Matterport Highlights from the CoStar Group 1Q2024 Earnings Call19763

Pages:

1

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

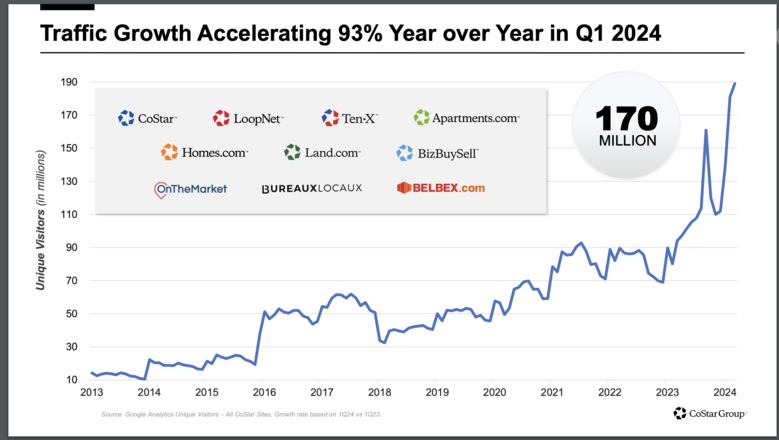

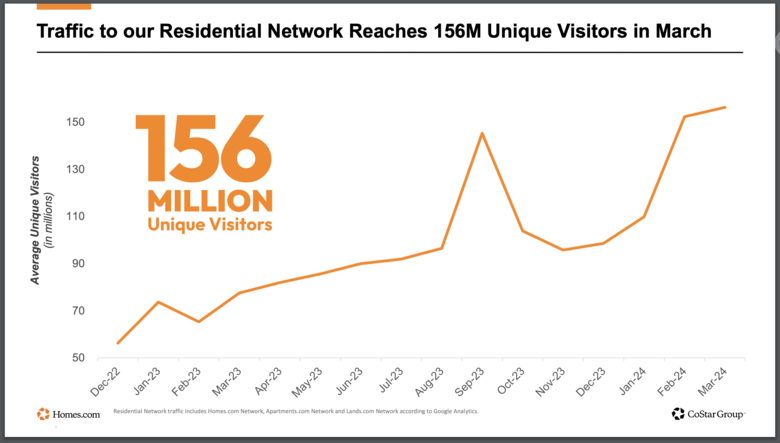

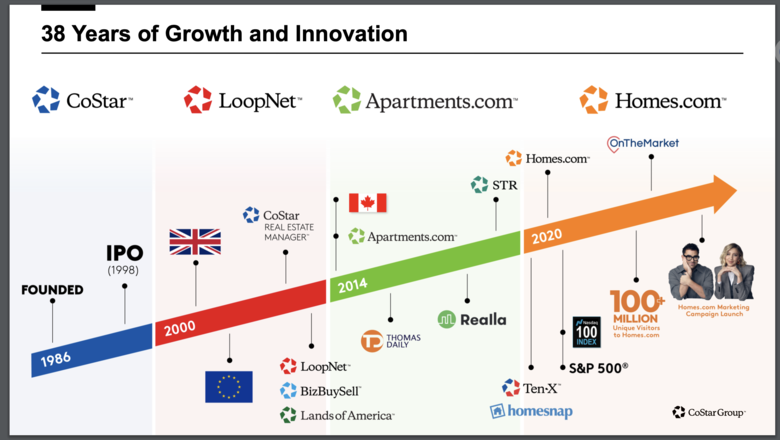

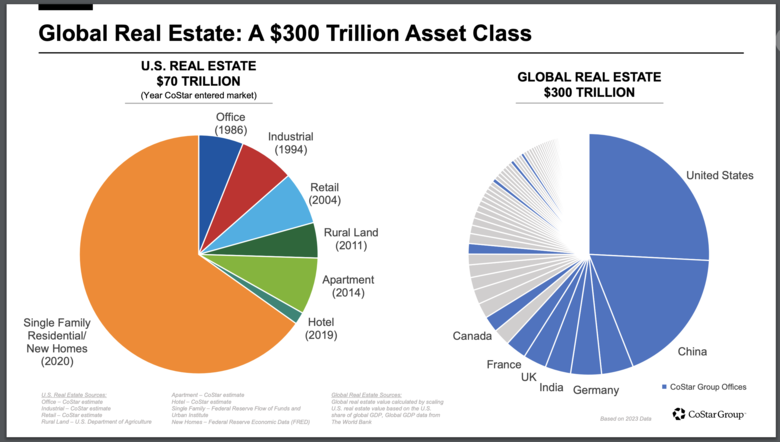

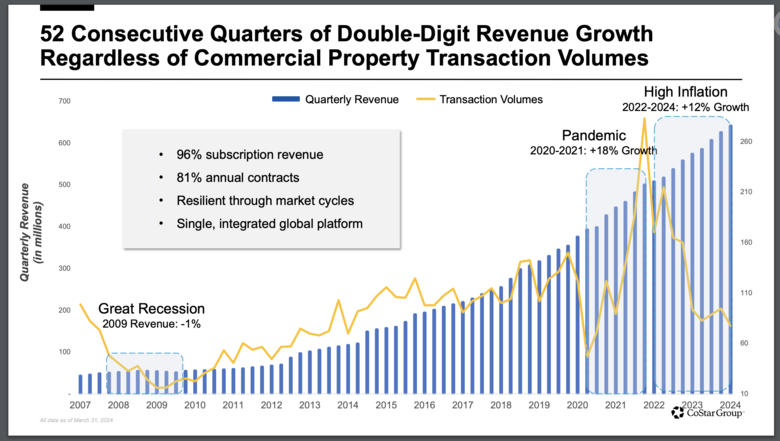

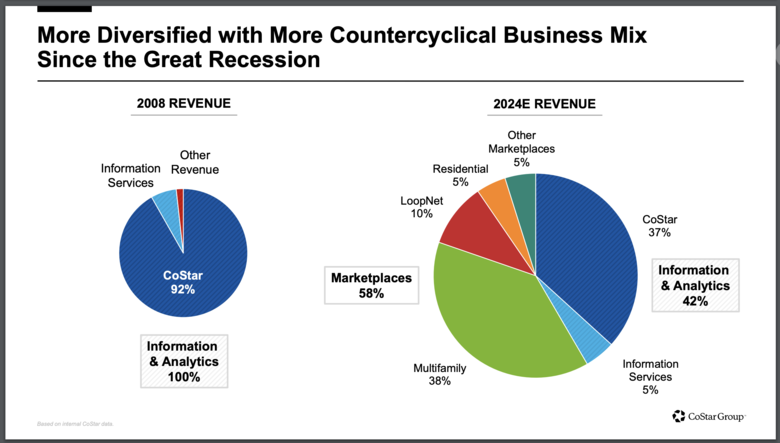

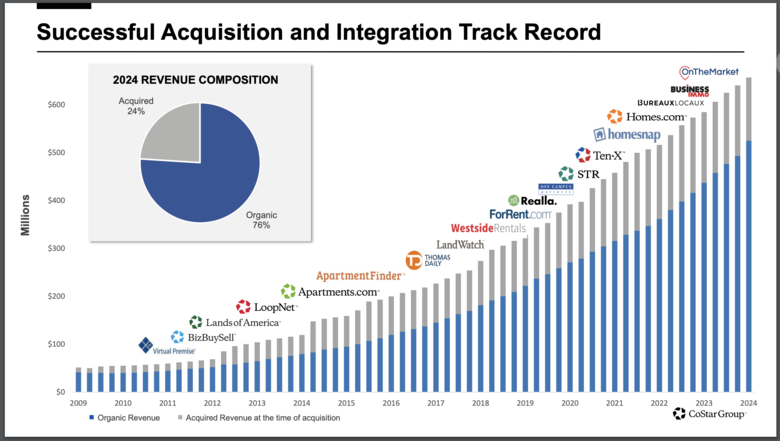

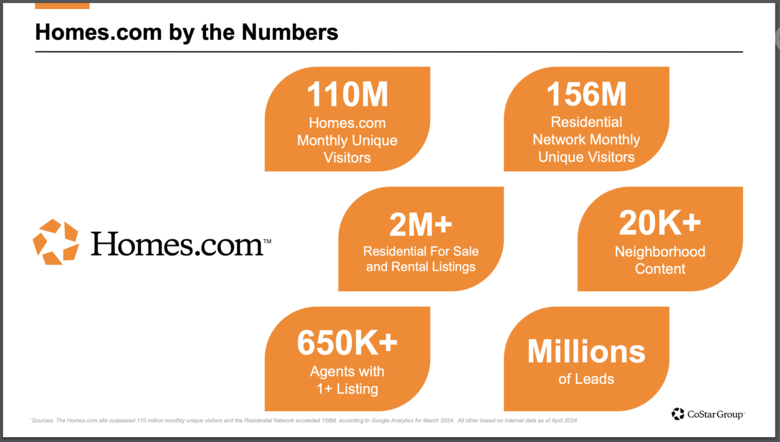

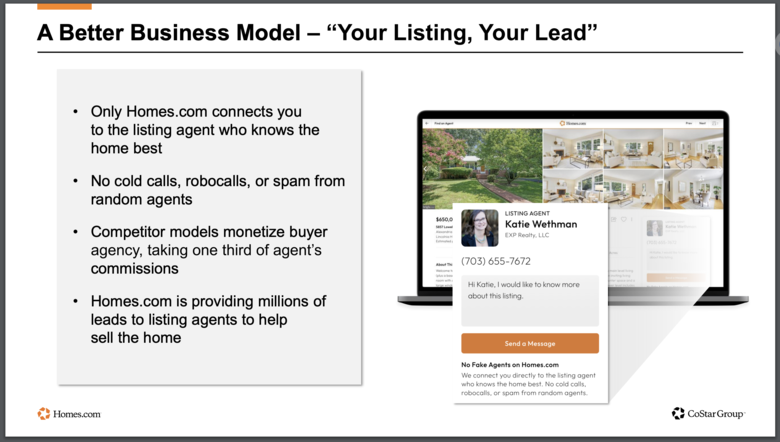

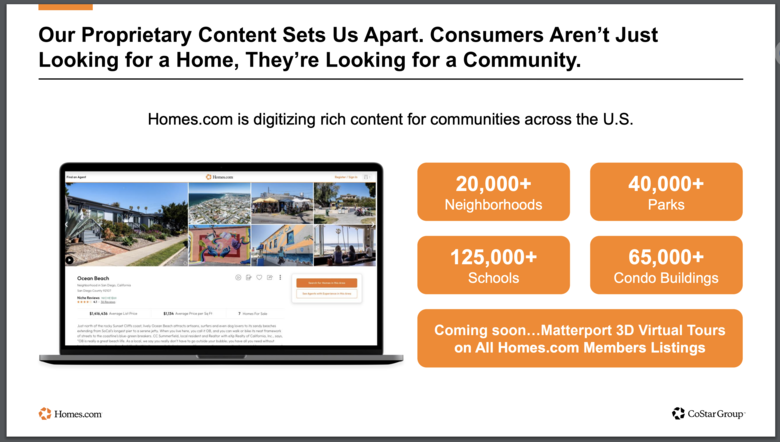

Screen Grab from CoStar Group First Quarter 2024 Investor Presentation | Page 5  Screen Grab from CoStar Group First Quarter 2024 Investor Presentation | Page 6  Screen Grab from CoStar Group First Quarter 2024 Investor Presentation | Page 7  Screen Grab from CoStar Group First Quarter 2024 Investor Presentation | Page 11  Screen Grab from CoStar Group First Quarter 2024 Investor Presentation | Page 12  Screen Grab from CoStar Group First Quarter 2024 Investor Presentation | Page 13  Screen Grab from CoStar Group First Quarter 2024 Investor Presentation | Page 15  Screen Grab from CoStar Group First Quarter 2024 Investor Presentation | Page 18  Screen Grab from CoStar Group First Quarter 2024 Investor Presentation | Page 19  Screen Grab from CoStar Group First Quarter 2024 Investor Presentation | Page 21  Screen Grab from CoStar Group First Quarter 2024 Investor Presentation | Page 24  Screen Grab from CoStar Group First Quarter 2024 Investor Presentation | Page 25  Screen Grab from CoStar Group First Quarter 2024 Investor Presentation | Page 26  Screen Grab from CoStar Group First Quarter 2024 Investor Presentation | Page 27 =================================== CoStar Group First Quarter 2024 Investor Presentation =================================== Hi All, Below are the Matterport Highlights from the CoStar Group 1Q2024 Earnings Call on Tuesday, 23 April 2024 (Full Audio Recording | Full Transcript | Full Deck Speaker: CoStar CEO Andy Florance Yesterday, we announced that we reached a definitive agreement to acquire Matterport, the global leader in immersive 3D Digital Twins and Artificial Intelligence for the real estate industry for $5.50 per share. Founded in 2011, Matterport pioneered the development of the first 3D capture solution to deliver dimensionally accurate photorealistic virtual tours or digital twins for any type of property. Matterport's proprietary and patented technology enables anyone to digitize a property using a variety of camera technologies, including cameras found on most smartphones. Matterport's 3D technology is utilized in nearly every sector of real estate, spanning residential, commercial, hospitality, retail and industrial spaces among others. Over the years, Matterport has curated what is considered the largest and most precise collection of spatial property data worldwide, with over 12 million spaces captured in 177 countries and representing more than 38 billion square feet of digital commercial property under management. Hundreds of thousands of new 3D digital twins for properties around the world are being added to this impressive database each month. Matterport makes it possible to experience real estate remotely. People now select their next home apartment, office, store, hotel or warehouse on their mobile device often without ever visiting the property. The pandemic accelerate the remote real estate shopping trend and we believe it is the new normal. CoStar Group and Matterport have nearly identical mission statements of digitizing the world's real estate. CoStar Group was one of the first adapters of Matterport's technology and currently has almost 300,000 Matterport digital twins available in the CoStar information product and online property marketplaces. In March of this year, there were over 7.4 million views of Matterport 3D tours on Apartments.com. Visitors who interact with the Matterport on Apartments.com spend 16.6 minutes on the site, which is 134% more than the 7.1 minutes time on site if they do not interact with a Matterport. Properties with a Matterport generated 74 leads, which is 10x the seven leads generated for property without Matterport. Currently, 50% to 60% of consumers looking for an apartment say they're comfortable selecting their next apartment without visiting the property at all. As we listen to corporate real estate executives who use loopnet, discussed their challenges of buying and leasing properties around the world. They tell us 3D digital twins are invaluable in facilitating technology for them. In residential focus groups, homebuyers are clearly telling us that they prefer listings that offer 3D digital twins so they can best understand the property. We believe that our substantial empirical data in our market research clearly shows that consumers and advertisers prefer real estate portals with digital twins. We intend to go all in on 3D digital twins adding more digital twins to Apartments.com, LoopNet, Homes.com. CoStar Land.com, BizBuySell, Real Estate Manager, STR Belbex on the market and others. We intend to add Matterport as one of the benefits of Homes.com membership. We believe adding 3D digital twins for Homes.com members will increase the leads we deliver, increased customer satisfaction, increased renewal rates, increase sales and increased site traffic further. We have thoroughly researched the many 3D digital twin solutions out there and have concluded that Matterport is the best solution for our client's needs. Given the fact that we intend to make a much greater commitment to capturing 3D digital twins, we decided to capture the value of our increased volumes by acquiring Matterport. As we make Matterport's more ubiquitous, we believe others will buy more Matterport, making the company more valuable. We believe that we can accelerate Matterport sales to non CoStar Group advertisers by increasing Matterport's investments in sales and marketing. Well, Matterport has been very responsive to us as customers over the past 9 years, we see the acquisition is giving us increased ability to influence the product roadmap for Matterport to best serve our clients needs. I believe we're standing on the verge of a potential exponential acceleration in the technology surrounding 3D digital twins, which will create transformative value for real estate. Artificial intelligence, machine learning, generative AI, computational photography, NeRF, SMERF and Gaussian Splat, all have tremendous potential for real estate. Matterport has incredible research and development talent. These are the people who are very passionate about the future of digital twins and literally invented the genre. And we believe we're the -- they are the ones who will imagine and create the industry's future. Right Dave? We intend to actively support invest in Matterport spatial technology research and development efforts. Imagine the potential scan your home and move 3D digital twins of your furniture and art into a virtual moving truck and trialing it out in a potential new home virtually. Imagine using a 3D digital twin to virtually see various potential kitchen renovations in seconds. Imagine the value of creating a 3D twin of an unattractive raw office space and using generative AI to rapidly generate 3D realistic potential build outs of the office space for a future tenant to see. Adding virtual reality to the Matterport, you can take a virtual tour of the property with your virtual agent walking to the space with you. The possibilities are certainly exciting to imagine and represent a massive opportunity to propagate new technologies to our global information and marketplace businesses. --- Speaker: CoStar Chief Financial Officer Scott Wheeler So I'll wrap up with a few financial comments on the pending acquisition of Matterport that was announced yesterday. Financially, Matterport operates a very attractive financial model, very similar to CoStar, but at a smaller scale. Matterport has a history of strong revenue growth with a 5-year compound annual growth rate of 31%. Their subscription business represents 60% of the overall revenue and is growing over 20% per year, has a very high renewal rate similar to CoStar. We love this kind of business. The Matterport subscriber customer base is highly diverse, operating across a variety of vertical markets with no single customer over 3% of revenue. Approximately 30% of their new 3D models, along with around 30% of revenue are generated outside of the United States. This customer and vertical market diversity creates a resilient financial growth profile just like CoStar. Matterport enjoys significant operating leverage on incremental subscription revenue with gross margins of around 70%. This is scalable for high profit margins and cash generation. Matterport has a strong and conservative balance sheet with over $400 million of cash and 0 debt. Sound familiar? The total purchase price of approximately $2 billion comes with around $400 million of cash and investments which is currently on the Matterport balance sheet, yielding an enterprise value of roughly $1.6 billion. The purchase consideration will be paid 50% from our available cash balances and 50% with CoStar stock. On a net basis, after closing, we expect to use around $550 million to $600 million of our cash to complete the acquisition. Matterport expects quarterly cash flow from operations to break even in the second half of 2024 and turn positive in 2025. The breakeven point is somewhat in line with what we might see as the expected time to close the transaction. With Matterport cash flow turning positive in 2025, and modest synergy assumptions, we expect the standalone acquisition to be neutral to slightly accretive to non-GAAP earnings per share in the first year post closing. Now it's far too early to estimate financial guidance outcomes for the acquisition. We expect the post integration benefits from this acquisition to be highly value accretive for many of the reasons that Andy described. We have a strong track record of successfully acquiring, integrating and growing great companies, which I believe will continue with the combination of Matterport technology and CoStar's marketplace scale, research capabilities and project -- product development expertise. We are in a very strong financial position as we head into the second quarter, with our growth and profit plans already exceeding our expectations for the year. We are focused on and committed to accomplishing our stated long-term revenue and profit goals and we've taken a big step closer to achieving those with the fast launch of Homes.com and the potential acquisition of Matterport. I certainly believe there will be many more exciting growth years ahead for the company. ==== Speaker: Bank of America Securities Stock Analyst Heather Balsky So on Matterport, I’m just curious a little bit to hear how you’re thinking about that business being part of CoStar going forward? There’s been some headlines around Homes.com, but curious about the broader business strategy and its existing sort of standalone business. Like how are you going to integrate it? How do you plan to use it more? And do you think you can do something to kind of jump start the existing sort of revenue growth strategy? Speaker: CoStar CEO Andrew Florance Yes. So in terms of — let’s start with the existing growth strategy. I am highly confident by — through pulling levers on pricing, on switching between upfront purchase equipment, subscription models, relying more heavily on capture networks. I feel — and then also by the virtue of the fact that we aggressively adopt the digital twins more broadly. That all those things together will allow us to significantly accelerate the sales or revenue of Matterport outside of it being used inside of anything in CoStar. In other words, outside of being used as part of Homes.com Apartments.com, LoopNet, so on and so forth. But — and I think Matterport penetration will have some slight different numbers on that. I’m confident sub 5% in the United States. I’m confident sub 1% in Europe. And at that — at those levels, I am a big believer in the value of a Matterport when you’re trying to sell a $500,000 or $1 million property. And then I think those adoption rates will ultimately go up 50% or more for digital twins with people moving real estate. There was a time when only 5% of the real estate listings had a photo. So the digital twins is going to be — I think. And there are a number of different players out there, and our goal will be to try to capture a leading share of the digital twin. So there are different solutions at different quality levels. When you look at how we integrate it into our product, we are going to — first of all, we believe that just — the overall goal of what we’re doing is helping people lease and sell their real estate or to analyze real estate. These three dimensional, these 3D, three spatial twins are transformative, really important tools, and we are going to make them ubiquitous across our sites. So we’ve been an aggressive adopter to date, we’re going grow it dramatically. And virtually everything we are doing. So even think about something like our CoStar Real Estate Manager, a significant percentage of the Fortune 500 use CoStar Real Estate Manager to manage their leases, critical dates, their facility strategies, giving their real estate people the ability to look at a 3D representation, a walk through one of their facilities is super valuable. Even if it’s something is as small as a — the equipment room on a cellular antenna, being able to go into that Matterport and seeing what the RAC configuration is and see how much room there is, is there room for more RACs, that kind of stuff. The stuff is ubiquitous and super valuable. So being aggressively adopting it, we think will fuel growth and differentiate us from other folks. But the other thing is I think there’s an enormous amount of data here. So if you think of the failure of AVMs, automated valuation models, to deliver real value, my belief is that one of the big failures of AVMs to date has been the fact that they are taking tabular data, a handful of tabular data fields around one point on a map is really fails to capture the real characteristic of the real estate asset. When you have a Matterport, you’re able to recognize infinitely more information about the space you’re in, you can determine quality, you can determine build out, you determine just things like sensing the fact that there’s really [indiscernible].There’s a — the nature of the layout, looking at the views out the windows, are you looking at another building 5 feet away or do you have a view of the Hudson River, which one is it? So I think this will also — there’s an enormous data advantage here that you can use to inform automated valuation models and understand market statistics better. And that’s certainly true with certainly residential, but also commercial real estate. So if I’m trying to understand where lease rates are, and I can ascertain that this space was raw, which machine vision can do. Artificial intelligence can determine whether it was unfinished space versus polished space, that’s going to impact how you calculate the economics of what the lease deal was. And then with — right now, Matterport is really beautiful at being able to move through a space in a semi-natural format. But with the work that Apple, the commitment that Apple has and Meta has to building headsets, I believe that you will, in the next 3 years or so have smooth walk-through capabilities through these digital twins, which will be super powerful. The ability to also take the twin outside of the structure and actually capture the exterior of the structure and possibly moving the capture equipment to a drone as well. So in my spare time, I have been putting expensive Matterport’s on top of expensive drones and trying to capture it externally. But it’s hard to do that with a weekend research projects, really need professionals to do that. CoStar Chief Financial Officer Scott Wheeler Leading to extensive write-offs and expensive drones. Speaker: CoStar CEO Andrew Florance No, no big crashes yet. No big crashes. But the odd looks from the neighbors. But the — so I think the technology is going to be — is going to go through a real exponential acceleration. I think the data is super valuable. I think it’s table stakes going forward for marketing space. I think it moves the AVMs. And I think as the rest of the world figures out that it’s really silly. To me, today, to market an office building or a warehouse building or a hotel event space or a home without a digital twin is thoughtless. It’s sort of inadequate. Do I sound passionate about that? Speaker: Bank of America Securities Stock Analyst Heather Balsky Yes. I appreciate the answer. Thank you very much. |

||

| Post 1 • IP flag post | ||

Pages:

1