Question of the Day: Have you/will you buy stock in Matterport (MTTR)?14189

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| CNBC (4 March 2021) SPACs are becoming less of a sure thing as the deals get stranger, shares roll over AXIOS (4 March 2021) Why fears of a SPAC bubble may be overblown Daily Journal Online (4 March 2021) Should You Buy SPACs After Their Crash? |

||

| Post 26 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Video: Is MATTERPORT The Next 15x SPAC? | What You Should Know About GHVI Stock SPAC Merger | MTTR Stock | Video courtesy of Couch Investor YouTube Channel | 14 February 2021 The Motley Fool (6 March 2021) Is Matterport the Next 15x SPAC? |

||

| Post 27 • IP flag post | ||

WGAN Fan WGAN FanClub Member Queensland, Australia |

Wingman private msg quote post Address this user | |

| Back to that H&S pattern. It is playing well and it has even come up to test the line, bounced from it and going down now. I would say it is confirming a possible drop in the stock price to at least $11.70 See the updated graph.  |

||

| Post 28 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Hi All, Matterport Job Opening: ✓ Matterport Vice President, Investor Relations & Treasury Dan |

||

| Post 29 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

Screen Grab: eBlast received Thursday, 18 March 2021 --- Everything Communicators Need to Know About SPACs | 1 pm EDT Wednesday, 25 March 2021 Register for Free Business Wire Webinar |

||

| Post 30 • IP flag post | ||

WGAN Fan WGAN FanClub Member Queensland, Australia |

Wingman private msg quote post Address this user | |

| I finally have found an australian company that provides an access to GHVI ticket on nasdaq for trading. Other 4 I contacted do not let you trading this ticket and big ones like banks have 15 business days for approving you after you submit an application for a trading account. It is a bit hard to fund a trading account with any instant payment but at least they promise do it overnight and have funds available the next morning. if you are in Australia and want to buy GHVI googling for "Monex Securities" will save you on searching for any company that will let you trade it without any leverage and own purchased shares as long as you want to. |

||

| Post 31 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| InvestorPlace (19 March 2021) Buy Gores Holdings VI Stock on the Pullback, Ahead of the Matterport Deal - Yet another SPAC merging with a 'future of real estate' play, take advantage of the recent weakness in GHVI stock In short, it’s yet another “future of real estate” play — changing the game for this “old school” industry. With exposure to many trends, this company stands to gain massively. Now, as is par for the course for fast-growing companies going public via SPACs, initial valuation looks rich. But, when factoring in its projected growth between now and 2025, this looks more than reasonable. Especially after the stock’s 40% pullback from its post-deal announcement highs. Overall, GHVI stock is one of the most interesting pending SPAC deals out there. Thus, now’s the time to take advantage of its recent weakness and buy the dip. Bottom Line: Buy GHVI Stock Before the Matterport Deal Closes Based on 2021 results, valuation may look a bit rich. But, as the company continues to scale up at an impressive clip, today’s valuation could look “cheap” in hindsight. With its high gross margin, and software-as-a-service (SaaS) revenue model, once scaled up, it could be worth many times what it current trades for today. Source: InvestorPlace It's a lengthly -- and very favorable -- analysis. I encourage you to read the entire article, if you are considering investing in Matterport (Gores Holding VI). Dan |

||

| Post 32 • IP flag post | ||

|

|

Axis360Media private msg quote post Address this user | |

| I am as addicted to this stock as I was initially my MP device. Everytime it dips below $15 I buy more, and more. | ||

| Post 33 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Seeking Alpha (21 March 2021) Matterport: 3D For The Real World | ||

| Post 34 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

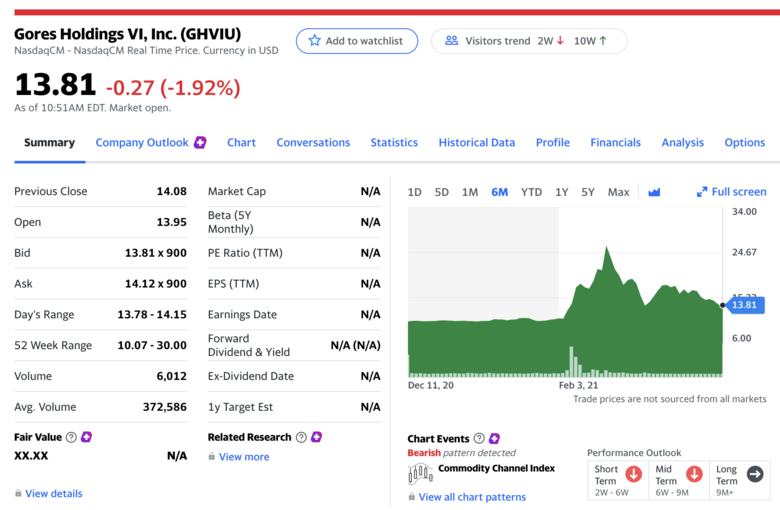

Screen Grab: Yahoo! Finance | 11:42 pm EDT Tuesday, 30 March 2021 --- The Motley Fool (29 March 2021) Where Will Matterport Be in 5 Years? - The market leader in creating "digital twins" of real-world spaces could generate explosive growth after it goes public. |

||

| Post 35 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Seeking Alpha (30 March 2021) Matterport: 3D Digital Assets Without The Hype As the SPAC sector sells off, investors can now pick up some quality names without the insane premium valuations. Gores Holdings VI (GHVI) is working on closing an attractive business combination with Matterport, a leader in 3D spatial data for buildings. The stock is a far better deal after the 50% dip from the highs at $28, but investors need to still realize this valuation is aggressive. Source: Seeking Alpha |

||

| Post 36 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Property Week (31 March 2021) Matterport EMEA MD on imminent merger: ‘We are really at the beginning of this journey’ | ||

| Post 37 • IP flag post | ||

WGAN WGANStandard Member Los Angeles |

Home3D private msg quote post Address this user | |

| When the C-suite decides to go public, remember that they know more about their business than we do. There is a reason they want to cash out now. | ||

| Post 38 • IP flag post | ||

|

|

Axis360Media private msg quote post Address this user | |

| @home3D I am not sure I agree their primary goal is a cash out. Keep in mind I hate the MP board of directors enough to file several federal lawsuits. In simplest terms I am quick to judge, except now. In fact I have the equivalent of a pro 2 device invested in GHVI because I am supremely confident that ticker MTTR will have its day in the sun in the days, weeks or months following the merger. Actually I believe it will be a fantastic LONG TERM INVESTMENT, if for no other reason that they have valuable patents that will keep competition at bay in a repeat of the GeoCV lawsuit. This isn’t rocket science. There are dozens of publicly traded companies HEMORRHAGING BILLIONS and still holding their own on NASDAQ as if they were actually making money. Tesla, UBER, Lyft, DoorDash, Snapchat just to name a few of the stocks that have lost BILLIONS, presumably held up by smoke and mirrors. I guess you could say I believe a virtual reality entity is exactly as capable of raising the hopes of the wannabe Warren Buffet’s of the world. Don’t misunderstand, I definitely agree Matterport needs to cash out their initial investors. The harsh facts of life of using venture capitalists is eventually they want their money back (hopefully with healthy interest). I would argue that their primary goal is to get a 350 million dollar cash infusion from Gores Holdings to possibly give all of us USERS the features we have demanded. Maybe even a new Matterport device that fuses the spherical features with the reliability of the real Pro 1 and Pro 2 devices. Imagine if Apple decided the IPhone 12 is the pinnacle and they didn’t need to build a better device. |

||

| Post 39 • IP flag post | ||

WGAN WGANStandard Member Los Angeles |

Home3D private msg quote post Address this user | |

| @Axis360Media - “ Imagine if Apple decided the IPhone 12 is the pinnacle and they didn’t need to build a better device.” Well then... Imagine if Apple decided the iPhone 13, with Lidar and HiRes wide angle photography, mounted to a future NodalView-style motorized rotator, wanted to automate the capture of HiRes 360° panos complete with embedded 360° spherical point cloud data - that works in full sunlight. They’d have a “GeoCV+” camera in your pocket that you can also use for a thousand other things. Nothing to buy but a $50 rotator. Matterport had the heft and attitude to step on GeoCV like a bug. With Apple, MP would be the bug. |

||

| Post 40 • IP flag post | ||

|

|

Axis360Media private msg quote post Address this user | |

| @home3d Apple has zero incentive to “smash matterport like a bug”. Quite the opposite, they are the corporate owner of Prime Sense, the Israeli firm that created the magical infrared sensor in the Matterport devices. In fact, it doesn’t take a genius to determine that the photogrammetry technology Apple is deploying in their latest devices is a direct result of buying Prime Sense. As for ANY FUTURE COMPETITOR. They are legally prohibited from a dozen or so features we all love, like the dollhouse, etc. If you are confused, and it seems you are, READ THE PATENTS. I did before buying my first device. After you are finished with what existing case law has already protected, give me your ideas for how any of the current or future competition will get around what shut down GeoCV in a couple months. In simplest terms even you (or me) @home3d can create an VR app maybe with a tiny drone, or Roomba as the capture device but eventually you will pay Matterport for infringing on their really well written patents. |

||

| Post 41 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Bloomberg Markets (31 March 2021) SPAC Market Has Dried Up, Bill Foley Says | ||

| Post 42 • IP flag post | ||

|

|

Axis360Media private msg quote post Address this user | |

| @DanSmirgrod Maybe I am overly optimistic but not all SPAC’s have an almost complete deal with what can best be described as the “Uber of virtual reality”. Both a disruptor and unicorn with few competitors. Stock prices typically react to myriad market conditions chief amongst them the market in general, current world events, and the company’s announcements, press releases, new products and features. If Matterport doesn’t have a dog and pony show in the late stages of execution RJ needs to be replaced with someone who knows how tech firms build and RETAIN, business, investors, super fans, etc. |

||

| Post 43 • IP flag post | ||

|

|

Axis360Media private msg quote post Address this user | |

| My big takeaway after watching that clip is the CEO that was interviewed explicitly stated the reason for the SPAC bust was inexperienced players entering the SPAC market space. Except in our case billionaire Alec Gores is absolutely not inexperienced. If any additional points were made I missed them. |

||

| Post 44 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

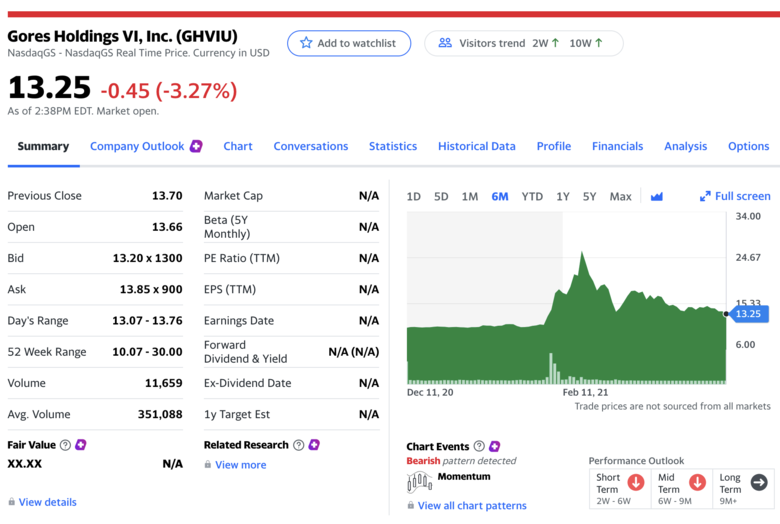

Yahoo! Finance | Gores Holding VI | 3:14 pm EDT Thursday, 15 April 2021 Market Realist (15 April 2021) Buy GHVI Stock on the Dip Before Matterport SPAC Merger GHVI shares have fallen by more than 46 percent since their peak in mid-February when the shares were trading at $24.46. Now, at $13.17 per share, investors are better positioned to earn from a pre-merger SPAC investment. Matterport announced its SPAC agreement with GHVI in early February. The shares swelled 127.32 percent before dropping off. With a target selected, it's only a matter of time until the GHVI ticker transitions over to the new ticker symbol. For new IPOs, overvaluation is a big concern, even for those taking the SPAC route. Matterport has experienced high growth in the past year. The company expects its 2021 revenues to hit $123 million—a number that will likely multiply five times over closer to 2025. Unlike many high-growth companies, Matterport's prospects of profitability are actually high. The projected post-SPAC valuation of at least $1 billion is a bit rich, but not totally unfair. Source: Market Realist (I encourage you to read the entire article.) |

||

| Post 45 • IP flag post | ||

|

|

Axis360Media private msg quote post Address this user | |

| @dansmigrod I am still buying GHVI. Every dip I buy more. Likely that will continue till the formal merger. In my opinion MTTR is half price right now for no other reason than certain parts of the market are retracting. | ||

| Post 46 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| The Motley Fool (19 April 2021) Why Matterport Could Be a Multi-Bagger Stock | ||

| Post 47 • IP flag post | ||

|

|

Axis360Media private msg quote post Address this user | |

| @dansmigrod I coulda wrote that article myself. But don't just invest $1,000. Invest the price of a Pro2, especially if you own a Pro 2 and pay Matterport a gradually increasing monthly subscription. | ||

| Post 48 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

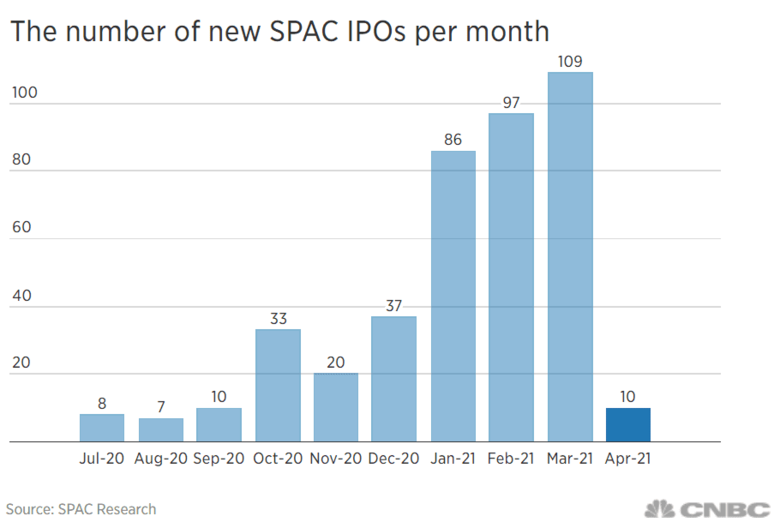

Chart courtesy of SPACE Research via CNBC CNBC (21 April 2021) SPAC transactions come to a halt amid SEC crackdown, cooling retail investor interest |

||

| Post 49 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

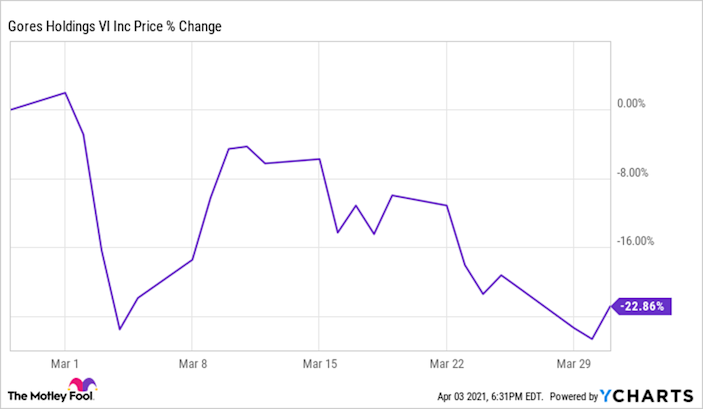

Chart courtesy of The Motley Food Yahoo! Finance (5 April 2021) Why Gores Holdings VI Stock Dropped 22.9% in March [2021] Gores Holdings VI (GHVI) went public early in February, and its stock has gained 65% from market close on the day of its debut thanks to excitement surrounding its pending merger with real estate software company Matterport. There wasn't any business-specific news related to Matterport or the merger driving GHVI's stock lower last month, but a pullback on tech stocks was enough to pressure the SPAC's share price. Source: Yahoo! Finance |

||

| Post 50 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Market Realist (23 April 2021) Why Has GHVI Stock Dropped and Will It Recover? GHVI stock has dropped 12 percent in the past month and retreated more than 50 percent from its peak. The decline can be attributed to several factors. Investors have been trading of SPAC stocks more cautiously after reports the SEC is closely monitoring SPAC deals, and SPAC stocks tend to adjust to trade near their IPO price as merger date draws close. |

||

| Post 51 • IP flag post | ||

|

|

Axis360Media private msg quote post Address this user | |

| It seems GHVI is bouncing back nicely. | ||

| Post 52 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Reuters (27 April 2021) EXCLUSIVE U.S. watchdog mulls guidance to curb SPAC projections, liability shield -sources | ||

| Post 53 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| The Wall Street Journal (5 May 2021) The Man With More SPACs Than Anyone | After minting billions in the private equity arena, Alec Gores has become a serial SPAC backer | ||

| Post 54 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Video: RARE Stock Opportunity - GHVI Stock Price Update - Matterport Stock Price Update | Video courtesy of Dr. Stock YouTube Channel | 12 May 2021 | ||

| Post 55 • IP flag post | ||