Matterport Announces 2Q 2023 Financial Results (Tuesday, 8 Aug. 2023)18961

Pages:

1

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

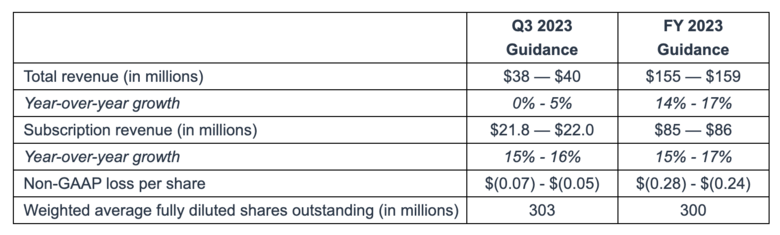

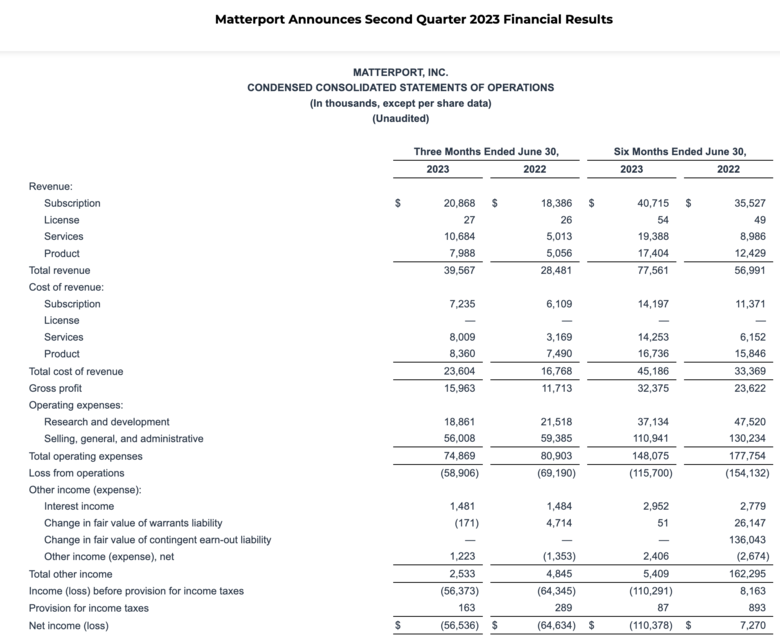

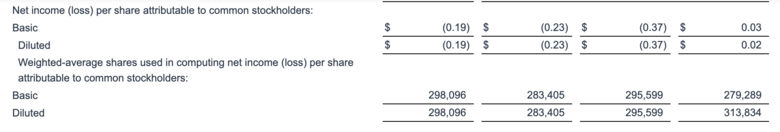

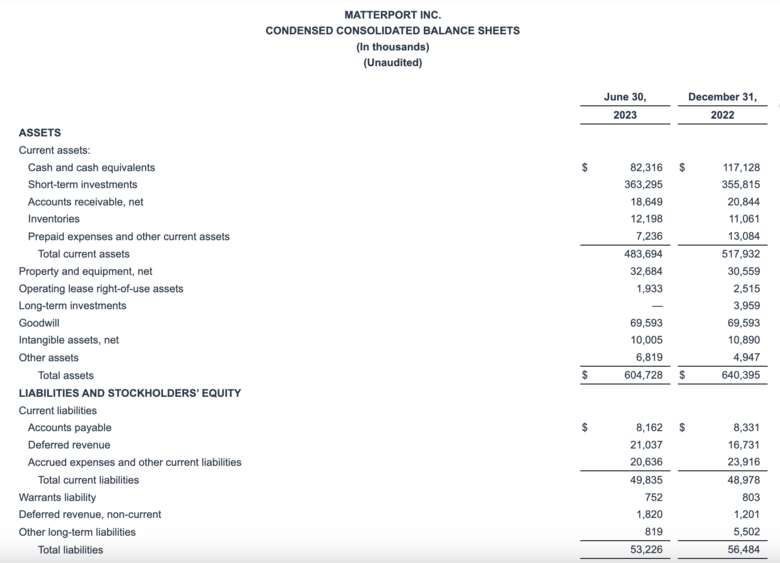

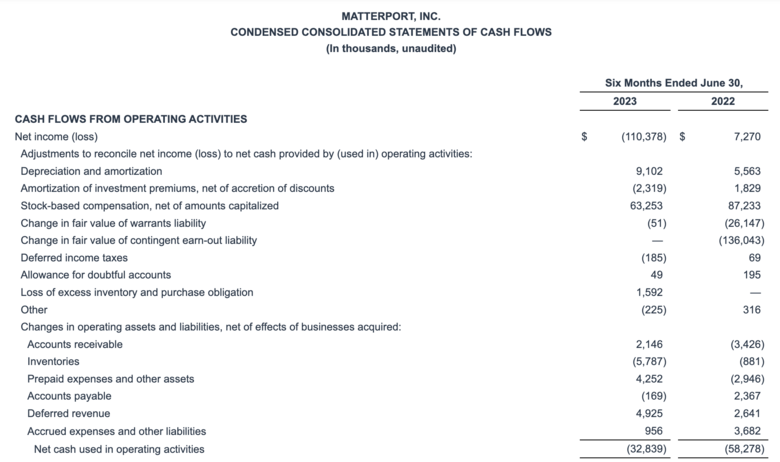

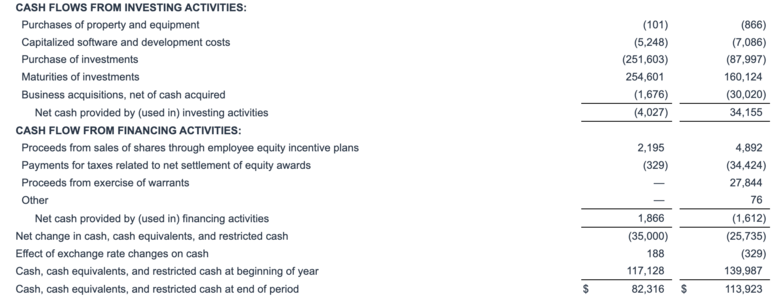

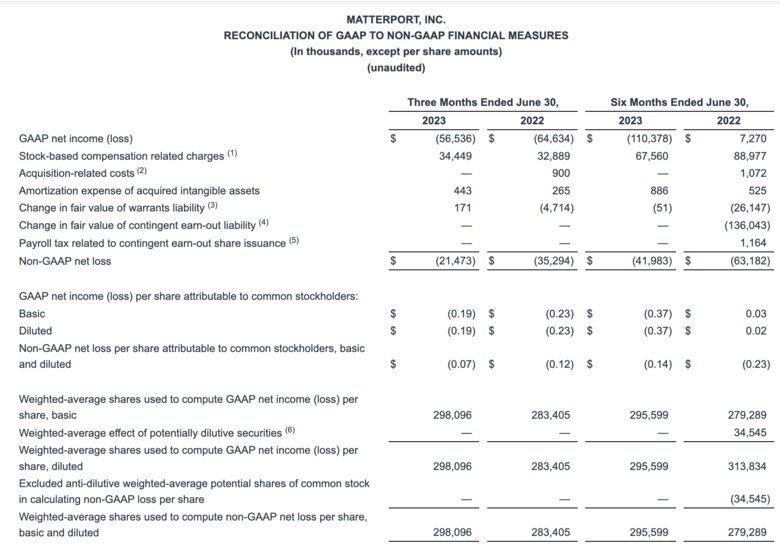

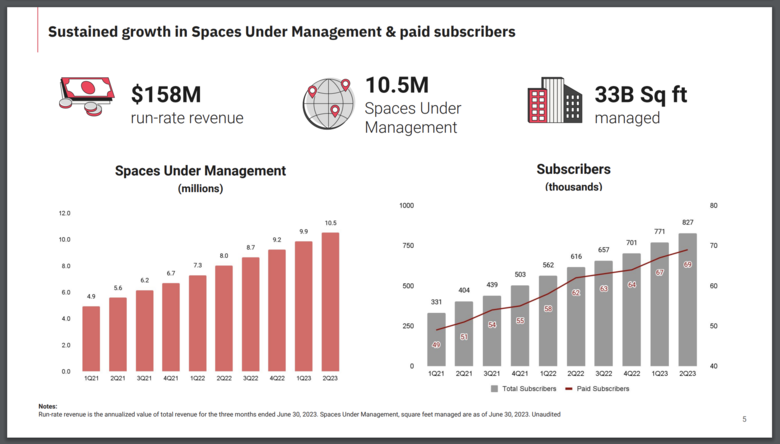

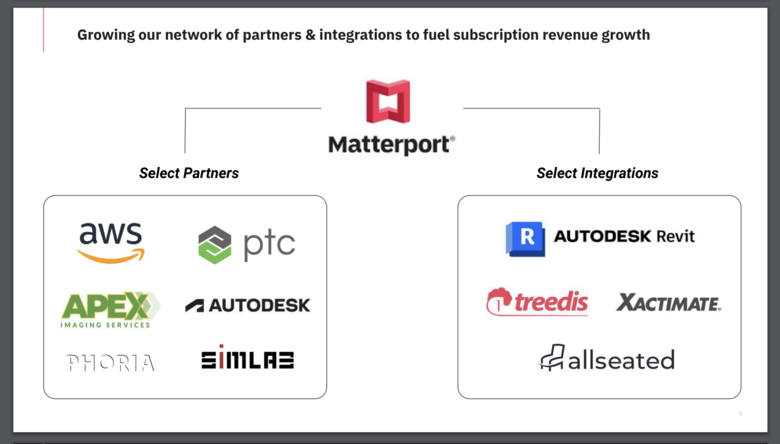

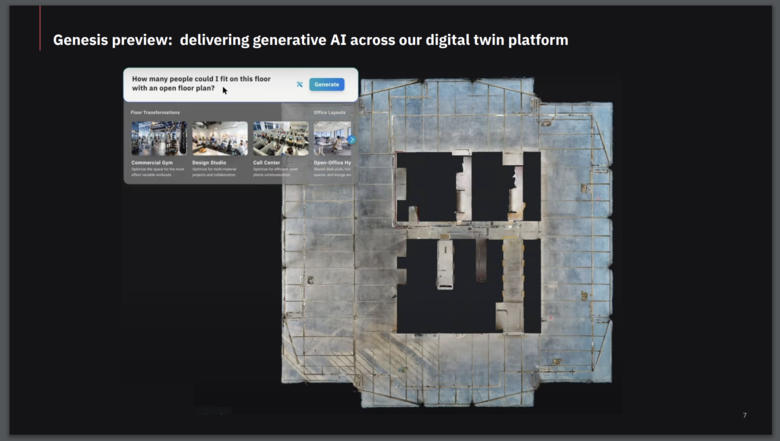

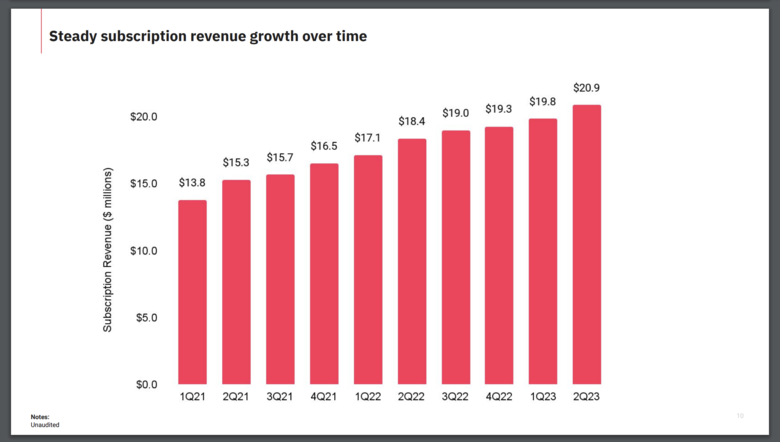

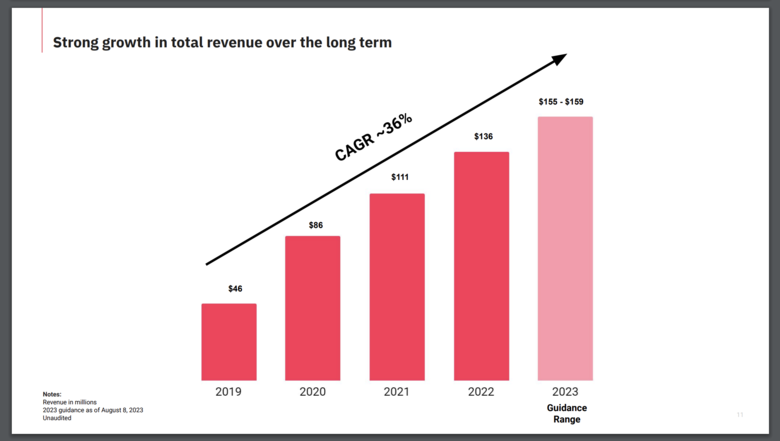

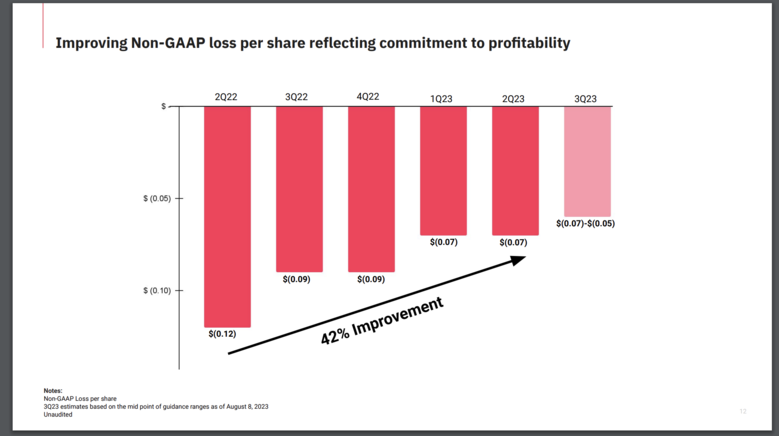

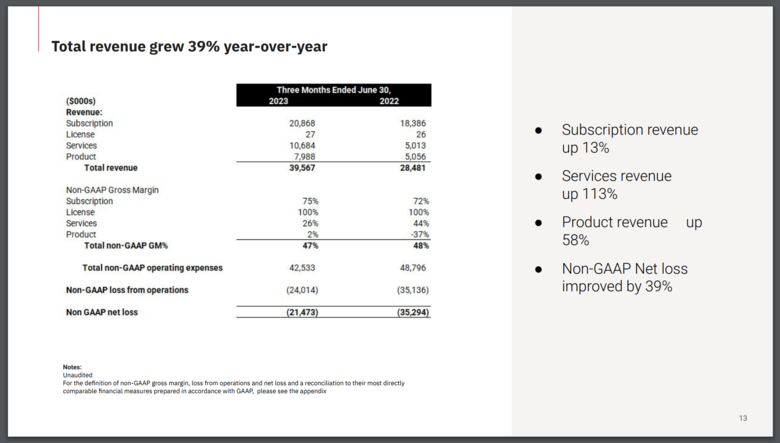

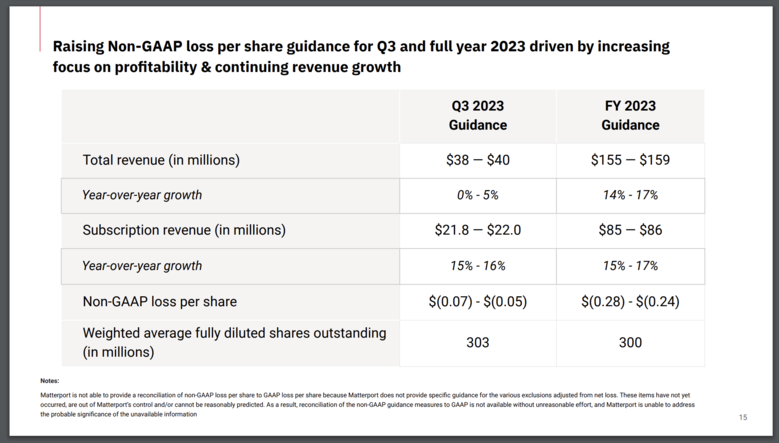

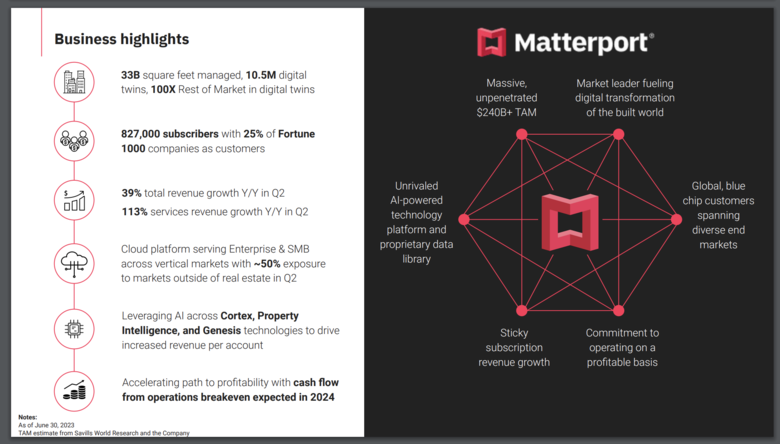

| Matterport Media Release --- Video: Matterport Announces Second Quarter 2023 Financial Results | Video courtesy of WGAN-TV YouTube Channel | Tuesday, 8 August 2023 WGAN Forum Podcast | Episode #215 ==================================================================================== Matterport Deck | Second Quarter 2023 Financial Results | August 8, 2023 ==================================================================================== Matterport Announces Second Quarter 2023 Financial Results 1. Q2 total revenue of $39.6 million, up 39% year-over-year, at high end of guidance range 2. Q2 subscription revenue reached record $20.9 million, at high end of guidance range 3. Q2 GAAP loss per share of $0.19 and Non-GAAP loss per share of $0.07, at high end of guidance range 4. Company raises 2023 Non-GAAP loss per share guidance 5. Accelerates operational cash flow profitability target to 2024 Sunnyvale, California, Tuesday, August 8, 2023 (GLOBE NEWSWIRE) -- Matterport, Inc. (Nasdaq: MTTR) (“Matterport” or the “Company”), the leading spatial data company driving the digital transformation of the built world, today announced financial results for the quarter ended June 30, 2023. “The second quarter execution was pivotal for the company this year. We delivered record subscription and services revenue while doubling-down on our efficiency initiatives to deliver step function productivity gains in the second half of 2023. Total revenue for the quarter grew to nearly $40 million, fueled by strong enterprise adoption and steady improvements with our small and medium-sized businesses,” said RJ Pittman, Chairman and Chief Executive Officer of Matterport. “Our strategic partnerships continue to drive pipeline, connect us to large industry ecosystems, open new technology distribution channels, and critically enhance our platform's functionality for customers. Our unmatched digital twin platform equips customers with crucial tools for managing and marketing their properties and facilities. By harnessing our extensive spatial data library, we expect our new AI solutions will generate breakthrough customer value and bolster our subscription revenue per account,” Pittman added. “Our continued growth in total and subscription revenue as well as commitment to streamlining operations have propelled us to another quarter of exceptional bottom-line outperformance, delivering Non-GAAP loss per share toward the top end of guidance,” said JD Fay, Chief Financial Officer of Matterport. “Looking forward, our recent restructuring aims to fast-track our path to operational cash flow profitability to 2024, a full year ahead of our previous plan. These difficult and decisive steps reflect our dedication to constructing a sustainable business emphasizing long-term growth and profitability.” Second Quarter 2023 Financial Highlights 1. Total subscribers increased to 827,000, up 34% year-over-year 2. Spaces under management increased to 10.5 million, up 31% year-over-year 3. Total revenue of $39.6 million, up 39% year-over-year 4. Subscription revenue of $20.9 million, up 13% year-over-year 5. Annualized Recurring Revenue (ARR) exiting the second quarter was $83.5 million 6. Services revenue of $10.7 million, up 113% year-over-year 7. Net loss of $0.19 per share 8. Non-GAAP net loss of $0.07 per share, a 42% improvement year-over-year 9. Cash used in operating activities was $12.4 million, and improvement of 62% year-over-year Recent Business Highlights 1. Announced Genesis, a new initiative that aims to deliver generative AI across the Company’s digital twin platform for customers looking to bolster efficiency and profitability of their property portfolios worldwide. Genesis combines deep learning and computer vision innovations including Cortex AI and Property Intelligence, with generative AI to deliver a new generation of digital twins. These will be dynamic with interiors easily removed, redesigned, and presented in dimensionally accurate 3D. New design concepts, operational layouts, and other space utilization requirements can be quickly evaluated and customized for buildings of any size, residential or commercial. The project builds upon the Company’s decade-long expertise in artificial intelligence and its market-leading 3D spatial data library of more than 30 billion square feet of digitized physical space, to help customers market, manage, and reimagine every type of property across the built world– automatically. 2. Announced changes to subscription plans and pricing. The Company implemented price increases ranging from 7% to 11% across its subscription plans, representing its first pricing change since 2019. New subscription plans offer increased flexibility alongside the rich features and functionality added to the Company’s digital twin platform each every year. The Company updated plans so customers can find the right subscription that fits their needs and budget while recognizing the value these plans offer customers. 3. Announced a reorganization to streamline business operations in July. As part of ongoing efforts to optimize our global workforce and improve operating efficiency, the Company eliminated certain roles, and started the process to evaluate possible redundancies in Europe. The Company’s ability to adapt to rapidly changing global market conditions has been vital to its continued success. The health and strength of the business is critical to ensuring the Company continues to serve its customers with world-class products and services. 4. Announced the general availability of new integrations with AWS IoT TwinMaker, enabling enterprise customers to seamlessly connect real-time factory data into a Matterport digital twin. This new offering from Matterport supports enterprise digital transformation efforts by providing customers with an efficient and cost-effective solution to remotely optimize building operations, increase production output, improve equipment performance, and increase environmental health and safety at their facilities. 5. Announced its partnership with Equinox Technologies, a distributor of global technologies and Managed Security Services to offer Matterport’s digital twin platform to Government, Enterprise and Small-to-Medium sized customers out of its offices in the United Arab Emirates, India, Oman, Saudi Arabia, and South Africa. The Company also announced that it is significantly expanding its presence in Latin America, partnering with CompuSoluciones, one of the largest value-added distributors of technology in the region, as a key distributor of Matterport’s digital twin technologies in Mexico and Colombia. 6. Announced that Tenzan Sake Brewery Co., one of the world’s oldest sake brewers, has selected Matterport’s digital twin platform and 3D capture technology to digitally recreate its historic facility. The Company also entered its third year of collaboration with the global forum for collectible design, Design Miami/, to create an immersive digital twin of the iconic Swiss event, Design Miami/ Basel. Third Quarter and Full Year 2023 Outlook The Company is providing the following financial guidance for the third quarter and full year 2023. The Company is raising its full year guidance for Non-GAAP loss per share driven by the Company’s continued focus on operating efficiency. This guidance will be discussed in greater detail on today’s conference call.  Matterport is not able to provide a reconciliation of non-GAAP loss per share to GAAP loss per share because Matterport does not provide specific guidance for the various exclusions adjusted from net loss. These items have not yet occurred, are out of Matterport’s control and/or cannot be reasonably predicted. As a result, reconciliation of the non-GAAP guidance measures to GAAP is not available without unreasonable effort, and Matterport is unable to address the probable significance of the unavailable information. Non-GAAP Financial Information Matterport has provided in this press release financial information that has not been prepared in accordance with generally accepted accounting principles in the United States (GAAP). We believe that the presentation of non-GAAP financial information provides important supplemental information to management and investors regarding financial and business trends relating to Matterport’s financial condition and results of operations. The presentation of these non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP financial measures and should be read only in conjunction with the Company’s consolidated financial statements prepared in accordance with GAAP. For further information regarding these non-GAAP measures, including the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures, please refer to the financial tables below. Non-GAAP Net Loss and Non-GAAP Net Loss Per Share, Basic and Diluted. Matterport defines non-GAAP net loss as net loss, adjusted to exclude stock-based compensation-related charges (including share-based payroll tax expense), fair value change of warrants liability, fair value change of earn-out liabilities, payroll tax related to contingent earn-out share issuance, acquisition-related costs, and amortization of acquired intangible assets, in order to provide investors and management with greater visibility to the underlying performance of Matterport’s recurring core business operations. We define non-GAAP net loss per share, as non-GAAP net loss divided by the weighted-average shares outstanding, which includes the dilutive effect of potentially diluted common stock equivalents outstanding during the period if any. Conference Call Information Matterport will host a conference call for analysts and investors to discuss its financial results for the second quarter 2023 today, August 8, 2023, at 1:30 p.m. Pacific time (4:30 p.m. Eastern time). A recorded webcast of the event will also be available following the call for one year on Matterport’s Investor Relations website at investors.matterport.com. The dial-in number will be (412) 902-4209, conference ID: 10176797. The financial results press release and a live webcast of the conference call will be accessible from the Matterport website at investors.matterport.com. An audio webcast replay of the conference call will also be available for one year at investors.matterport.com. About Matterport Matterport, Inc. (Nasdaq: MTTR) is leading the digital transformation of the built world. Our groundbreaking spatial data platform turns buildings into data to make nearly every space more valuable and accessible. Millions of buildings in more than 177 countries have been transformed into immersive Matterport digital twins to improve every part of the building lifecycle from planning, construction, and operations to documentation, appraisal and marketing. Learn more at matterport.com and browse a gallery of digital twins. ©2023 Matterport, Inc. All rights reserved. Matterport is a registered trademark and the Matterport logo is a trademark of Matterport, Inc. All other marks are the property of their respective owners.        (1) Consists primarily of non-cash share-based compensation expense related to our stock incentive plans and earn-out arrangement, and the employer payroll taxes related to our stock options and restricted stock units. (2) Consists of acquisition transaction costs. (3) Consists of the non-cash fair value measurement change for public and private warrants. (4) Represents the non-cash fair-value measurement change related to our earn-out liability. (5) Represents the payroll tax related to earn-out shares issuance and release in the three months ended March 31, 2022. (6) Consists of the potentially dilutive effect of employee equity incentive plan awards. Source: Matterport via Globe Newswire |

||

| Post 1 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Matterport Deck | Second Quarter 2023 Financial Results | August 8, 2023 [Below are Some Pages from this Deck]              |

||

| Post 2 • IP flag post | ||

Pages:

1This topic is archived. Start new topic?