Transcript: Matterport/Gores Holdings VI Biz Combo Announcement Call14193

Pages:

1

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

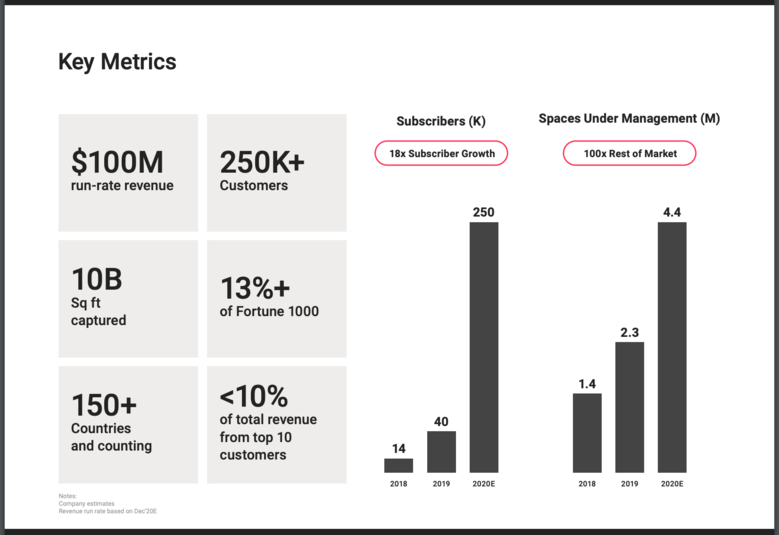

Screen grab from Matterport Fact Sheet for use in Matterport Going Public Transcript: Matterport/Gores Holdings VI Biz Combo Announcement Call Hi All, Below is the transcript to the Matterport and Gores Holdings VI Business Combination Investor Conference Call held Monday, 8 February 2021. [Editor's Note: Bold by We Get Around Network Forum Founder and Managing Editor @DanSmigrod to help highlight significant talking points.] You can listen to a recording on the Matterport Investors Microsite. --- WGAN Forum discussions tagged: Matterport Going Public --- Dan Transcript (Audio) MATTERPORT AND GORES HOLDINGS VI BUSINESS COMBINATION ANNOUNCEMENT CALL TRANSCRIPT List of Participants ● Eric Hackel, Vice President, Deutsche Bank ● Alec Gores, Chairman and CEO, Gores Holdings VI ● Mark Stone, Senior Managing Director, Gores Holdings VI ● RJ Pittman, Chief Executive Officer, Matterport ● Jay Remley, Chief Revenue Officer, Matterport ● JD Fay, Chief Financial Officer, Matterport Introduction (Eric Hackel, Vice President, Deutsche Bank) Good morning everyone – this is Eric Hackel from Deutsche Bank. We are very excited to announce the de-SPAC transaction between Gores Holdings VI and Matterport Inc. Thank you for joining our announcement call today [Monday, 8 February 2021]. Before we begin, I would like to remind everyone that our remarks contain forward-looking statements and we refer you to slides 2 and 3 of the accompanying investor presentation for a detailed discussion of these forward-looking statements and associated risks. With that, I would like to introduce today’s speakers: ✓ Alec Gores, Chairman of Gores Holdings VI ✓ Mark Stone, CEO of Gores Holdings VI, as well as ✓ RJ Pittman, CEO of Matterport ✓ Jay Remley, CRO of Matterport and ✓ JD Fay, CFO of Matterport. I will now turn our conference over to Alec Gores, Chairman of Gores Holdings VI. Opening Remarks (Alec Gores, Chairman and CEO, Gores Holdings VI) Thank you, Eric and good morning everyone. I would first like to thank you all for joining us today. We are really excited to share with you the proposed business combination between Gores Holdings VI and Matterport. Gores Holdings VI set out to find a partner with a strong growth profile and high quality management team with an attractive valuation proposition, and we believe Matterport fits these criteria perfectly. This transaction represents the sixth de-SPAC business combination for the Gores platform, and we view this as an incredible opportunity to partner with a company that has massive long-term growth potential, a truly differentiated product and sustainable competitive advantages. Matterport is the clear market leader of spatial computing - the gold standard in 3D data capture, collaboration, and analysis. We look forward to supporting the company as it becomes the digital platform for the built world. Now, I would like to hand over the presentation to Mark Stone to provide further detail regarding the transaction terms and highlights. Transaction Highlights (Mark Stone, Senior Managing Director, Gores Holdings VI) Thank you, Alec. For those of you who saw the press release this morning [8 February 2021], we filed a detailed investor presentation that provides an overview of both Matterport and the transaction. Matterport has been leading the digital transformation of the built world - a $230 trillion asset class - for a decade. Matterport’s unrivaled software and data platform allows customers to accurately and efficiently digitize physical space -- and the company is only just beginning to tap its massive, un-penetrated $240 billion addressable market. The company is led by a world-class management team with significant large-scale platform experience in CEO RJ Pittman, CFO JD Fay, and CRO Jay Remley. We’re excited to partner with them as we bring Matterport to the public markets. The combined company will have an estimated pro forma enterprise value of $2.3 billion and an equity value of approximately $2.9 billion at closing. Matterport will receive $615 million cash to fund growth, and stockholders will receive approximately $291 million in rollover shares at closing. Cash proceeds raised will consist of Gores Holdings VI’s $345 million of cash in trust, as well as $295 million in fully committed PIPE proceeds, done at $10.00 per share and led by high quality institutional investors including: ✓ Tiger, ✓ Senator, ✓ Dragoneer, ✓ BlackRock, ✓ Fidelity, ✓ Miller Value, and ✓ Lux. Matterport’s pioneering technology has set the standard for transforming buildings into data and they continue to raise the bar for the future. Their unrivaled spatial data library has proven to be a durable and evolving competitive advantage, taking property insights and analytics to new highs. The company’s attractive unit economics deliver a profit margin today, positioning Matterport to invest in growth and scale existing markets. With strong revenue growth projected for years to come, we are excited to support the company as it enters the public markets. Please stay tuned as Gores Holdings VI will file a preliminary proxy statement in connection with the proposed business combination with the SEC and will mail a definitive proxy statement and other relevant documents to its stockholders. The proxy statement will contain important information about the proposed business combination which is subject to the approval of Gores Holdings VI stockholders. We anticipate the transaction will close in the second quarter of 2021. With that, I will turn things over to RJ Pittman, CEO of Matterport to expand on the business and its potential moving forward. Company Highlights (RJ Pittman, CEO, Matterport) Thank you Alec, Mark and the entire Gores team. We are excited to partner with Gores to accelerate the next chapter of Matterport’s growth. I’m RJ Pittman, the Chief Executive Officer of Matterport. Prior to joining Matterport as CEO in late 2018, I served as Chief Product Officer at eBay and before that was leading product and technology initiatives for Apple and Google. I’ve spent the last two decades building technology companies and have participated in multiple public offerings and M&A transactions for companies I have founded or led. With me today is Jay Remley, Chief Revenue Officer of Matterport, a seasoned executive with decades of experience, including leading Maps and Cloud revenue for Google worldwide. Jay will speak to you later about how our global customers use Matterport across the entire property lifecycle. Also with me today is JD Fay, Chief Financial Officer of Matterport, and a long time Silicon Valley veteran. JD has a wealth of public company CFO experience, including at View, NeoPhotonics and At-Road. He has over 20 years of experience as a globally-focused senior executive, finance leader, and corporate lawyer. JD will speak to you about how our data-driven SaaS business model produces rapid growth and capital-efficient financial performance. At Matterport, we have assembled an extraordinary executive team of industry veterans from some of the most valuable companies in the world, including Google, Apple, Salesforce, LinkedIn, and more. This team has the necessary senior leadership experience building and scaling multi-billion dollar platform businesses to help Matterport achieve its mission of making every building and every space in the built world more valuable and more accessible. Real estate is the largest asset class in the world, with an estimated value of $230 trillion. This is more than three times the value of all global equities combined. With more than four billion buildings worldwide, the built world is the largest undisrupted market, with less than 1% digitized today. For building owners, managers, underwriters, and occupants, managing the lifecycle of a building is unnecessarily costly, time consuming, and inefficient in the modern world. Founded in 2011, Matterport has been digitizing the built world for nearly a decade. We defined the spatial data category for the built world with our market-leading technology platform that turns any physical space into an immersive three dimensional digital twin. We have created what we believe is the largest spatial data library in the world, with more than 10 billion square feet of space and growing. Millions of buildings in more than 150 countries have been digitized, from homes, office spaces, museums and schools to factories, hospitals, and retail stores. As we continue to transform buildings into data, we are extending our spatial computing and data platform to deliver unparalleled building intelligence and insights for our customers around the world. We believe the demand for spatial data, analytics, and the resulting high-value building insights for enterprises, businesses and institutions across industries, will continue to grow rapidly. The combination of digitization and datafication represents a tremendous greenfield opportunity for growth across this massive category and asset class. From the early stages of design and development to marketing, operations, insurance and building repair, our software provides customers critical tools and insights to drive cost savings, increase revenues and optimally manage their buildings and spaces. We believe that hundreds of billions of dollars in unrealized utilization and operating efficiencies in the built world can be unlocked through the power of our data platform. Our platform and data solutions are universal across industries and building categories, giving Matterport a significant advantage as we address this huge market and strive to increase the value of the largest asset class in the world. We believe the total addressable market opportunity for digitizing the built world is over $240 billion, and could be as high as $1 trillion as the market matures at scale. This is based on our analysis, modeling and understanding of the global building stock of over 4 billion properties and 20 billion spaces in the world today and growing. With the help of artificial intelligence (AI), machine learning (ML) and deep learning (DL) technologies, we believe that with the additional monetization opportunities from powerful spatial data-driven property insights and analytics, the total addressable market for the digitization and datafication of the built world will reach more than $1 trillion. The Matterport spatial data platform delivers value across a diverse set of industries and use cases. Large retailers can manage thousands of store locations remotely, real estate agencies can provide virtual open houses for hundreds of properties and thousands of visitors at the same time, and property developers and insurance companies can more precisely document and assess the construction process every step of the way with greater speed, efficiency and precision. Matterport delivers the critical digital experience, tools and information that matter to our customers about properties of virtually any size, shape, and location worldwide. For nearly a decade, we have been perfecting our craft to create the most detailed, accurate, and data-rich digital twins in the industry. Moreover, our 3D reconstruction process is fully automated, allowing our solution to scale with equal precision to millions of buildings and spaces of any type, shape, and size in the world. The universal applicability of our service provides Matterport significant scale and reach across diverse verticals and any geography. By the start of 2021 our customer base had grown to over 250,000, with our digital twins reaching more than 150 countries and growing. We have digitized more than 10 billion square feet of space across multiple industries, representing significant scale and growth over the rest of the market. With our 10-year head start, a robust patent portfolio, proven technology, and significant first scaler advantage, we are uniquely positioned to significantly extend our market leading position worldwide. I will now turn it over to Jay who will talk about our global customers and how they use Matterport. Customer Highlights (Jay Remley, CRO, Matterport) Thanks, RJ. Every building in the world has the same lifecycle -- from its design and construction to its renting or selling; from insuring, financing, and managing it to repairing, remodeling or redesigning it. Matterport adds value across each of these stages whether it’s a home, office building, hotel, manufacturing plant, or commercial airplane. We enable companies to take their built assets from offline to online and manage them at scale on the Matterport platform. We primarily sell to enterprises, including the Fortune 100, but we also sell to small- and medium-sized businesses. Our customer base is global and spans numerous categories, as we have expanded ✓ beyond the real estate vertical to ✓ AEC, ✓ travel and ✓ hospitality, ✓ repair and ✓ insurance, and ✓ industrial and facilities. We currently serve over 250,000 businesses across these verticals, and we are building significant market share in each of them. We have long standing relationships with many of the largest companies in these industries that by themselves, manage tens of billions square feet of property. We expect our global customer base to continue to grow rapidly as Matterport establishes itself as the digital standard of the built world, and an integral component of managing a building’s lifecycle. Matterport’s fundamental go-to-market model is built upon a SaaS-first, capture device agnostic approach. We have invested aggressively to unlock a scalable SaaS flywheel for customer adoption with multiple on-ramps to Matterport and a variety of ways to expand customer engagement. We will continue to invest in these SaaS-first multiple on-ramps and cross-sell opportunities to accelerate our growth. The key benefit to this approach is to offer our customers and future customers a frictionless, cost effective way to start and then scale with Matterport. Our SaaS plans are priced from free for a single space captured with a smartphone to custom plans tailored to large scale enterprise customer needs. Now I am going to spend a few minutes talking about our customers and how Matterport is saving them significant amounts of time and money, while providing the spatial data they need to make informed decisions. Architecture, engineering and construction firms like Gilbane and Burns & McDonnell use Matterport to centralize all of their documentation through a browser and compare as-built models to engineering drawings. And, our platform seamlessly integrates with their enterprise software applications, such as AutoCAD, Revit, and BIM360 to streamline design and BIM modeling. Or Procore to manage all aspects of a project as well as increase productivity with remote team collaboration. Large residential real estate customers like Redfin, Compass and Keller Willams use Matterport to dramatically increase engagement, attract more prospects, and close business virtually without time consuming physical site visits. In fact, research shows that homes with virtual tours sell 30% faster and realize up to 9% higher price. Commercial real estate companies like JLL and Cushman & Wakefield use Matterport to digitize thousands of their buildings globally. By taking these assets online, our platform helps manage their global portfolio anywhere, on any device. Ericsson, with our platform partner Talon, is leveraging Matterport to manage the construction, as-built, and facilities management of their vast telecom locations globally. As you can imagine, the time, expense and CO2 emissions of travel to inspect and monitor the construction of thousands of structures worldwide is very costly. Talon integrated Matterport into Ericsson’s enterprise tools to bring all of their buildings online, helping them collaborate during the design and construction phases, and virtually manage their global footprint. Time and time again, our customers realize significant operating efficiencies, cost savings, and increased property value with Matterport. I will now turn it over to JD who will talk about the strength of our business model and financial performance. Financial Highlights (JD Fay, CFO, Matterport) Thank you, Jay. 2020 was a record year for Matterport - the strongest year in our 10 year history. I am excited to share our preliminary unaudited financial results today. I would also like to highlight the strength of our subscription-based business model and performance metrics. As earlier noted, we have the largest subscriber base in our industry, with over 250,000 subscribers on our platform at the end of 2020. This is up an incredible 6.3x from 40,000 subscribers on the platform at the end of 2019. We have both free and paid subscriptions to the Matterport platform. The free subscription plan is an important part of our model, as it provides subscribers a way to try Matterport using any compatible device, including the smartphone in their pocket. Many of these subscribers trade up to paid plans over time on their own or by connecting with our sales team to form an enterprise-level relationship. As a consequence of our freemium flywheel strategy, as well as the great work by my colleagues growing our paid subscriber base all year, we generated record total revenue in 2020. Total revenue was $85.9 million, up a remarkable 87% from 2019. The majority of our revenue is comprised of monthly recurring subscription revenue and license revenue. Total revenue from these sources is expected to be $45.2 million for 2020, up 85% from $24.5 million in 2019. Our annual recurring revenue run rate, or ARR, exiting 2020 was $50.5 million. When adding in our typical expansion from existing customers, we have visibility into approximately 85% of subscription revenue forecasted for 2021. We also have a Services business and a Product business. Both of these businesses are designed to accelerate the speed at which customers come on to our platform as new subscribers. We provide a variety of services, including in-app purchases and Capture Services. Capture Services is an offering by which enterprise customers hire us to subcontract the capture of their spaces in high volume, enabling them to get onto our platform more quickly and at scale. We can do this around the world because we have built a large network of capture services partners. Services revenue is expected to be $7.4 million for 2020, up an exceptional 159% from 2019. Finally, we invented a high-precision, 3D, spatial data camera called the Matterport Pro2. This breakthrough innovation is a proprietary technology that captures unparalleled spatial data for our customers at scale. Product revenue from the sale of our camera is expected to be $33.3 million for 2020, up 79% from 2019. Now, I’d like to discuss our fast-growing subscriber base in more detail. In addition to our demonstrated track record of growing overall revenue, the average monthly recurring revenue from subscribers who joined the platform in 2019 compared to those who joined in 2020 is expected to have grown by a remarkable 250% year-over-year. Further, subscribers who joined the platform in 2019 have grown their average monthly recurring revenue by 20% over the past year, and those who joined the platform in 2020 are expected to have grown their average monthly recurring revenue by 32% in just six months. Net-net, subscribers are joining the Matterport platform on paid plans at an increasing rate, and those subscribers are also increasing their spend with us at an accelerating rate. Our strategy for flexibly enabling customers to join our platform has resulted in a highly-efficient subscriber-acquisition model that results in long-term, sticky customer relationships. We have an extremely attractive ratio of subscriber lifetime value to customer acquisition cost of 11.7. This is nearly 4 times higher than the traditional level for high-performing companies. Moreover, we grew our LTV / CAC ratio in 2020 by 4.7 times compared to 2019. Our LTV / CAC ratio is a strong indicator that we have a unique opportunity to invest and further accelerate our growth. Accordingly, we plan to continue to invest in the rapid growth of our business. And, even with this record performance in 2020, we have only scratched the surface in our mission to digitally transform the built world. Now, I would like to turn the call back over to RJ for concluding remarks. Concluding Remarks (RJ Pittman, CEO, Matterport) Thanks JD. We believe Matterport has tremendous growth potential ahead. After securing market leading positions in a variety of geographies and vertical markets, we have demonstrated our repeatable value proposition and the ability of our sales growth model to scale. The magnitude of our total addressable market is so large that even with leading market share, we believe our penetration rates today are a small fraction of the true opportunity for Matterport. With a mature and tested go-to-market playbook and team in place, we are focused on scaling execution across a carefully selected set of growth vectors. These include: First, scale the enterprise across industry verticals. Matterport will continue to drive customer growth by expanding use cases and introducing new applications. We are particularly focused on acquiring and retaining enterprise customers. With our massive spatial data library and pioneering AI-powered capabilities, we pride ourselves on our ability to deliver value across the property lifecycle to customers from a variety of different industries, including ✓ real estate, ✓ AEC, ✓ travel and hospitality, ✓ insurance, ✓ industrial and facilities. We will continue expanding our solutions and reach to new industries such as ✓ manufacturing and ✓ oil and gas. We will also increase investments in industry-specific sales and marketing initiatives to increase sales efficiency and drive customer and recurring revenue growth, particularly from large enterprise customers. Second, expand internationally. The majority of the world’s buildings are located outside of the United States, and we foresee massive opportunities in pursuing the digitization and datafication of the building stock worldwide. Currently serving customers in more than 150 countries, we will seek to further penetrate these existing geographies in order to add their unique spatial data to our platform as more customers are acquired and more use cases adopted. This creates a powerful network effect that will allow us to expand further into under-penetrated countries and unlock additional properties and spaces. Third, invest in research and development. We will continue to invest in research and development to improve our core AI technology and data science, expand our solutions portfolio, and support seamless integration of our platform with third-party systems. We have a robust pipeline of new product releases. For example, in May 2020, we launched Matterport for iPhone, which gave every recent iPhone owner the ability to capture and collaborate on 3D spaces, and resulted in a significant number of new subscriptions and Matterport spaces under management. In October 2020, we launched Matterport for Android as an Early Access app, and we plan to make an official version of the app with capture functionality widely available later this year [2021]. We see significant potential for future customer growth as we release more products and create additional upselling opportunities. And finally, expand partner integrations and our third party developer ecosystem. We aim to foster a strong network of partners and developers around our Matterport platform. Through seamless integration with our open, scalable and secure enterprise platform, organizations across numerous industries have been able to automate workflows, enhance customer experiences and create custom extensions for high-value vertical applications. For example, in May 2020, we rolled out integration capability with Autodesk to help construction teams streamline documentation across workflows and collaborate virtually. Going forward, we plan to develop additional strategic partnerships with leading software providers to enable more effective integrations and enlarge our marketplace of third-party applications. Matterport is a once in a decade company with extraordinary potential to revolutionize the way the world’s largest asset class is created, managed, and valued over its lifetime. Today marks the beginning of a pivotal milestone for our company that will drive acceleration across our business and create tremendous growth opportunities for our customers, partners, and our employees. Matterport created this category for the built world and we are the market leader, but in many respects we are just getting started and our biggest and best years still to come. We can’t wait to get started on this next stage of growth for Matterport. Thank you very much for joining us. [END] Financial Disclaimers [omitted by @DanSmigrod] |

||

| Post 1 • IP flag post | ||

Pages:

1This topic is archived. Start new topic?