Matterport Announces 3Q21 Financials: Annual Recurring Revenue $111 million15903

Pages:

1

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

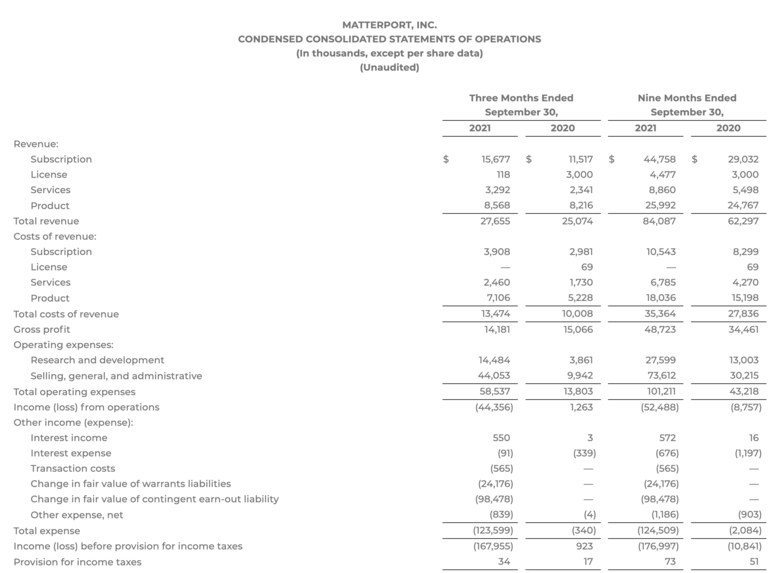

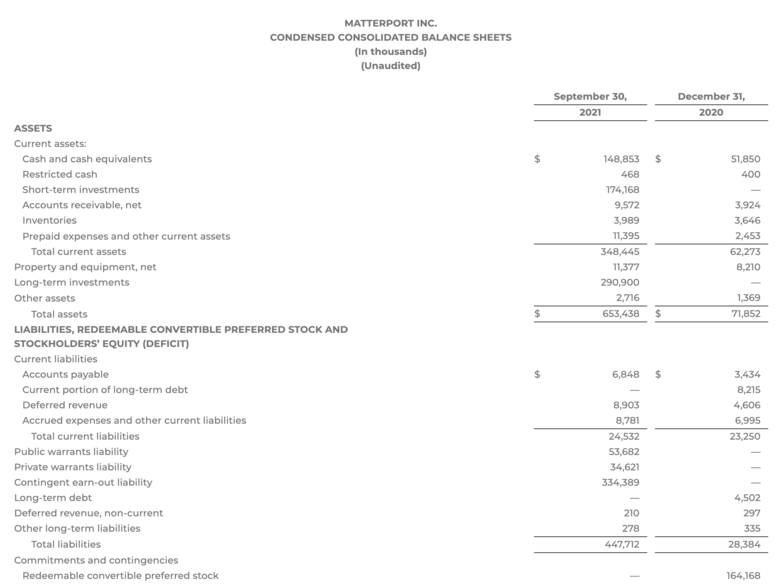

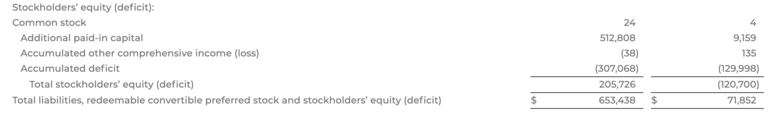

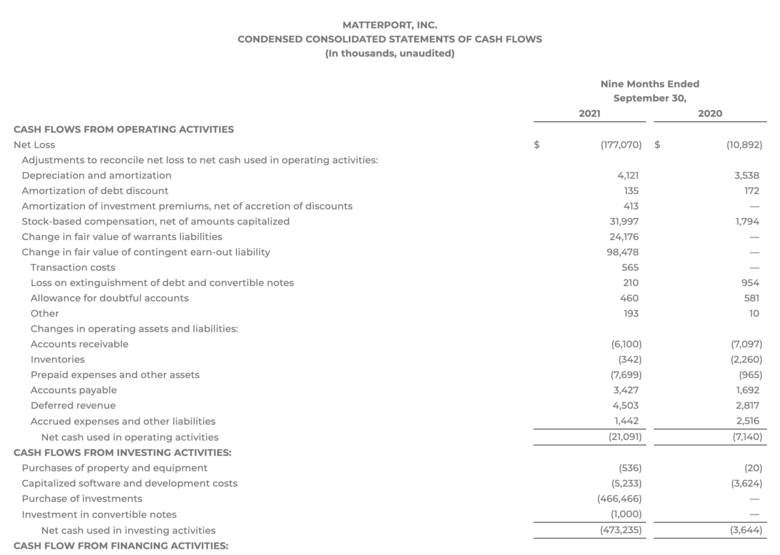

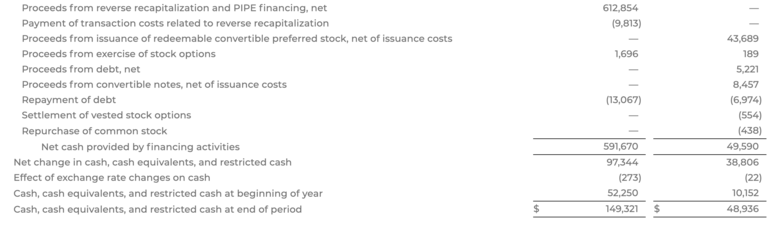

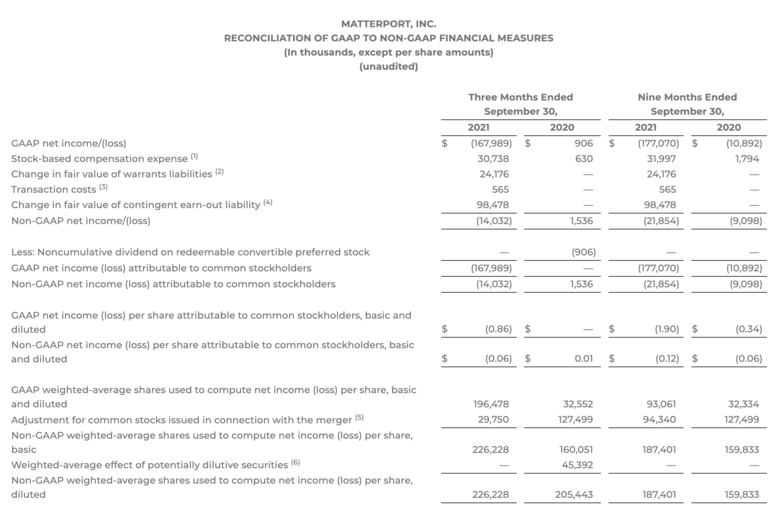

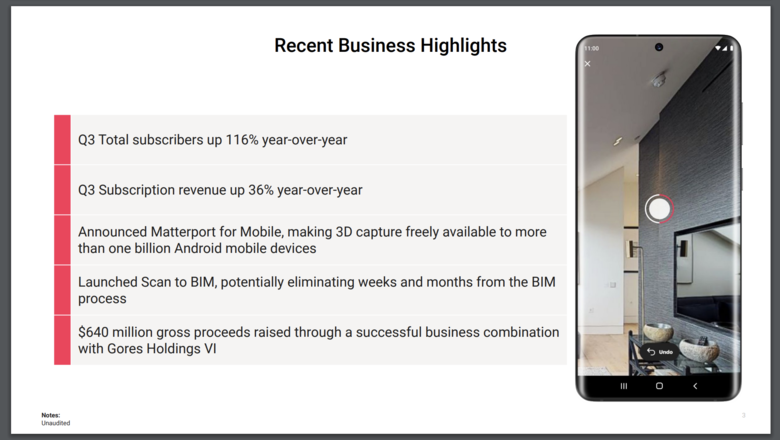

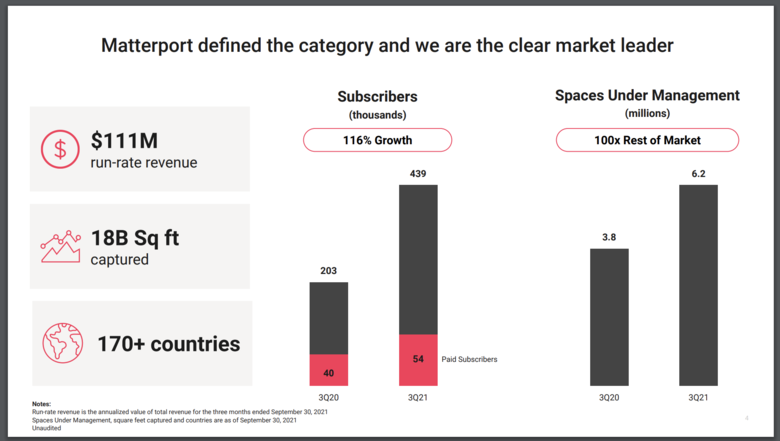

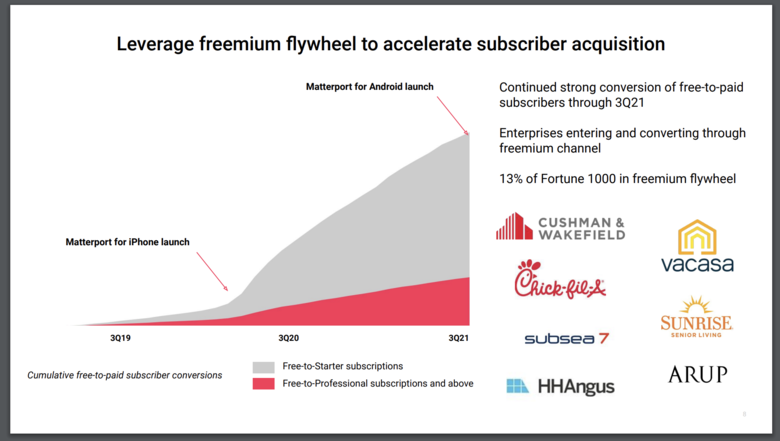

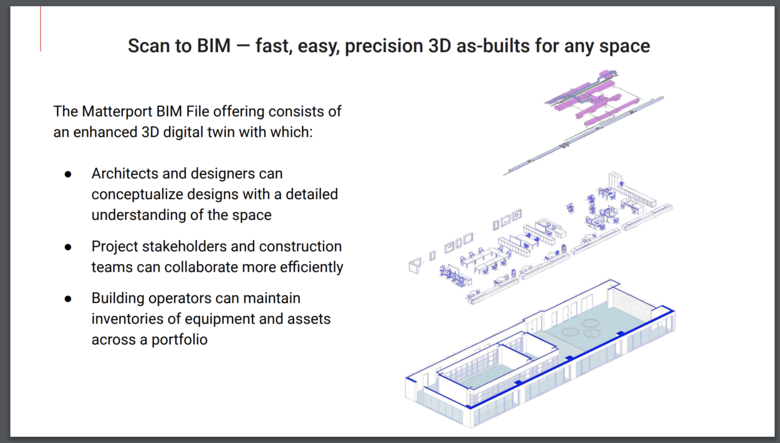

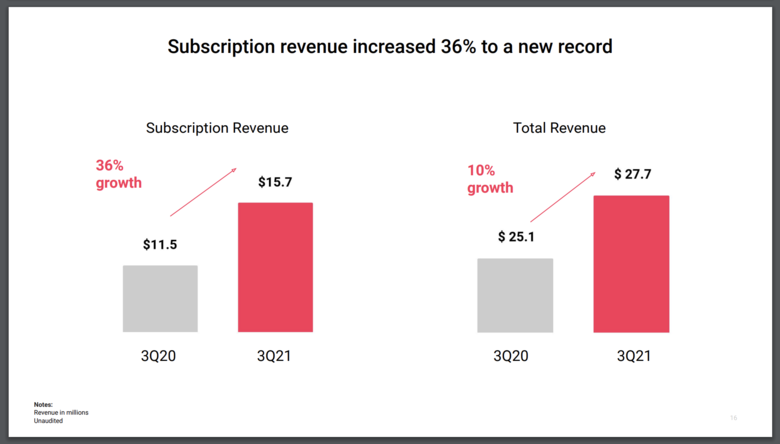

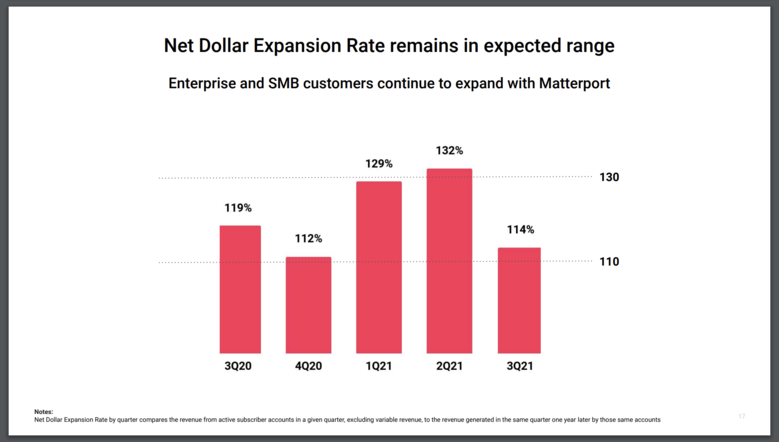

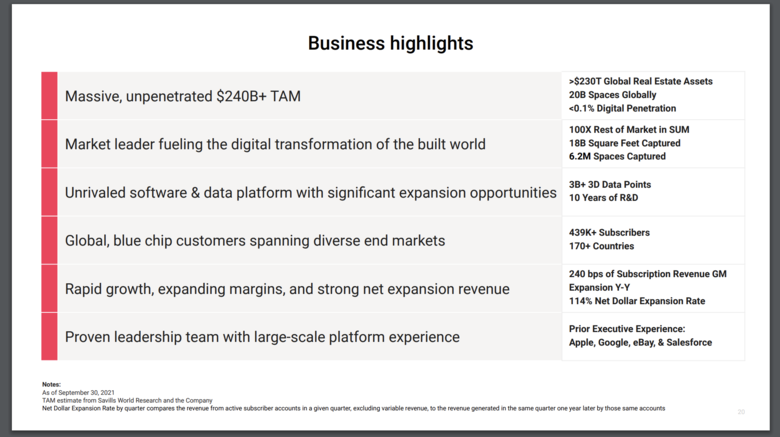

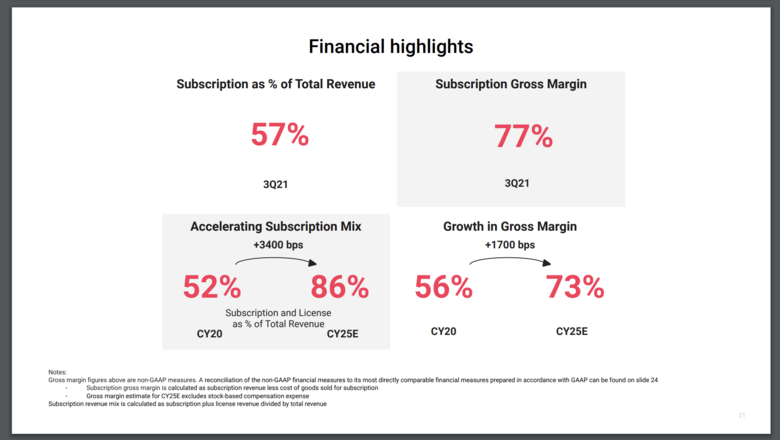

| Matterport Media Release ✓ Matterport Announces Third Quarter 2021 Financial Results Conference Call Information Matterport will host a conference call for analysts and investors to discuss its financial results for the third quarter of fiscal 2021 today at 2:00 p.m. Pacific time (4:30 p.m. Eastern time). A recorded webcast of the event will also be available following the call for one year on the Matterport’s Investor Relations website at investors.matterport.com. Date: Wednesday, November 3, 2021 Time: 1:30 p.m. Pacific time (4:30 p.m. Eastern time) Webcast: investors.matterport.com --- Matterport Announces Third Quarter 2021 Financial Results ✓ Total subscribers increased 116% to 439,000 from year-ago period ✓ Paid subscribers rose 35% to 53,000 from year-ago period ✓ Subscription revenue grew 36% to $16 million from year-ago period ✓ Annual recurring revenue grew to $63 million [ARR now $111 million] ✓ GAAP loss per share of $0.86, Non-GAAP loss per share of $0.06 SUNNYVALE, Calif., Nov. 03, 2021 (GLOBE NEWSWIRE) -- Matterport, Inc. (Nasdaq: MTTR), (“Matterport” or the “Company”), the spatial data company leading the digital transformation of the built world, today announced financial results for the quarter ended September 30, 2021. "We are pleased to report another strong quarter, more than doubling our subscriber count to 439,000 subscribers, and increasing our Spaces Under Management by 62% to 6.2 million Spaces,” said RJ Pittman, Chairman and Chief Executive Officer of Matterport. “We made significant advances in all of our objectives, including strategic product launches, key industry partnerships, expanded service offerings, and the scaling of our global workforce to address the huge opportunity ahead. We have also been navigating the dynamics of the global supply chain and labor markets to minimize the impact on our hardware and services business. Our recent launch of Matterport for Android is very timely, and dramatically expands our reach for digitizing spaces using just the phone in your pocket, while giving us an important advantage to our global growth plans for Asia Pacific, Europe, the Middle East and Africa.” “We are also pleased to report that we increased our subscription revenue by 36%, contributing to another quarter of year-over-year double digit growth,” said JD Fay, Chief Financial Officer of Matterport. “The third quarter was a transformational one for Matterport as we closed our merger with Gores Holdings, VI to become a public company. We added over $600 million to our balance sheet to fuel the long-term growth of the business worldwide.” Third Quarter 2021 Financial Highlights: ✓ Total revenue was $27.7 million, up 10% compared to third quarter of 2020 ✓ Subscription revenue of $15.7 million, up 36% compared to third quarter of 2020 ✓ Annual Recurring Revenue (ARR) of $62.7 million ✓ Spaces Under Management (SUM) grew to 6.2 million, up 62% compared to third quarter of 2020 ✓ Total subscribers increased to 439,000, up 116% compared to third quarter of 2020 ✓ GAAP loss per share of $0.86, Non-GAAP loss per share of $0.06 Recent Business Highlights: ✓ Announced Matterport for Android, making 3D capture freely available to more than one billion Android mobile devices ✓ Announced the open beta launch of Notes, a conversational, real-time team collaboration, communication and file sharing tool directly inside Matterport digital twins ✓ Entered the public sector with an agreement to develop a compliant Government Cloud (GovCloud) offering a strategic partnership with In-Q-Tel, Inc. ✓ Became a public company and raised $640 million in gross proceeds by successfully completing a merger with Gores Holdings VI, Inc. ✓ Announced industry partnerships with Verisk, PTC, Apex, SIMLAB, and Facebook (now known as Meta) -- New integration between Matterport and Verisk’s Xactimate allows property professionals to order a TruePlan of a Matterport 3D Space with a single click, eliminating the need for property professionals to manually sketch loss sites -- Platform integration with the PTC Vuforia Engine™ and Vuforia Studio™ augmented reality (AR) software offerings, enables customers to view a precise location of an immersive 3D environment and access experiences such as wayfinding, virtual training, real-time information retrieval, and more -- Partnership with Apex enables retail brands across the North America to access, collect and evaluate building data and information from all of their stores in a single location -- Strategic partnership and investment in SIMLAB, a technology company that specializes in the digitization of buildings throughout the design and construction phases -- Partnership with Meta AI Research for advancing research and development of AI systems for the physical and virtual world, which has been adopted by over 180 academic institutions to date ✓ Continued expansion of Capture Services™ On-Demand to a total of 80 cities in the United States from 12 in Q2 and launched internationally with four cities in the United Kingdom ✓ Strengthened executive team -- Pranab Sinha, Chief Information Officer -- Jon Maron, Vice President of Growth -- Seth Finkel, Vice President of Public Sector -- Preethy Vaidyanathan, Head of Product Non-GAAP Financial Information Matterport has provided in this press release financial information that has not been prepared in accordance with generally accepted accounting principles in the United States (GAAP). We believe that the presentation of non-GAAP financial information provides important supplemental information to management and investors regarding financial and business trends relating to our financial condition and results of operations. The presentation of these non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP financial measures and should be read only in conjunction with the Company’s consolidated financial statements prepared in accordance with GAAP. For further information regarding these non-GAAP measures, including the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures, please refer to the financial tables below. Non-GAAP Net Income (Loss) and Non-GAAP Net Income (Loss) Per Share, Basic and Diluted. Matterport defines non-GAAP net income (loss) as net income (loss), adjusted to exclude stock-based compensation expense, fair value change of warrants liabilities, fair value change of earn-out liabilities, and transaction costs associated with the recently completed merger, in order to provide investors and management with greater visibility to the underlying performance of Matterport’s recurring core business operations. In order to calculate non-GAAP net income (loss) per share, basic and diluted, Matterport uses a non-GAAP weighted-average share count. Matterport defines non-GAAP weighted-average shares used to compute non-GAAP net income (loss) per share, basic and diluted, as GAAP weighted average shares used to compute net income (loss) per share attributable to common stockholders, basic and diluted, adjusted to reflect the shares of Matterport’s Class A common stock exchanged for the previously issued and outstanding shares of redeemable convertible preferred stock and common stock warrants of Matterport, Inc, (now known as Matterport Operating, LLC) in connection with the recently completed merger, that are outstanding as of the end of the period as if they were outstanding as of the beginning of the period for comparability, and the diluted effect of the company's employee equity incentive plan awards. Conference Call Information Matterport will host a conference call for analysts and investors to discuss its financial results for the third quarter of fiscal 2021 today at 2:00 p.m. Pacific time (5:00 p.m. Eastern time). A recorded webcast of the event will also be available following the call for one year on the Matterport’s Investor Relations website at investors.matterport.com. Date: Wednesday, November 3, 2021 Time: 1:30 p.m. Pacific time (4:30 p.m. Eastern time) Webcast: investors.matterport.com About Matterport Matterport, Inc. (Nasdaq: MTTR) is leading the digital transformation of the built world. Our groundbreaking spatial computing platform turns buildings into data making every space more valuable and accessible. Millions of buildings in more than 150 countries have been transformed into immersive Matterport digital twins to improve every part of the building lifecycle from planning, construction, and operations to documentation, appraisal and marketing. Learn more at matterport.com and browse a gallery of digital twins. ©2021 Matterport, Inc. All rights reserved. Matterport is a registered trademark and the Matterport logo is a trademark of Matterport, Inc. All other marks are the property of their respective owners. ---   Source: Matterport   Source: Matterport   Source: Matterport   Source: Matterport (1) Consists primarily of non-cash share-based compensation related to the Company's stock incentive plans and earn-out arrangement (2) Consists of the loss related non-cash fair value measurement change for public and private warrants (3) Consists of the transaction costs associated with warrants instrument issuance (4) Represents the non-cash fair-value measurement change related to our earn-out liability (5) Consists non-GAAP adjustment of unweighted average common stock issued and converted from Matterport, Inc.’s (now known as Matterport Operating, LLC) previously issued and outstanding shares of convertible preferred stock and common stock warrants prior to the completion of the merger (6) Includes the potentially dilutive effect of employee equity incentive plan awards. -- Source: Matterport via Global Newswire |

||

| Post 1 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Source: Matterport | 3 November 2021 | Third Quarter 2021 Earnings Deck ---  Source: Matterport  Source: Matterport  Source: Matterport  Source: Matterport  Source: Matterport  Source: Matterport  Source: Matterport  Source: Matterport All pages from the 3Q21 Matterport Earnings Deck |

||

| Post 3 • IP flag post | ||

Pages:

1This topic is archived. Start new topic?