Zillow: Surge in New Listings: 13.5% Up Estimate for 2021 versus 202014734

Pages:

1

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

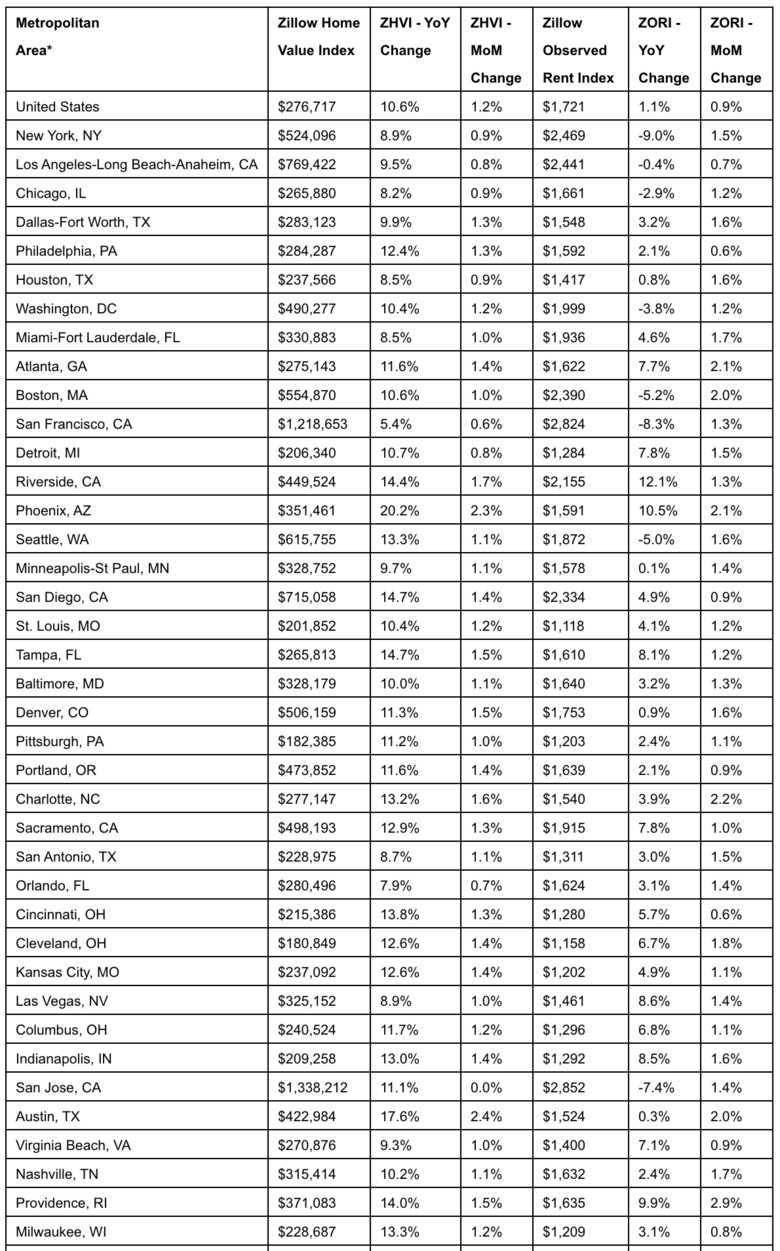

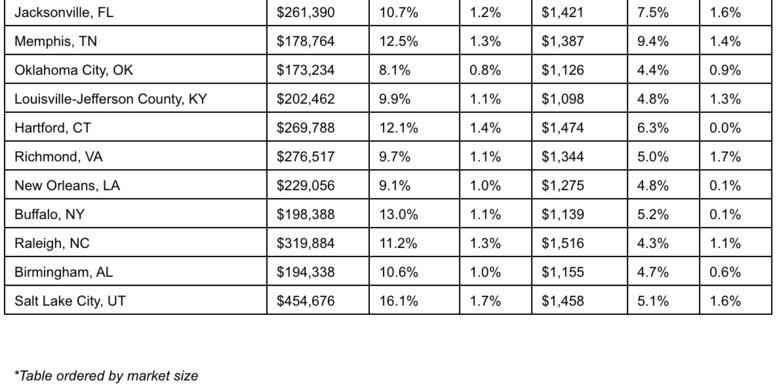

| Media Release --- Surge in New Listings Signals Potential Relief for Frustrated Shoppers Home appreciation breaks new records as demand crush persists, but inventory crunch shows signs of relenting - Driven by a seasonal rise in new listings, for-sale inventory fell only 1.1% month over month, a marked improvement after three consecutive months of drops around 8%. - Home values rose 1.2% in March, the largest monthly jump in 25 years. - Rent recovery picked up steam with the largest monthly rise since 2014. SEATTLE, April 23, 2021 /PRNewswire/ -- New data in Zillow's® Monthly Market Report1 suggests the inventory crunch bedeviling home searchers may be starting to turn around as record appreciation of home values makes it more enticing to sell. Meanwhile, the recovery of rents is gaining broad momentum and touching double-digit annual gains in hot markets like Phoenix and Riverside. Although continued demand for homes pushed total for-sale inventory down 1.1% in March, the monthly decline was the smallest seen since July. That's thanks to a rush of new inventory (rising 30% from late February to late March), which signals sellers are following the traditional pattern of listing their homes in spring. "March often sees a boost in inventory, and the return to some seasonal norms is a positive sign that supply is beginning to catch up with demand," said Zillow economist Treh Manhertz. "With home values skyrocketing, vaccination rates rising and employees getting long-term guidance on where they can work, we expect an increasing number of homeowners to join the market and list in the coming months. That will come as welcome news to home shoppers who are seeing bidding wars and homes plucked from the market weeks faster than usual." Home value appreciation pushed the accelerator closer to the floor in March, rising a record 1.2% month over month to $276,717. This is the largest monthly rise in Zillow records going back to 1996 and a roughly $3,200 jump in value from February to March for the typical home. Annual appreciation rose to 10.6%, the largest jump in 15 years. Zillow economists forecast 6.4 million homes to sell in 2021 -- up 13.5% from 2020 and the strongest year for sales since 2006 -- and expect home values to rise 10.4% over the next 12 months. Although the rapid ascent of home values have stoked fears of another housing bubble, strong fundamentals underpin the market's heat. Average credit scores among buyers are much higher than in the early 2000s, lending standards are tighter, and demand going forward -- including from a wave of millennials aging into homebuying -- is expected to keep sales strong in the coming months. The fastest monthly home value growth was seen in Austin (2.4%), Phoenix (2.3%) and Riverside (1.9%), all accelerating from the previous month. Growth is slowest in San Jose (0.05%), San Francisco (0.6%) and Orlando (0.7%). Annual appreciation as of March ranged from blistering highs of 20.2% in Phoenix to lows of 5.4% in San Francisco, which is still higher than historical averages. Rents nationally took a dramatic step upward in March, beginning to make up ground after a slump that began this time last year. Zillow's Observed Rent Index (ZORI) rose to $1,721, up 0.9% over February -- the largest monthly increase since 2014. This especially strong showing is the third consecutive monthly increase, bringing annual growth back above 1% for the first time since July. Rents have been softer since the beginning of the pandemic in many large markets and fell in the priciest ones -- though Zillow research shows those savings were limited to the most expensive zip codes. In March, rents rose at an accelerated rate almost across the board, though the highest year-over-year growth is taking place in the Inland West and Sun Belt, along with some more affordable metros in the Midwest and Rust Belt. Among the largest 50 U.S. metros, annual rent growth is highest in Riverside (12.2%), Phoenix (10.5%), and Providence (9.9%). Rents remain the lowest year-over-year in New York (-9.0%), San Francisco (-8.3%), San Jose (-7.4%), Boston (-5.2%) and Seattle (-5.0%). But all have improved at least a full percentage point since February, showing lost activity may be returning. Mortgage rates listed by third-party lenders on Zillow started March at 2.88%, reached a monthly low of 2.85% on the 3rd and the 25th, bounced off a high of 3.03% on March 17th and 19th, and ended at 2.89%. Zillow's real-time mortgage rates are based on thousands of custom mortgage quotes submitted daily to anonymous borrowers on the Zillow Group Mortgages site by third-party lenders and reflect recent changes in the market.2   Table courtesy of Zillow 1 The Zillow Real Estate Market Reports are a monthly overview of the national and local real estate markets. The reports are compiled by Zillow Real Estate Research. For more information, visit www.zillow.com/research/. The data in Zillow's Real Estate Market Reports are aggregated from public sources by a number of data providers for 928 metropolitan and micropolitan areas dating back to 1996. Mortgage and home loan data are typically recorded in each county and publicly available through a county recorder's office. All current monthly data at the national, state, metro, city, ZIP code and neighborhood level can be accessed at www.zillow.com/research/data. 2 Zillow Group Marketplace, Inc. is a licensed mortgage broker, NMLS #1303160. About Zillow Group Zillow Group, Inc. (NASDAQ: Z and ZG) is reimagining real estate to make it easier to unlock life's next chapter. As the most-visited real estate website in the United States, Zillow® and its affiliates offer customers an on-demand experience for selling, buying, renting or financing with transparency and nearly seamless end-to-end service. Zillow Offers® buys and sells homes directly in dozens of markets across the country, allowing sellers control over their timeline. Zillow Home Loans™, our affiliate lender, provides our customers with an easy option to get pre-approved and secure financing for their next home purchase. Zillow recently launched Zillow Homes, Inc., a licensed brokerage entity, to streamline Zillow Offers transactions. Zillow Group's brands, affiliates and subsidiaries include Zillow®, Zillow Offers®, Zillow Premier Agent®, Zillow Home Loans™, Zillow Closing Services™, Zillow Homes, Inc., Trulia®, Out East®, StreetEasy® and HotPads®. Zillow Home Loans, LLC is an Equal Housing Lender, NMLS #10287 (www.nmlsconsumeraccess.org). SOURCE: Zillow via PRNewswire |

||

| Post 1 • IP flag post | ||

Pages:

1This topic is archived. Start new topic?