Matterport Announces Record 2021 Financial Results; 500,000+ Subscribers16462

Pages:

1

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

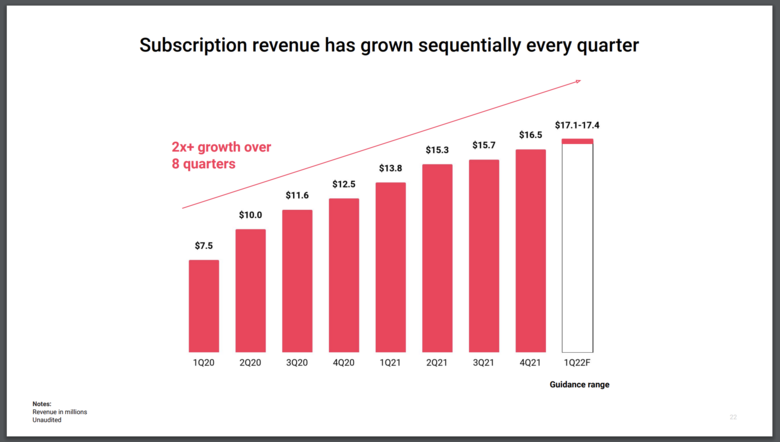

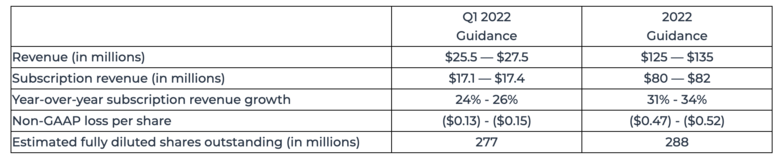

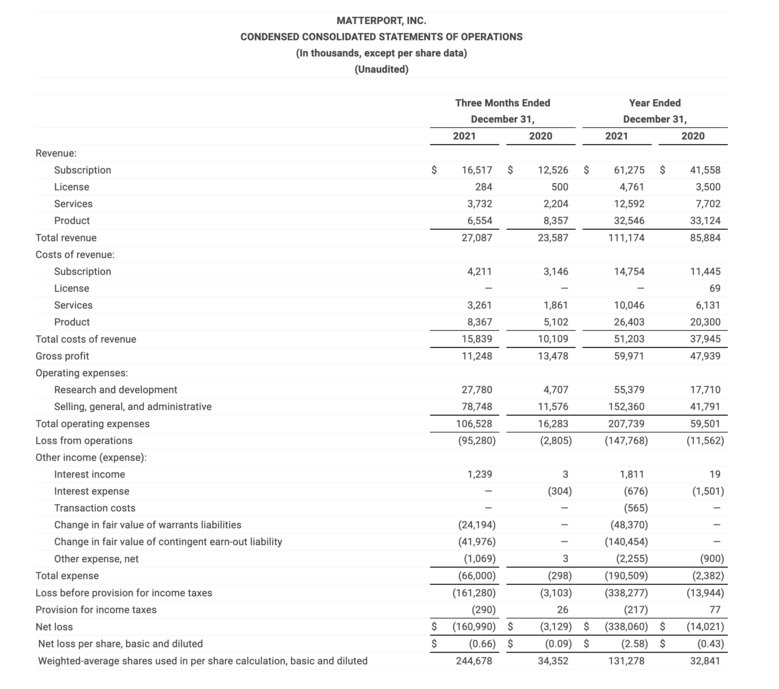

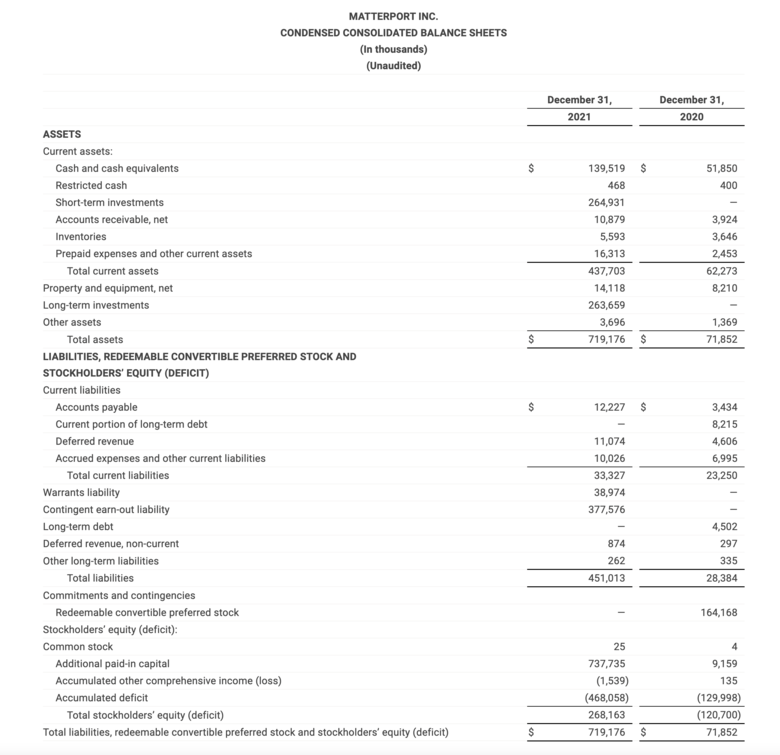

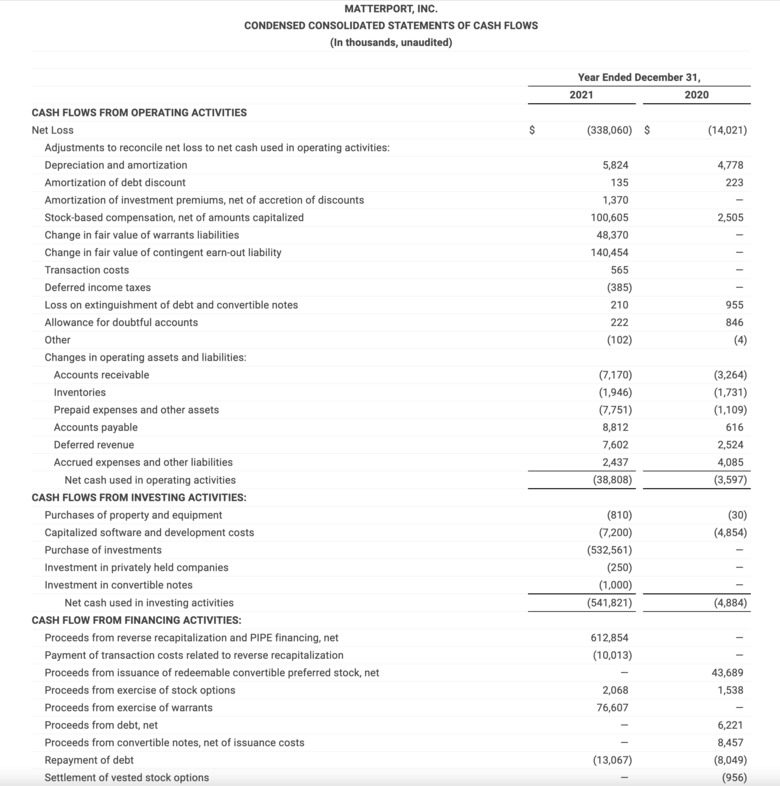

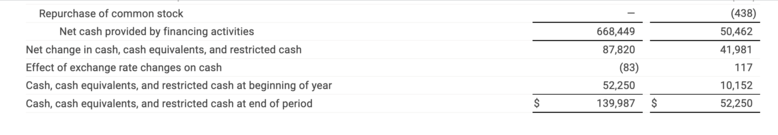

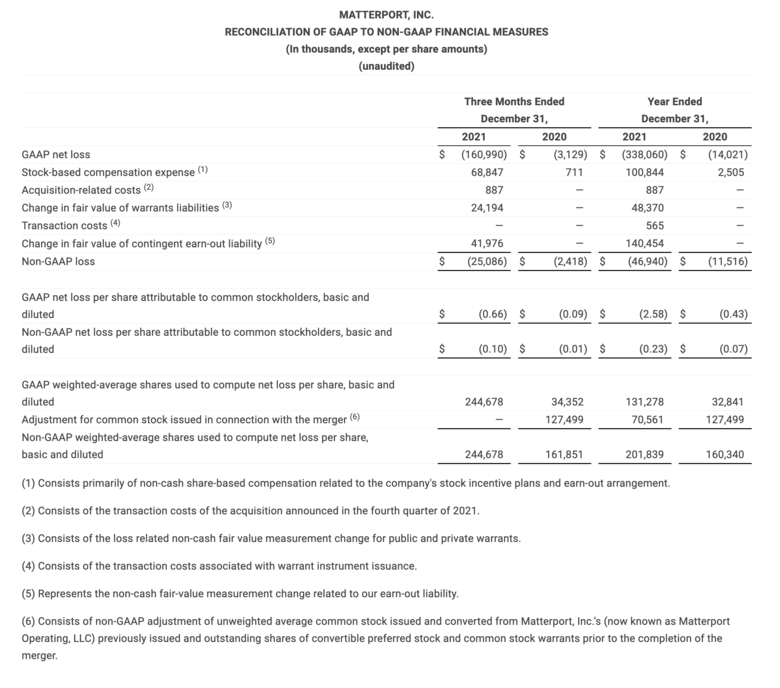

| Matterport Media Release ---  Page 22 of 30 from the Matterport 4Q21 Earnings Deck that was released 16 February 2022. Video: 65. Matterport Announces Record 2021 Financial Results; 500,000+ Subscribers | Video courtesy of WGAN-TV YouTube Channel | Wednesday, 16 February 2022 | Reading of Matterport Media Release (below) WGAN Forum Podcast Matterport Announces Record Full Year 2021 Financial Results and More Than 500,000 Subscribers Breakthrough product launches including Smartphone Capture and Axis to democratize space capture and drive adoption 1. Total subscribers increased 98% to 503,000 from year-ago period 2. Fiscal year 2021 subscription revenue rose 47% year-over-year 3. Annualized recurring revenue (ARR) grew to $66 million 4. Q4 GAAP loss per share of $0.66, Non-GAAP loss per share of $0.10 SUNNYVALE, California, Wednesday, February 16, 2022 (GLOBE NEWSWIRE) -- Matterport, Inc. (Nasdaq: MTTR), the leading spatial data company driving the digital transformation of the built world, today announced unaudited financial results for the quarter ended December 31, 2021. “2021 was a pivotal year for Matterport, delivering strong growth as we closed our merger with Gores Holdings VI, Inc. and became a public company on The Nasdaq, gaining industry visibility and balance sheet strength to execute our ambitious growth plans,” said RJ Pittman, Chairman and Chief Executive Officer of Matterport. “Our business model is well-proven and scaling as momentum increased across our key operating metrics. In 2021, we doubled our subscriber base, increased Spaces Under Management by 54%, and subscription revenue grew 47%, and total revenue was up 29% for the full year. Most importantly, we strengthened the management team with new world-class executives across the globe. Relentless innovation is the norm at Matterport, and with new products like Matterport Axis and Matterport for Android, we are racing to bring precision 3D capture and digital twins to everyone in the built world. Looking forward, the physical world is going digital. Every industry on every continent is embracing digitization, and I am more confident than ever about the company’s outlook for 2022 and the decade ahead.” “In the fourth quarter we continued to make strong progress on the path of building our recurring subscription revenue business, which represented 61% of total revenue,” said JD Fay, Chief Financial Officer of Matterport. “We also strengthened our balance sheet and reduced the complexity in our capital structure by announcing the redemption of our public warrants, which resulted in another $104 million of cash proceeds from the exercise of warrants prior to redemption. Proceeds from the warrant exercises, along with the $640 million in gross proceeds raised in the third quarter, together provide us tremendous flexibility in allocating capital to accelerate our growth in 2022 and beyond.” Fourth Quarter 2021 Unaudited Financial Highlights Matterport reported the following unaudited financial results: 1. Total revenue was $27.1 million, up 15% compared to fourth quarter of 2020 2. Subscription revenue was $16.5 million, up 32% compared to fourth quarter of 2020 3. Annualized Recurring Revenue (ARR) of $66.1 million 4. Total subscribers increased to 503,000, up 98% compared to fourth quarter of 2020 5. Spaces Under Management (SUM) grew to 6.7 million, up 54% compared to fourth quarter of 2020 Recent Business Highlights 1. Introduced Matterport Axis™, a new hands-free motor mount for precision 3D capture for smartphones 2. Announced Matterport for Mobile, making 3D capture freely available to more than a billion Android mobile devices 3. Announced industry partnerships with Amazon Web Services (AWS) and Autodesk 3A. Announced the availability of the Matterport platform in AWS Marketplace so that AWS customers will be able to access Matterport’s digital twin technology with AWS add-ons that increase the value of digitization 3B. Announced a new plugin for Autodesk Revit customers, allowing them to upload the Matterport Scan-to-BIM file into Revit and start creating and managing information on a construction or design project across its different stages 4. Introduced Matterport Scan-to-BIM file, a new add-on service that dramatically decreases the time and costs of Building Information Modeling (BIM) for the Architecture, Engineering, and Construction industry 5. Announced the acquisition of Enview, Inc., a pioneer in the scalable, artificial intelligence (AI) for 3D spatial data, which was completed in January 2022 6. Continued expansion of Capture Services™ On-Demand to seven countries and 152 cities 7. Announced the redemption of our public warrants, resulting in approximately $104 million in cash proceeds from the warrants prior to redemption, which is additive to the $640 million of gross proceeds raised in the closing of the merger in July 2021 8. Won two Comparably Awards, including Best Company Culture and Best Company for Women 9. Strengthened executive team through the addition of the following: 9A. Tom Klein, Chief Marketing Officer 9B. Deepti Illa, Vice President, Global Integrated Marketing 9C. Florence Shaffer, Vice President, Strategy & Operations, Chief of Staff to CEO 9D. Ben Corser, Managing Director, Asia Pacific 9E. Rob Hines, Managing Director, Americas 9F. Peter Presunka, Chief Accounting Officer 9G. Amy Hsueh, Vice President of Corporate Development Full Year and First Quarter 2022 Outlook Matterport is providing the following guidance for the full year ending December 31, 2022 and the first quarter. The company’s progress in 2021 has set the stage for even broader adoption of Matterport across the global real estate asset class. With the recent releases of Matterport for Android and Matterport Axis, the company has democratized digital capture of any physical space using just a smartphone and a free subscription. Additionally, in 2021 the company significantly strengthened its balance sheet and staff to create a powerful foundation for future growth. Combining its ongoing development efforts with the technology and talent from the acquisition of Enview, in 2022 and beyond, Matterport looks forward to even greater property digitization, as well as beginning to deliver data and insights across millions of digitized spaces to the even larger datafication market for real estate. Accordingly, the company expects continued growth in 2022, with total revenue between $125 and $135 million. Recurring subscription revenue is expected to be between $80 and $82 million, translating to 31% to 34% year-over-year growth. For the first quarter, the company expects total revenue to be between $25.5 and $27.5 million. Recurring subscription revenue is expected to be between $17.1 and $17.4 million, translating to 24% to 26% year-over-year growth.  Source: Matterport Non-GAAP Financial Information Matterport has provided in this press release financial information that has not been prepared in accordance with generally accepted accounting principles in the United States (GAAP). We believe that the presentation of non-GAAP financial information provides important supplemental information to management and investors regarding financial and business trends relating to our financial condition and results of operations. The presentation of these non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP financial measures and should be read only in conjunction with the company’s consolidated financial statements prepared in accordance with GAAP. For further information regarding these non-GAAP measures, including the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures, please refer to the financial tables below. Non-GAAP Net Loss and Non-GAAP Net Loss Per Share, Basic and Diluted. Matterport defines non-GAAP net loss as net loss, adjusted to exclude stock-based compensation expense, fair value change of warrants liabilities, fair value change of earn-out liabilities, transaction costs associated with the acquisition announced in the fourth quarter in 2021, and transaction costs associated with the recently completed merger, in order to provide investors and management with greater visibility to the underlying performance of Matterport’s recurring core business operations. In order to calculate non-GAAP net loss per share, basic and diluted, Matterport uses a non-GAAP weighted-average share count. Matterport defines non-GAAP weighted-average shares used to compute non-GAAP net loss per share, basic and diluted, as GAAP weighted average shares used to compute net loss per share attributable to common stockholders, basic and diluted, adjusted to reflect the shares of Matterport’s Class A common stock exchanged for the previously issued and outstanding shares of redeemable convertible preferred stock and common stock warrants of Matterport, Inc, (now known as Matterport Operating, LLC) in connection with the recently completed merger, that are outstanding as of the end of the period as if they were outstanding as of the beginning of the period for comparability, and the potentially dilutive effect of the company’s employee equity incentive plan awards. Conference Call Information Matterport will host a conference call for analysts and investors to discuss its financial results for the fourth quarter of fiscal 2021 today at 2:00 p.m. Pacific time (5:00 p.m. Eastern time). A recorded webcast of the event will also be available following the call for one year on the Matterport’s Investor Relations website at investors.matterport.com. Date: Wednesday, February 16, 2022 Time: 2:00 p.m. Pacific time (5:00 p.m. Eastern time) Webcast: investors.matterport.com About Matterport Matterport, Inc. (Nasdaq: MTTR) is leading the digital transformation of the built world. Our groundbreaking spatial computing platform turns buildings into data making every space more valuable and accessible. Millions of buildings in 177 countries have been transformed into immersive Matterport digital twins to improve every part of the building lifecycle from planning, construction, and operations to documentation, appraisal and marketing. Learn more at matterport.com and browse a gallery of digital twins. ©2022 Matterport, Inc. All rights reserved. Matterport is a registered trademark and the Matterport logo is a trademark of Matterport, Inc. All other marks are the property of their respective owners. --- Source: Matterport via Globe Newswire --      Source: Matterport --- WGAN Forum Podcast | Tagged: Matterport |

||

| Post 1 • IP flag post | ||

WGAN WGAN Basic Member Boston |

Noddy private msg quote post Address this user | |

| And yet the stock continues to drop like a stone...? | ||

| Post 2 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

Quote:Originally Posted by Noddy Matterport call just started! -- Conference Call Information Matterport will host a conference call for analysts and investors to discuss its financial results for the fourth quarter of fiscal 2021 today at 2:00 p.m. Pacific time (5:00 p.m. Eastern time). A recorded webcast of the event will also be available following the call for one year on the Matterport’s Investor Relations website at investors.matterport.com. Date: Wednesday, February 16, 2022 Time: 2:00 p.m. Pacific time (5:00 p.m. Eastern time) Webcast: investors.matterport.com -- I could imagine that may be a topic for discussion by Matterport management. Dan |

||

| Post 3 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Seeking Alpha (16 February 2022) Matterport, Inc. (MTTR) CEO RJ Pittman on Q4 2021 Results - Earnings Call Transcript | ||

| Post 4 • IP flag post | ||

Pages:

1This topic is archived. Start new topic?