scenario where the company that sells you the camera, processing and hosting competes with you by sells scanning services. By empowering photography agencies - and companies - to offer an "easy button" to order from Matterport Service Providers, Matterport would have scaled its business exponentially – without trying to become a service business – and with Matterport Service Providers having a choice of whether to participate - or not - in the 3rd party solutions to scanning at scale. As I wrote a year ago here ... ✓ Matterport Survey: a Wolf in Sheep's Clothing? Matterport should be championing Matterport Service Provides getting the most money for our services. What are your thoughts? Matterport Capture Services: Dan Smigrod Recommendations | Part 4 In Part 4 of my Capture Services: Dan Smigrod Recommendations to be published the week of 27 April in the WGAN Forum, I will talk about how Matterport investors might still salvage their investment in Matterport, help Matterport reach its full-potential and win back the hearts of Matterport Service Providers. Stay healthy, Dan WGAN Forum Related Discussions ✓ Transcript: Matterport Capture Services Webinar | Thursday, 16 April 2020 ✓ Matterport Capture Services: Dan Smigrod Recommendations | Part 1 ✓ I Apologize. I Made a Big Mistake. ✓ Matterport Capture Services: Dan Smigrod Recommendations | Part 2 ✓ Long-Time MSP Client Cancels Scans to Book via Matterport Capture Services ✓ WGAN Forum discussions tagged: Matterport Competes with MSPs |

||

| Post 1 • IP flag post | ||

|

izoneguy private msg quote post Address this user | |

| If anything, the MP scan program makes them an acquisition target for someone like AWS or Microsoft or Google. LOL - if Google bought Matterport then it would be dead. The way Google Street View works is a joke. |

||

| Post 2 • IP flag post | ||

|

CharlesHH private msg quote post Address this user | |

| @izoneguy. You’ve just given the perfect reason for Google to buy MP. Imagine every GSV inside was the quality of a MP tour. | ||

| Post 3 • IP flag post | ||

|

|

Changesin3d private msg quote post Address this user | |

| Dan: Looking at screen capture 5 you posted, Matterport is addressing that most MSPs do under 4 scans a month. Do you figure that is because people purchased it as a business opportunity and expect to get the leads that were promised as part of the purchase. Was it part of the failure, who would have purchased the cameras if the leads were not promised. This was a promise on their website and in their promotions until just a few months ago. Salesmen used that line on me. To become and MSP we had to jump threw some hoops, like build websites, prove we could do scans and more. And now we cannot even get the promised logo for all we did. Does that sound fair to you? Some time back someone mentioned a lawsuit, someone named Chris was he talking about GEo CV or are their any other legal issues you have heard about? Have you invited the CEO of Matterport on to your weekly TV to do a town hall, I loved it when you had those guys on, what happened? |

||

| Post 4 • IP flag post | ||

|

MeshImages private msg quote post Address this user | |

| Another question that arises from my point of view: Why should enterprise customers let their thousands of properties be scanned with a 4 year old MP2 camera? For Engel Volkers and all other realtors this can make sense (short term perspective). But for large stores like Walmart or Ikea with room heights, that sometimes exceed 15 meters and sizes exceeding 10.000 sqm fully packed with stuff? Or outdoor businesses like Exxon and many others - with a MP2 camera, seriously? Or any other enterprise customer with a longterm perspective: would you spend millions for scans with this proprietary 4-year-old Matterport system? Scans from kinect sensors? The more I read about Matterports latest move towards a service company, that is actively competing with their clients, the more I get the impression, that they are simply desperate. RJ Pittman invested all the investor's money in the wrong direction, because nobody wants to scan cheap looking 3D models with 360 cameras. By the end of the year he will be gone. And maybe Matterport will be gone, too. |

||

| Post 5 • IP flag post | ||

WGAN WGANStandard Member Los Angeles |

Home3D private msg quote post Address this user | |

| Maybe it’s a minor point but one of the biggest problems I see in the way all enterprise scan brokers function is the inequity of rates paid for the work done by MSPs. The internet has many cost-or-living calculators based on the ongoing economic research done by trusted institutions. It would be simple to harness any one of these to provide predictable costs to an enterprise customer while paying MSPs equitably according to their individual cost-or-living indices, so they are truthfully paid equally rather than being offered poverty wages in major cities. The COL calculators are there. Why not use them? If anyone knows an enterprise scan-aggregator that is doing this, let me know so I can compliment them. |

||

| Post 6 • IP flag post | ||

WGAN Forum WGAN ForumFounder and Advisor Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Thanks all! Other thoughts! Dan |

||

| Post 7 • IP flag post | ||

Pages:

1This topic is archived. Start new topic?