Vacation Home Demand Plummets Over 50% as Market Shifts Post-Pandemic18530

Pages:

1

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

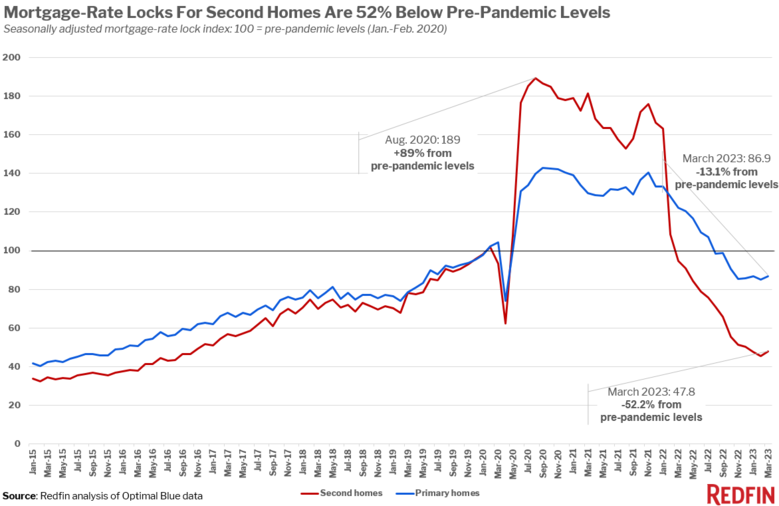

| Source: Redfin | Monday, 10 April 2023 | Summarized by ChatGPT Plus --- Video | Redfin: Vacation Home Demand Plummets Over 50 Percent as Market Shifts Post-Pandemic | video courtesy of WGAN-TV YouTube Channel | 10 April 2023 | Redfin Media Release Summarized by ChatGPT Plus | Read by Synthesia AI News Reader Alex (www.WGAN.INFO/Alex) Audio | WGAN Forum Podcast | Episode: 182 | Redfin: Vacation Home Demand Plummets Over 50 Percent as Market Shifts Post-Pandemic | Redfin Media Release Summarized by ChatGPT Plus | Read by Synthesia AI News Reader Alex (www.WGAN.INFO/Alex)  Source; Redfin Vacation Home Demand Plummets Over 50% as Market Shifts Post-Pandemic The demand for vacation homes has decreased by a staggering 52% from pre-pandemic levels, according to a recent report by Redfin, the technology-powered real estate brokerage. Mortgage-rate locks for second homes hit their lowest point since 2016 in February, with March not far behind. During the pandemic, second-home demand skyrocketed, with mortgage-rate locks peaking at 89% above pre-pandemic levels in August 2020. This boom was fueled by affluent Americans seeking vacation properties due to low mortgage rates, remote work opportunities, and travel restrictions. However, six factors have contributed to the sharp decline in second-home demand: 1. The high cost of vacation homes, with the average second home valued at $465,000 compared to $375,000 for primary homes. Additionally, the federal government increased loan fees for second homes in April 2022. 2. Second homes being a luxury rather than a necessity, leading buyers to pull back from the market. 3. The gradual return to office work, reducing the appeal of second homes. 4. The decreasing attractiveness of buying vacation homes for rental purposes, due to a saturated short-term rental market and cooling long-term rental market. 5. Shrinking bank accounts as stock markets decline, reducing available funds for down payments and monthly payments. 6. Many potential second-home buyers having already made their purchases during the 2020 and 2021 pandemic homebuying boom. Redfin Deputy Chief Economist Taylor Marr explains that the current challenging financial climate, including high housing payments, inflation, and uncertainty in financial markets, has made it difficult for most Americans to consider purchasing a vacation home. Despite the downturn, affluent cash buyers are still seeking vacation properties in popular destinations. Phoenix Redfin agent Van Welborn notes that these buyers are motivated by the potential to purchase vacation homes below asking price, although interest in short-term rental properties has waned due to market saturation. --- Source: Redfin | Monday, 10 April 2023 | Summarized by ChatGPT Plus |

||

| Post 1 • IP flag post | ||

WGAN Standard WGAN StandardMember Las Vegas |

VTLV private msg quote post Address this user | |

| 7th factor could have something to do with local government laws limiting the number of short term rentals in a neighborhood. Making shopping for one that much more difficult to find a legal home. | ||

| Post 2 • IP flag post | ||

Pages:

1This topic is archived. Start new topic?