GHVI Stock Tumbling14381

Pages:

1

Regina, Saskatchewan Canada |

Queen_City_3D private msg quote post Address this user | |

| Anyone else wishing they had sold their GHVI shares on February 18th? Wondering what's with the price decline as of late? I guess the good news is that I likely won't be forced 30 days after a merger to exercise the extra warrants I had purchased with the GHVIW stock (they'd have to be trading for $18.00 per share for an average of 20 days out of 30 for the company to force a call redemption). Personally I do think that Matterport has a tremendous upside so I will ride this out. If anyone missed in before stock went crazy the first wave, now might be the time to invest. Anyone have further insights into the movement of the stock right now? |

||

| Post 1 • IP flag post | ||

WGAN Basic WGAN BasicMember Denver |

pixelray private msg quote post Address this user | |

| Yeah...I'm not too happy at the moment. I even talked others into buying. I may buy some more...but will prob see how far this "crash" goes | ||

| Post 2 • IP flag post | ||

|

Shawn_P private msg quote post Address this user | |

| Sounds like a merger is about to go belly up | ||

| Post 3 • IP flag post | ||

Regina, Saskatchewan Canada |

Queen_City_3D private msg quote post Address this user | |

Quote:Originally Posted by Shawn_P Really? Where'd you come across info on that? |

||

| Post 4 • IP flag post | ||

Regina, Saskatchewan Canada |

Queen_City_3D private msg quote post Address this user | |

| As recently as yesterday there's SEC reports on merger details: clickable text |

||

| Post 5 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

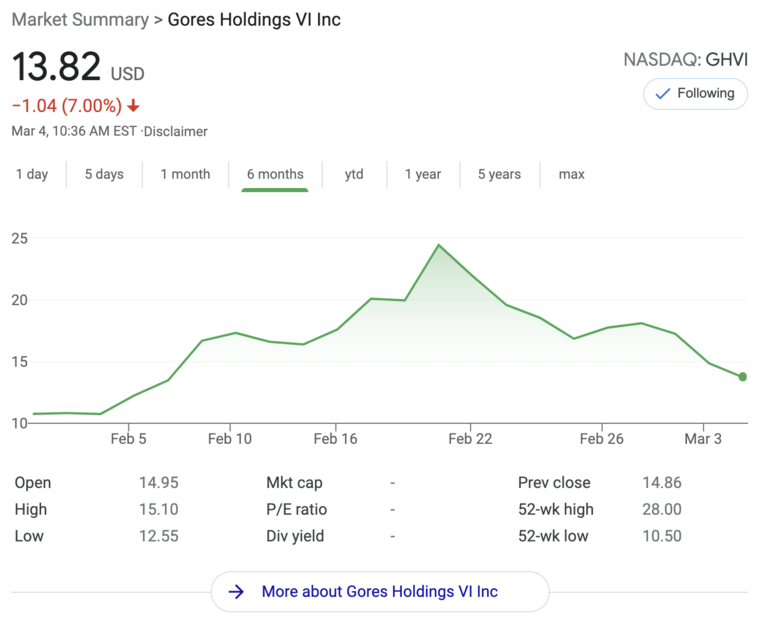

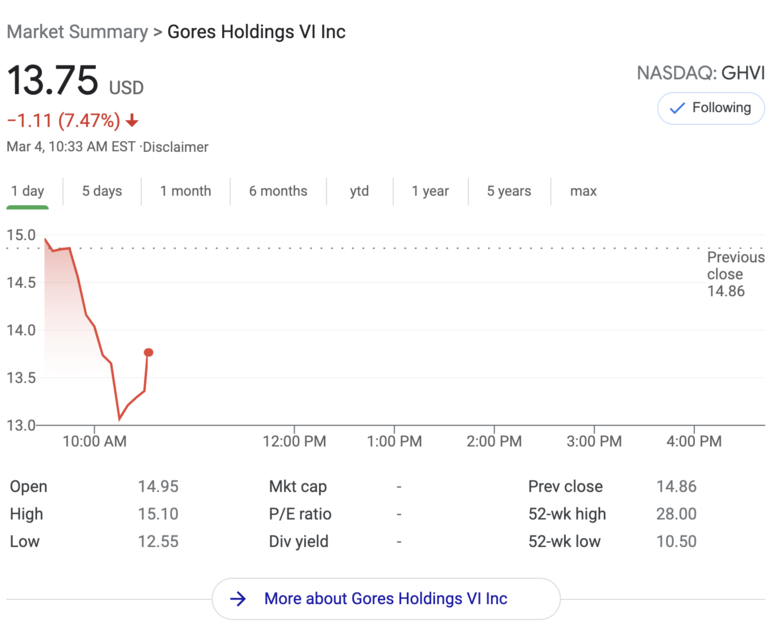

10:30 am EST Thursday, 4 March 2021 Wow! Gores Holdings VI is like a rollercoaster: first the big climb; now the steep decline. I wonder what's up? Dan @Queen_City_3D Thanks for the SEC report link! |

||

| Post 6 • IP flag post | ||

|

Shawn_P private msg quote post Address this user | |

| @Queen_City_3D a stock that's going the other direction maybe. | ||

| Post 7 • IP flag post | ||

|

bryanhscott private msg quote post Address this user | |

| Gores Holdings VI, Inc. is registered with the U.S. Security and Exchange Commission and incorporated in the state of Delaware. Gores Holdings VI, Inc is primarily in the business of blank checks. Focusing on the last two words above, "blank checks," is a pretty good indication their primary line of business is going the way of the buggy whip. No idea why GHVI has dropped so much since their 2/22/21 high of $28, but clearly the market doesn't like them much. Buying more could be similar to catching a falling knife. Based on what's happened in the Nasdaq, there are many, many other opportunities that are much better investments. For my part, I treated GHVI like so many Chinese stocks. I don't like China, so I don't buy Chinese stocks. I feel same about Matterport or anything they touch. But, that's just me :-) |

||

| Post 8 • IP flag post | ||

|

coulee360 private msg quote post Address this user | |

| This is similar to what happened with Churchill Capitol iv stock with the lucid motors talk. I held off on buying either stocks in Churchill and Gore because I was reading up on it and several experts were advising NOT to buy until after the mergers went through and they had their own ticker because this type of thing always happens. I'll wait until then and even shortly after as most start high briefly then drop. An example is Bumble Inc. Started at $70/share first day of trading and went up briefly then dropped and is currently sitting below that. Granted it will potentially rise but thats part of the stock game. | ||

| Post 9 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

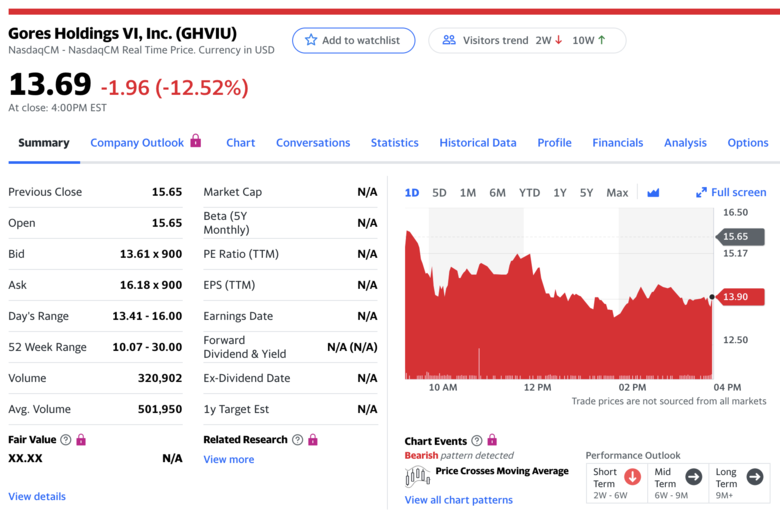

Yahoo Finance | 5:40 pm EST Thursday, 4 March 2021 |

||

| Post 10 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| CNBC (10:16 am EST | 4 March 2021) SPACs are becoming less of a sure thing as the deals get stranger, shares roll over "The proprietary CNBC SPAC 50 index, which tracks the 50 largest U.S.-based pre-merger blank-check deals by market cap, dropped more than 15% in the past two weeks, giving up all of its 2021 gains," says CNBC. |

||

| Post 11 • IP flag post | ||

Regina, Saskatchewan Canada |

Queen_City_3D private msg quote post Address this user | |

Quote:Originally Posted by DanSmigrod I did a lot of reading up on SPACs, and I can see the advantage to companies utilizing them to go public, but on the flip side I also agree that there are some ridiculous acquisitions happening. I think some of these Blank Cheque companies start to panic that they've raised all this capital and now have to find a valid business to buy and some seem to be grasping at straws. That said, when you see the growth potential of Matterport, I do feel the GHVI merger is a strong one. |

||

| Post 12 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| @Queen_City_3D Also from the CNBC link: SPACs are becoming less of a sure thing as the deals get stranger, shares roll over "Faced with intense competition, deadline pressure and a volatile market, some SPACs had to settle for less ideal targets, and in some cases, throw their entire blueprint out the window." Dan |

||

| Post 13 • IP flag post | ||

Pages:

1This topic is archived. Start new topic?