Mortgage Rates Hit All-Time Record Low Heading Into Holiday Weekend12401

Pages:

1

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

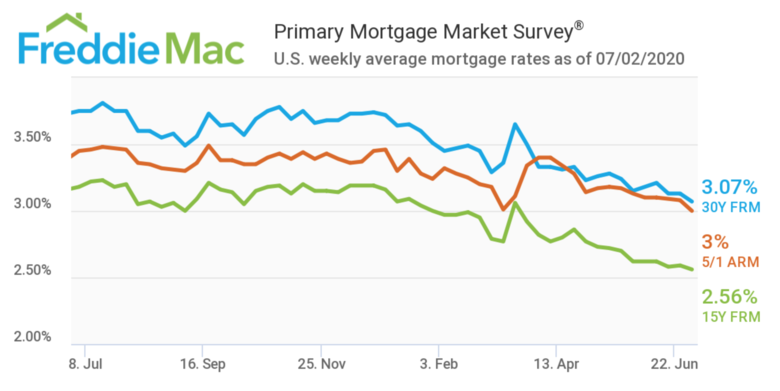

Screen Grab courtesy of FreddieMac Media Release ---- Mortgage Rates Hit All-Time Record Low Heading Into Holiday Weekend MCLEAN, Va., July 02, 2020 (GLOBE NEWSWIRE) -- Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing that the 30-year fixed-rate mortgage (FRM) averaged 3.07 percent, the lowest rate in the survey’s history dating back to 1971. “Mortgage rates continue to slowly drift downward with a distinct possibility that the average 30-year fixed-rate mortgage could dip below 3 percent later this year,” said Sam Khater, Freddie Mac’s Chief Economist. “On the economic front, incoming data suggest the rebound in economic activity has paused in the last couple of weeks with modest declines in consumer spending and a pullback in purchase activity.” News Facts ✓ 30-year fixed-rate mortgage averaged 3.07 percent with an average 0.8 point for the week ending July 2, 2020, down from 3.13 percent. A year ago at this time, the 30-year FRM averaged 3.75 percent. ✓ 15-year fixed-rate mortgage averaged 2.56 percent with an average 0.8 point, down slightly from last week when it averaged 2.59 percent. A year ago at this time, the 15-year FRM averaged 3.18 percent. ✓ 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.00 percent with an average 0.3 point, down slightly from last week when it averaged 3.08 percent. A year ago at this time, the 5-year ARM averaged 3.45 percent. Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Visit the following link for the Definitions. Borrowers may still pay closing costs which are not included in the survey. Freddie Mac makes home possible for millions of families and individuals by providing mortgage capital to lenders. Since our creation by Congress in 1970, we’ve made housing more accessible and affordable for homebuyers and renters in communities nationwide. We are building a better housing finance system for homebuyers, renters, lenders, investors and taxpayers. Learn more at FreddieMac.com, Twitter @FreddieMac and Freddie Mac’s blog FreddieMac.com/blog.  Source: FreddieMac |

||

| Post 1 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

Screen grab of eBlast I received today (Thursday, 16 July 2020) |

||

| Post 2 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

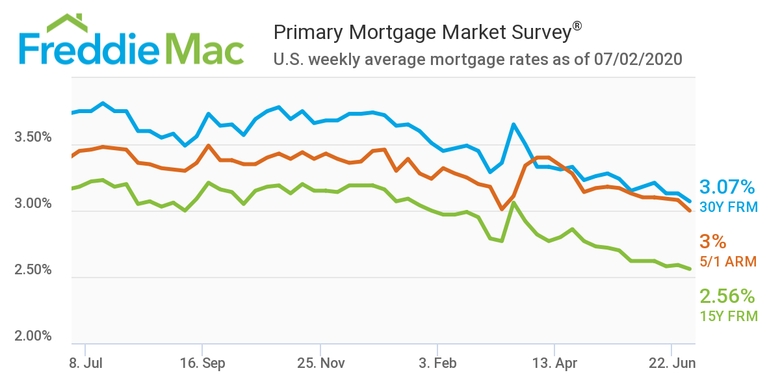

| HousingWire.com (16 July 2020) Average U.S. mortgage rate falls below 3% for the first time "The average mortgage rate fell to 2.98% this week, breaking the 3% threshold for the first time, as investors concerned about a resurgence of the COVID-19 pandemic fled to the safety of the bond markets and the Federal Reserve continued to scoop up securities backed by home loans," reports HousingWire.com. "The average rate for a 30-year fixed mortgage fell to the lowest in almost five decades of data, down from 3.03% last week, Freddie Mac said in a statement Thursday. The average 15-year rate fell to 2.48%, the lowest in a data series going back almost 30 years, according to the mortgage financier," reports HousingWire.com. |

||

| Post 3 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Inman (20 July 2020) Could mortgage rates under 3% be bad for the housing market? "While prospective homeowners are likely salivating at the plummeting mortgage rates — which continue to climb to new historic lows weekly — there is one reason that the 30-year fixed-rate mortgage falling under 3 percent could hurt the housing market: with mortgage rates so tantalizingly low, many existing homeowners are opting to refinance and stay put, Mark Fleming, the chief economist at First American said in an appearance on Yahoo Finance," reports Inman. ---- I encourage you to subscribe to Inman (like I do) to read articles like this. Free 90 day trial of Inman with this WGAN Affiliate Code |

||

| Post 4 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| TheRealDeal (29 July 2020)Mortgage applications fall as fears of second wave rise Hi All, "Uncertainty over rising Covid infections, wait-and-see for next round of government relief holds buyers back," reports TheRealDeal. "Homebuyers are pumping the breaks as mortgage rates, Covid infections and uncertainty rises," reports TheRealDeal. I encourage you to subscribe to TheRealDeal to read this and other news stories. Best, Dan |

||

| Post 5 • IP flag post | ||

Pages:

1This topic is archived. Start new topic?